Next Tuesday, the RBA meets again and is widely expected to raise the cash rate. Once again, the main question will be by how much.

RBA communique in mid-July brought a new hawkish element to the RBA's monetary policy table, noting that "the current level of the cash rate is well below" the estimated neutral rate, thought to be "at least" 2.5%.

The comments jolted the interest rate market towards pricing a more aggressive 75bp rate hike for this week's RBA Board meeting.

However, the release of a better than feared Q2 CPI print has since seen the interest rate market erase all chances of a 75bp rate hike. And the debate has returned to the merits of a 50bp rate hike vs a 25bp rate hike on Tuesday.

Due to a tight labour market, an expectation that inflation will rise above 7% in the coming quarters and a desire from the RBA to see the cash rate move back to a neutral setting, a 50bp rate hike is likely next week, taking the cash rate to 1.85%.

A possible fourth consecutive 50bp rate hike in September followed by a 25bp rate hike before year-end would see the cash rate rise to 2.60%, into restrictive territory.

Due to the impact of falling house prices on consumer confidence and household spending, it's unlikely the RBA's cash rate will get to the 3.35% terminal rate the interest rate market currently has priced by April 2023.

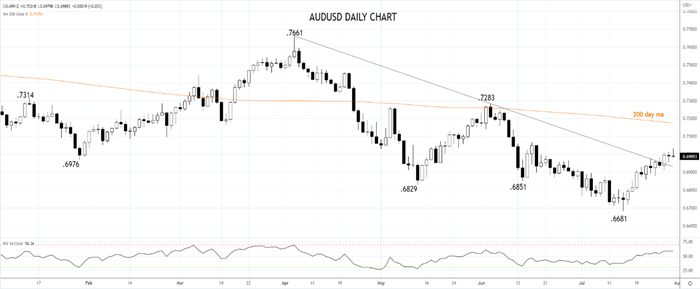

Over the past fortnight, the AUDUSD has rallied over 5% from its .6681 low. This week's break and close above the downtrend resistance from the April 2022 .7661 high suggests the rally can continue in the short term.

However, with the global economy seemingly moving closer to a recession, an energy crisis in Europe and China's property market woes, sellers are expected to emerge near the 200-day moving average at .7175 before a dip below .6900c.

Source Tradingview. The figures stated are as of July 29th ,2022. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade