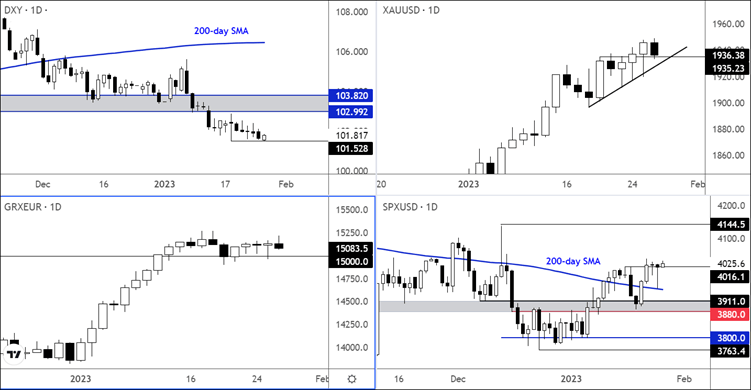

So far in the day, we have seen a bit of consolidation against the recent moves. By mid-day in London, US index futures had pulled back from their earlier highs, along with European indices, while the dollar had found mild support after selling off the day before. This in turn caused gold and silver to edge lower, as yields rose. There are still a couple of important macro pointers that investors will be watching this week ahead of a very busy next week, when three major central banks will make their first monetary policy decisions of 2023. First up is today’s publication of fourth quarter US GDP data, followed tomorrow by the Fed’s favourite measure of inflation – Core PCE Price Index. The earnings season is also moving to a higher gear, which should keep stock market investors on their toes.

US GDP coming up

In terms of US GDP, well this is expected to show that growth slowed in Q4 to 2.6%, down from 3.2% in Q3. The data is due at 13:30 GMT. The dollar has bounced back a little ahead of it, after selling off yesterday. How will the market react to the data? Well, a weaker GDP print should further boost bets that the Fed will pause rate hikes sooner, which should be bad for the dollar and good for markets such as gold and stock indices. A stronger report will probably have the opposite impact, which may fade later as I don’t think we will see a massive reaction anyway. This is because the Fed is meeting just a week later, when we will also have the ECB and BOE policy decisions. So, I reckon the market reaction will not be too big, unless the data is really poor or really good. Anything a bit above or below expectations shouldn’t cause too much volatility.

Central banks in focus

Once this week’s data releases are out of the way, the focus is going to turn to central banks in the week ahead. The Bank of Canada was the first major central bank to imply strongly that it will pause its aggressive rate hikes on Wednesday. This has raised hopes others will follow suit and thus we are near the peak in terms of interest rates. In turn, this could prevent a severe recession this year, something which the markets had been very worried about last year.

Up next, the US Federal Reserve, European Central Bank and the Bank of England are all due to decide on interest rates in the week ahead.

- Federal Reserve Policy Decision (Wednesday, February 1)

The Fed will kick off a busy week of central bank action on Wednesday. Signs of peak inflation has seen investors lower their expectations about the pace of tightening and the terminal interest rate. Risk assets have rallied as a result. But will the Fed throw a spanner in the works? The FOMC is expected to hike rates by a more standard 25 basis points following a 50-bps hike in December.

- Bank of England Policy Decision (Thursday, February 2)

An already-split Monetary Policy Committee is unlikely to be unanimous as they consider whether to opt for 50 or 25 basis point hike. The markets are about 65% confident of a 50-bps hike owing to high underlying inflation, strong wage growth and unexpected resilience in the economy. Will the GBP/USD rise to 1.25?

- European Central Bank Policy Decision (Thursday, February 2)

Several ECB officials have all but committed to raising the key rate by 0.5% to 2.5%, although policymakers have expressed different preferences for March. Thus, the market reaction on Thursday is likely to be about the future policy decision, especially after ECB President indicated there will be significant policy tightening at a "steady pace". Will Christine Lagarde provide more clarity on this?

Earnings in focus

My colleague Joshua Warner wrote the below. Read his full article HERE.

Results have been better than expected so far, but outlooks have been weak.

- Tesla is up almost 7% today and set to open at a one-month high after convincing markets that demand remains healthy and that it can deliver up to 2 million vehicles in 2023.

- Boeing delivered its first annual positive cashflow since 2018 last year, but says it has more work to do to stabilise the business.

- Southwest Airlines drops as flight disruption over the holidays costs it $800 million and sinks it into the red.

- IBM is set to open at a five-week low as it announces 3,900 job cuts.

- SAP down over 4% as it plans 3,000 #layoffs and considers selling Qualtrics.

- Chemicals company Dow sinks 5% after missing expectations and cutting 2,000 jobs.

- Shopify is on the rise after hiking prices, leading to improved outlook for revenue growth.

- Chevron triples budget for share buybacks to $75 billion ahead of results tomorrow.

- Big Tech stocks help push the Nasdaq 100 higher today as markets brace for results next week.

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade