When will Kingfisher release Q1 trading update?

Kingfisher will release a first-quarter trading update covering the three months to the end of April 2021 on the morning of Thursday May 20.

What to expect from Kingfisher’s trading update

Kingfisher, the owner of B&Q, Screwfix and a number of other home-improvement and DIY brands across Europe, has seen a boom in business over the past year and is hoping to emerge from the pandemic as a stronger business thanks to a new strategy launched last June.

Despite suffering disruption in the early stages of lockdown, pretax profits jumped more than seven-fold last year as sales grew over 7%, margins improved and it booked significantly fewer one-off costs.

People have been eager to improve and upgrade their homes during lockdown and interest in DIY has been reignited. Kingfisher expects these Covid-trends to continue even as Europe starts to ease restrictions and believes the home will remain a central hub.

To capitalise, Kingfisher launched a new strategic plan last year that included a new, faster and more localised operating model and a slew of new initiatives, from increasing online sales and selling more of its own-brand goods to opening more compact stores and cutting costs.

For now, Kingfisher is prioritising top-line growth and gaining market share, which it has been successfully delivering. It expects to continue to outperform its peers going forward and said that adjusted pretax profits will grow in-line with revenue over the short-term, before it tries to improve profitability at a faster pace in the future.

In terms of figures, Kingfisher’s quarterly updates concentrate on sales, including like-for-likes. It will also break down ecommerce and click-and-collect sales, and provide insight into how individual brands and countries have performed. Kingfisher has already revealed that like-for-like sales were up 24.2% between the start of February and March 18 thanks to strong demand in the UK and France.

That bodes well for the remainder of the quarter and the outlook considering like-for-like growth has accelerated from the 15.5% lift reported in the final quarter of its last financial year.

Still, Kingfisher is expecting to come up against strong comparatives later this year following the burst in demand seen in 2020, with like-for-likes jumping 16.6% in the second half of the last financial year. This means Kingfisher is currently expecting low double-digit like-for-like revenue growth in the first-half of its financial year but for a 5% to 15% decline in the second.

Where next for the Kingfisher share price?

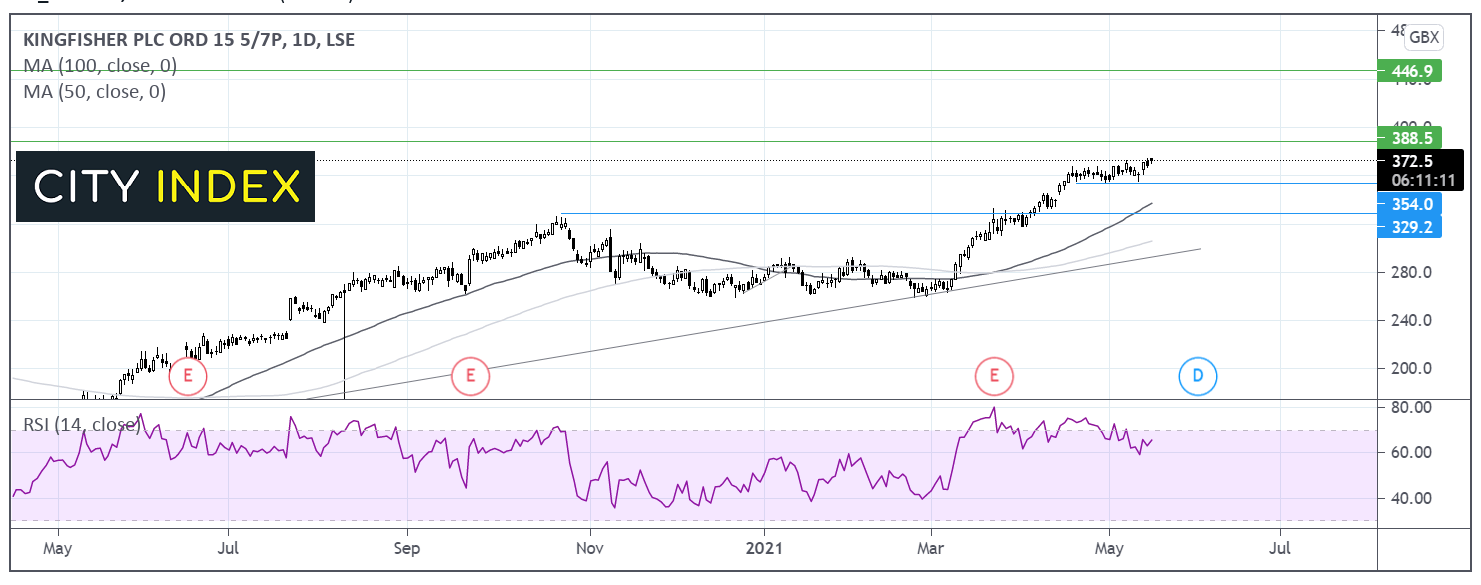

The Kingfisher share price trades above its 50 & 100 sma on the daily chart and above its 13 months ascending trend line showing an establish bullish trend. Whilst the Kingfisher share price has been steadily gaining ground from the mid-March low, the rally has picked up momentum since March.

The RSI is supportive of further gains whilst it remains out of overbought territory, with the buyers looking towards 380p round number and 388p the 2016 high as potential points of resistance.

It would take a move below 350p to negate the near-term uptrend and a move below 330p could see the sellers gain momentum.

How to trade Kingfisher shares

You can trade Kingfisher shares with City Index by following these four easy steps:

- Open a City Index account, or log-in if you’re already a customer.

- Search for ‘Royal Mail’ in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade