By now, readers are undoubtedly familiar with the souring backdrop for tech stocks. From the stubbornly persistent inflation readings to the ongoing Russian-Ukraine conflict to the broadly disappointing earnings season, highlighted by big disappointments from Amazon and Netflix, downbeat sentiment abounds for the Nasdaq 100 (US TECH 100) index.

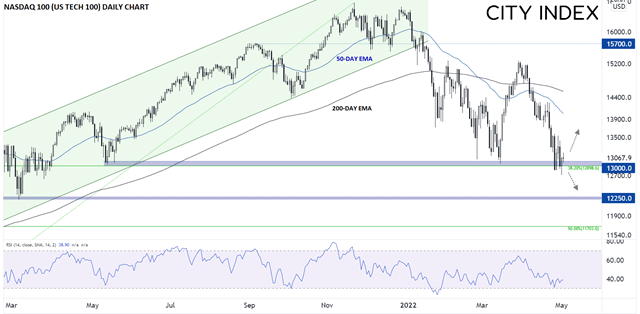

After falling by more than -13% for its worst month since the depths of the Great Financial Crisis, the Nasdaq 100 is testing a key support level near 13,000 as we hurtle toward a highly-anticipated FOMC meeting and another critical NFP employment report later this week. From a technical perspective, the 13,000 area marks previous support from March and last May, as well as the 38.2% Fibonacci retracement of the index’s full post-COVID rally, so traders are watching that area like a hawk heading into this week’s news:

Source: StoneX, TradingView

Notably, bulls are not panicking yet. Based on our internal data, 80% of global StoneX retail client open positions (across FOREX.com and City Index) in the index were on the long side, near the highest levels that we’ve seen in a month. In other words, the clear majority of traders still believe the Nasdaq 100 is heading higher from here. Time will tell whether the “buy the dip” mantra that has been so successful over the last couple of years will deliver again or whether bulls’ luck may finally be running out.

Despite the 14-day RSI not quite being in oversold territory as we go to press, we could certainly still see a bounce if the Fed is more balanced than some traders fear. In that case, the index could see a bounce toward 14,000 in the coming weeks. On the other hand, an unexpectedly hawkish Fed and technical breakdown below 13,000 would open the door for a quick drop toward the December 2020 / March 2021 lows near at 12,250 next.

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade