There’s a plethora of negative forces weighing on investor sentiment right now. Inflation. Weakening growth in China. Europe heading for recession. Rising interest rates. Quantitative tightening. Cryptocurrency in turmoil. As a result, the markets have been unable to stage a sustainable rally and explains why there’s been no real follow-through after the rally at the back end of last week. Investors have been quick to take profit and not keen to carry positions in case the markets continue to head lower. In other words, we are in a bear market and rallies get faded into, while support levels break more often than not. News continues to disappoint, so it is difficult to see an end to this.

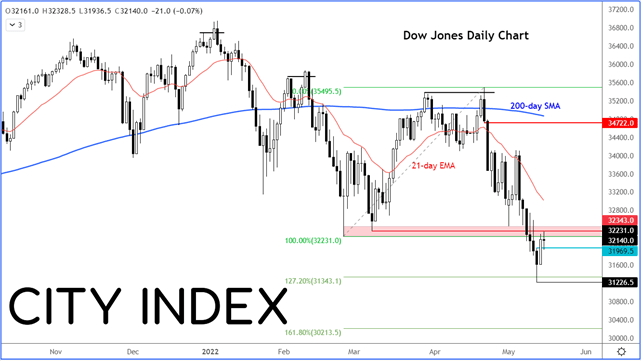

DJIA testing key resistance

The Dow like many other global indices has been printing lower lows and lower highs, which means the sellers have been in control of price action. It is now testing the broken support zone from late February and early March around 32,200 and 32,350 area. Once support, is this zone going to turn into resistance going forward? I wouldn’t be against it, judging by what has happened in the past with similar such levels.

Looking ahead to rest of the week

We have already seen Chinese retail sales and industrial production disappoint expectations overnight. The recent lockdowns in China means economic activity was always going to suffer, as we have found out. However, the numbers were even weaker than expected, which is why we are seeing renewed weakness in risk assets. Investor worries about a Chinese slowdown is real.

Globally, consumers are feeling the pinch with surging inflation. We will get a picture of how bad things really are at the world’s biggest economy, the US on Tuesday with the release of the latest retail sales report.

In the UK, meanwhile, inflation has climbed to a whopping 7.0% year-over-year in March, but there is hope that price pressures will come back down as the economy slows and due to base effects. Still, concerns over stagflation are likely to keep the pound and UK stocks under pressure for a while longer. UK CPI on Wednesday will be among the week’s macro highlights.

How to trade with City Index

You can trade with City Index by following these four easy steps:

- Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade