US indices are trading fairly quietly for the second straight day as traders soak up the end of the summer and avoid getting too committed ahead of Fed Chairman Jerome Powell’s keynote address at the Jackson Hole Economic Symposium on Friday (see our full preview of the highly-anticipated event here).

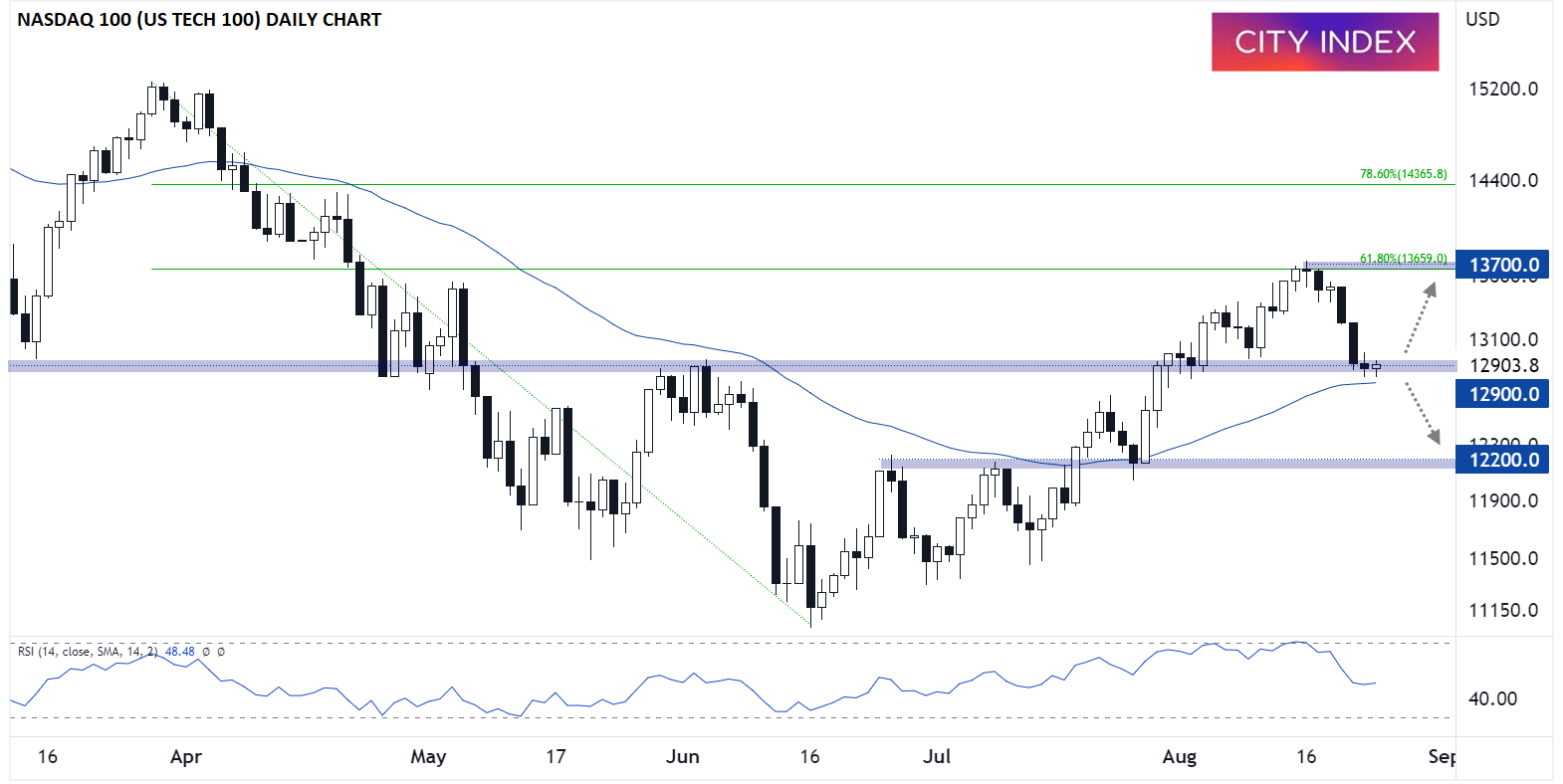

The pause gives us an opportunity to establish the key levels to watch on one of our most-widely traded indices, the Nasdaq 100 (US Tech 100). As the chart below shows, the index rallied nearly 25% off the June lows to last week’s peak, but sellers have aggressively pushed prices down in recent days, leaving the Nasdaq 100 testing a key previous support/resistance zone around 12,900. This area put a floor under prices in March and April, and once the index broke below it, it acted as resistance in early June; coincidentally, the 50-day EMA also sits in the upper 12,000s, strengthening the importance of that area for technical traders:

Source: StoneX, TradingView

Interestingly, our traders have flipped back to a bullish position in the index following last week’s selloff. According to our internal data, roughly two-thirds of the outstanding volume on the StoneX Retail platforms (FOREX.com and City Index) was on the short side throughout last week; this week, that’s flipped to about 60% net long, suggesting that our traders are expecting a bounce in the index on balance.

Will they be correct in their (slight) bias? Time will tell, but given the weakness in other risk assets and our expectation of a relatively hawkish speech from Chairman Powell on Friday, we wouldn’t be surprised to see a break lower heading into September. In that scenario, the next level of support to watch would be around 12,200.

Meanwhile, a confirmed bounce from this key level could take the index back toward the summer highs and the 661.8% Fibonacci retracement of the March-June fall at 13,700 in September.

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade