For the first time since November 2010, the RBA has raised interest rates today, from a record low of 0.1% to 0.35%.

The need for the RBA's ultra-low Covid rate settings has long since passed. The unemployment rate is at decade lows, and the participation rate is at record highs.

Last week the RBA's preferred measure of core inflation, the trimmed mean, increased by 1.4% QoQ and 3.7% YoY, pushing core inflation 70bp above the RBA's 2-3% target band.

While the RBA would have preferred to stay on the sidelines until after the May 21 Federal Election, today's rate hike recognises that the longer the RBA let high inflation rise without acting, the more difficult its task would become to tame inflation without sending the economy into recession.

"Inflation has picked up significantly and by more than expected, although it remains lower than in most other advanced economies."

Australian headline inflation at 5.1% is still well below the 8.5% rate in the U.S. and the ~7% rate in Europe. The lower inflation rate in Australia will allow the RBA to raise rates more cautiously than the Federal Reserve, which is expected to follow suit and raise interest rates by 50bp on Thursday morning.

This assessment is supported by the statement below that forecasts it will take 2 years before inflation returns to the top of the RBA 2-3% band, suggesting the board will raise rates slower than what is priced.

"The central forecast for 2022 is for headline inflation of around 6 per cent and underlying inflation of around 4¾ per cent; by mid 2024, headline and underlying inflation are forecast to have moderated to around 3 per cent."

Today's rate rise is expected to be the first by the RBA in a series of moves throughout 2022, including 25bps hikes in June, July and August that will take the cash rate to 1.5% by year-end. It is significantly below the 2.5% level that the interest rate market has priced into it by year-end.

"The Board is committed to doing what is necessary to ensure that inflation in Australia returns to target over time. This will require a further lift in interest rates over the period ahead."

According to the Bloomberg survey of economists, 5 were expecting no hike, about 20 expected a 15bps hike and 5 expect a 40bps hike to 50bps. No one was calling for a 25bp hike.

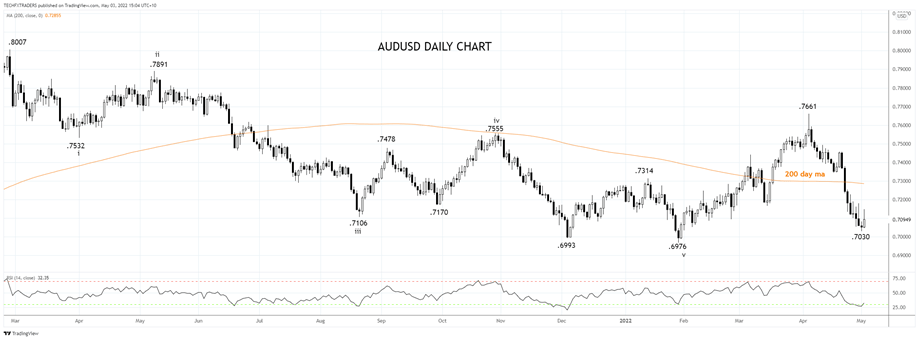

Following the decision, the AUDUSD springboarded 62 points higher from .7088 to a high of .7150 before easing back below .7100c. Dips should see the AUDUSD supported below .7100c over the next 36 hours on squaring up of short positions ahead of Thursday's FOMC meeting.

In the medium term, the main drivers of the AUDUSD will remain the war in Ukraine, Chinese Covid lockdowns, commodities, energy prices, inflation, and Federal Reserve rate hikes. Ultimately these factors will decide if the AUDUSD can remain above the key support at .7000c, a level its remained above since July 2020.

Source Tradingview. The figures stated are as of May 3, 2022. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade