Encouragingly the pace of vaccination in NZ has increased. 66% of the population have now received their first dose, and 33% of the population are double jabbed. These numbers should continue to increase after the NZ government secured 500k of Pfizer doses from Denmark and 275k from Spain.

Heading into Thursday's Q2 GDP release and reflecting delta optimism, pricing for an RBNZ hike has increased from 90% priced to fully priced for a 25bp hike at its meeting on October 6th.

Although Thursdays Q2 GDP data predates the current lockdown, it will confirm the economy was on a solid footing before the lockdowns. The market is looking for a 1.3% q/q lift in Q2 GDP, followed by a sharp drop in Q3, before a reopening fuelled recovery in Q4.

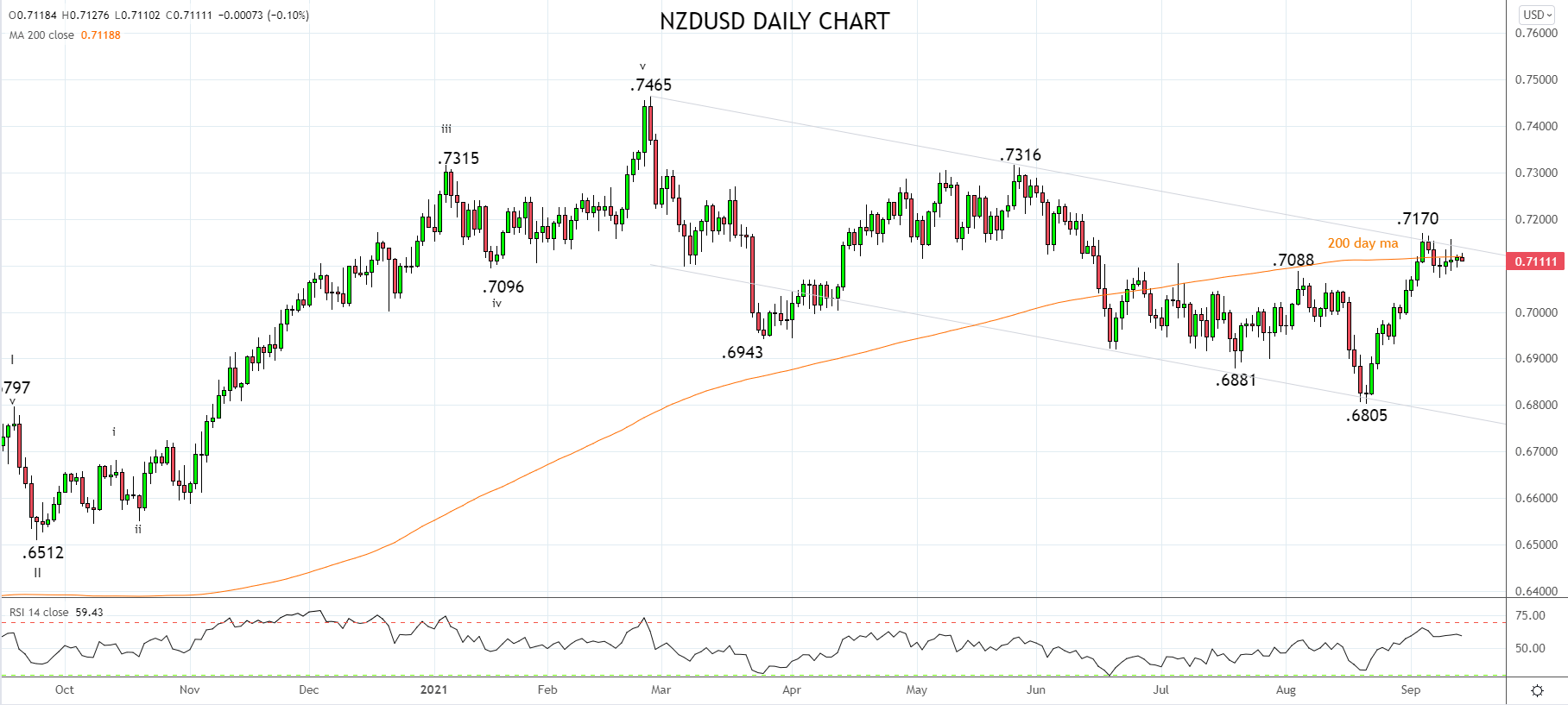

The NZDUSD's ability to withstand the recent bout of risk aversion in US equity equities has been impressive, despite the NZDUSD having one of the outstanding long positions in G10 FX currently.

Nonetheless, while the NZDUSD remains below trend channel resistance and recent highs .7140/70, the risks remain for a flush lower towards the 7000c area in the near term. Aware that if the NZDUSD were to break and close above .7175, it would negate expectations of a pullback and indicate a rally towards .7300c is underway.

Source Tradingview. The figures stated areas of September 14th, 2021. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation