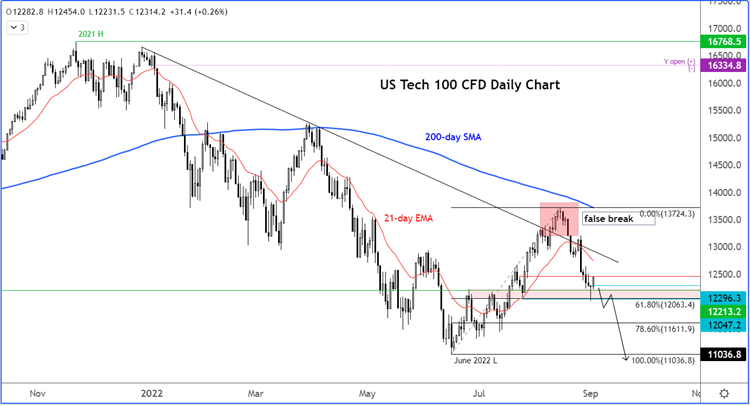

Following the goldilocks jobs report, US stocks rallied and added to their rebound from the second of Thursday's session. However, the markets remain in a longer-term bear trend and are not out of the woods. The Fed is going to be tightening its policy aggressively in coming months, which should put a ceiling on asset prices, especially US technology.

So, despite the bounce, I am not convinced the rally will hold, and I will be looking for fresh signs of traps to emerge. At the time of writing, the markets were still near their session highs, but I wouldn’t rule out a late sell-off ahead of a long weekend for US investors.

Still, the bears must now wait for the correct signal before stepping in. We could see a bit of reversal here as the Nasdaq tests short-term resistance around 12450. But what I would like to see is for the index to go back below Thursday's hammer head. That would be bearish. The move doesn't necessarily have to happen on Friday, but whenever we get such a bull trap sign, watch out below. That’s because, the longer-term trend is bearish and markets go down faster than they rise.

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade