When ?

Tuesday 9th February

What to watch

There is little doubt that food retailers have seen strong demand over the pandemic. With pubs and restaurants closed Brits have spent more on supermarket food and drink. Ocado is expected to show that its recent retail boom continued as it benefited further from olckdown.

We already know that the new joint venture with M&S is going well with sales outperforming. In Q3 revenues grew 52% rising to £587.3 million, whilst Q4 saw a rise of 35% in retail revenue. Furthermore, Ocado upgraded its full year earnings expectations to top £60 million, from £40 million.

Ocado is due to report as the share price is once again on the rise after struggling over the final 3 months of 2020. News that it was being sued by Norwegian rival AutoStore over a breached patent was partly to blame.

The outlook for the stock depends on how customer behaviours normalise after the pandemic – this has been considered a stay at home stock but Ocado has more than one string to its bow and there is also the robotics side to the business, Ocado Solutions.

Ocado Solutions should be completing its deal with Kindred Systems and Haddington Dynamic, firms which specialise in robotics as Ocado looks to streamline its picking function in the automated fulfilment centres to improve efficiency. However, the tech side of the business is still a long way off from profitability so investors will want to see timeline to success sooner rather than later particularly given that Ocado Solutions has contributed so significantly to the firm’s £1 billion debt pile.

Expectations are for revenue of £2.3 billion annually and earnings of £123.8 million.

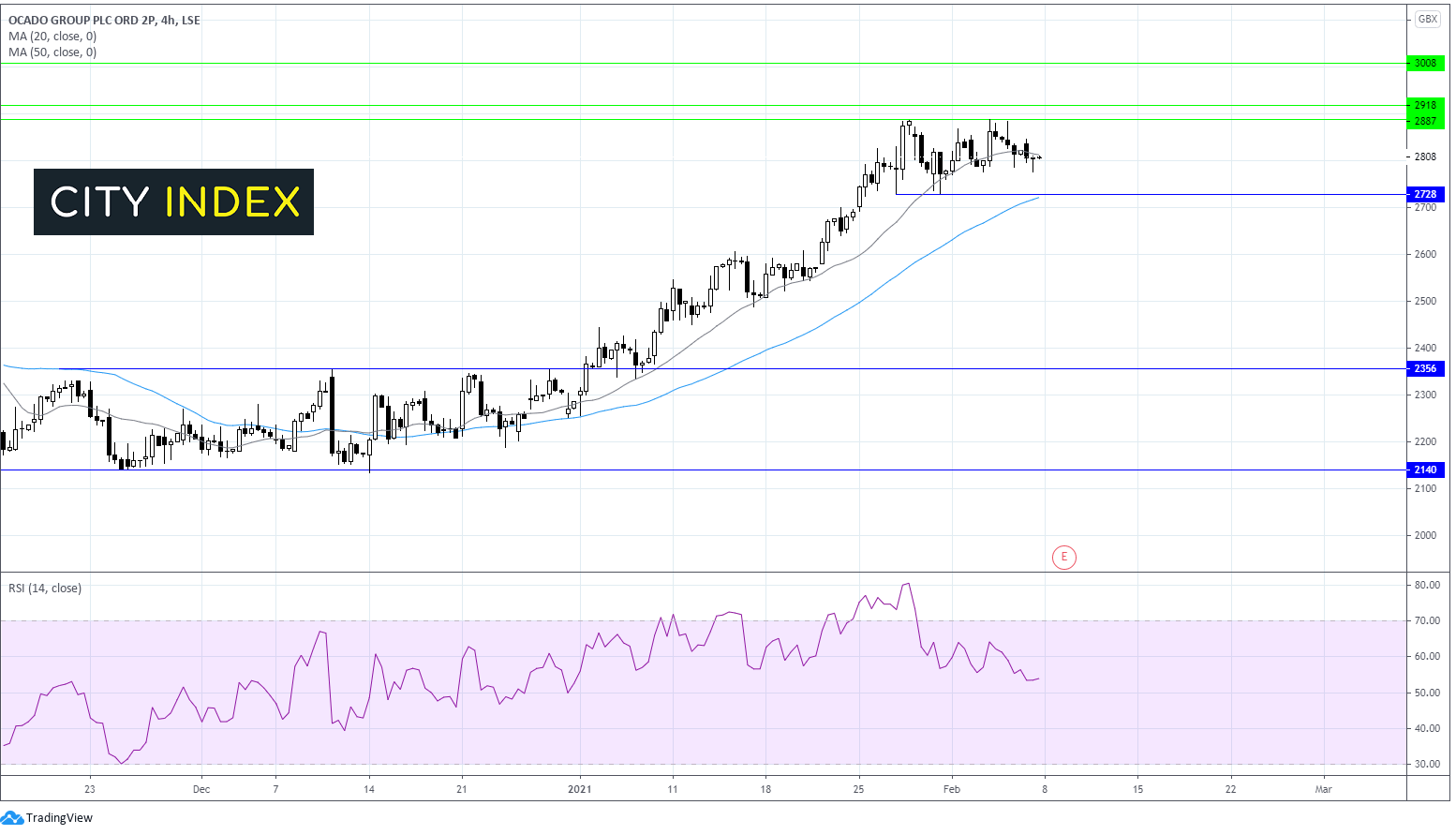

Ocado technical analysis

After spending the last three months of 2020 more or less rangebound, the price broke out to the upside at the start of this year. Supported by its 20 sma on the 4 hour chart the price experienced a series of higher highs and higher lows.

The price failed to push beyond 2890 and has traded in a tight 160 point range of 2890 and 2730 on the lower sides.

The price is currently in the middle of this range, on its 20 day sma and just marginally above neutral on the RSI.

Full year results could provide the catalyst needed to push the stock out of its current range to test a fresh all time high above 2914 before targeting round number 3000.

Meanwhile disappointing numbers could see 2730 lower band support and 100 dma broken down as the price looks towards 2600 and 2350 resistance turned support.

Learn more about trading equities