- Rising bond yields increase opportunity cost of holding zero-yielding assets

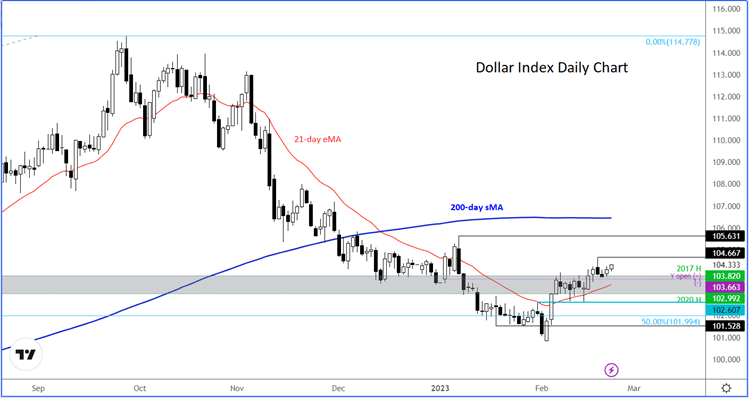

- Dollar index continues to print bullish price action

- All eyes on FOMC minutes at 19:00 GMT

Gold has bounced back a little ahead of the publication of FOMC meeting minutes, but it is far too early to talk up the prospects of a bottom. That’s because of the renewed strength in bond yields we have seen since the start of this month, when the Fed and ECB both appeared more hawkish than the markets had anticipated. Incoming data since those central bank meetings have been mostly better-than-expected, with US inflation and jobs data in particular supporting the view that more rate hikes are needed to cool the economy. But will today’s FOMC minutes match the recent hawkish Fedspeak? And – more importantly for gold traders – will the dollar and yields have further to run on the Fed story?

There’s been some talk that policymakers are looking to return to 50 basis point rate hikes again, but I highly doubt this is going to be the case as the Fed has already tightened its policy aggressively and will now go in with smaller increments so as to avoid an unwanted hard landing. Still, markets have realised that the Fed wants to keep its contractionary monetary policy in place longer than they had expected at the back end of last year and start of this year, owing to further improvement in US data and sticky inflation.

Correspondingly, the dollar has found good support and stocks have come under pressure, along with precious metals. The Dollar Index is looking perky, which is a major factor weighing on buck-denominated gold:

Source: StoneX and TradingView.com

All eyes are now on the FOMC minutes, due to be published at 19:00 GMT. If the FOMC minutes mirror the recent hawkish rhetoric from the Fed, then this is likely to push bond yields further higher, or at least keep them elevated near recent levels.

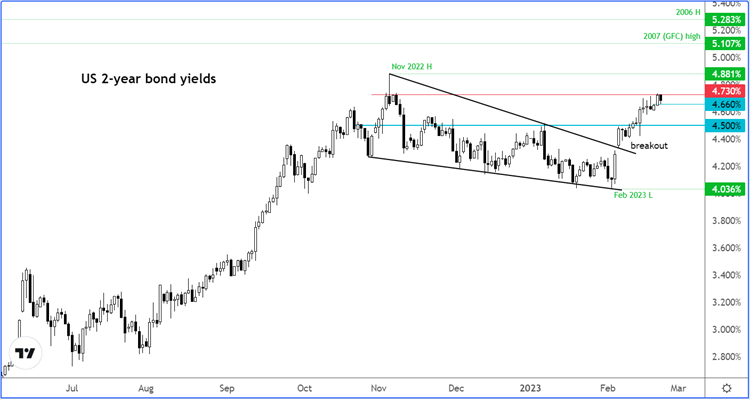

The 2-year yield is now approaching the high hit in November at 4.881% following the renewed hawkish tone at the Fed. If it gets there, this will further reduce increase the opportunity cost of holding non-interest-bearing commodities.

Source: StoneX and TradingView.com

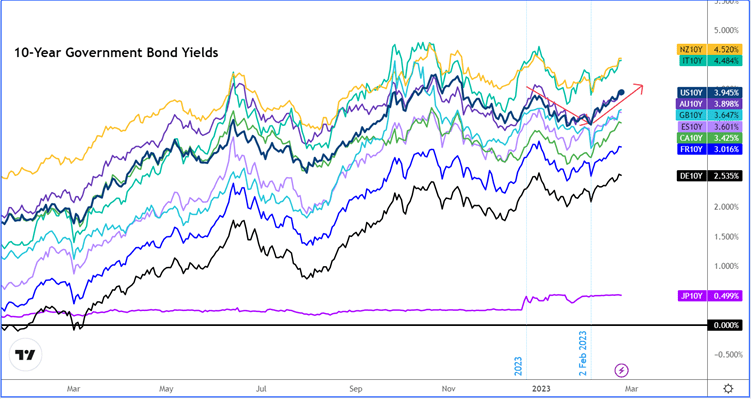

In fact, it is not just the US where yields are on the rise. If you look at the benchmark 10-year yields across the world, you will notice they have been on the rise since the start of the month:

Source: StoneX and TradingView.com

With global yields rising, some investors would argue that putting money into government bonds to earn a fixed, guaranteed, income is better than speculating on gold and other assets on capital appreciation.

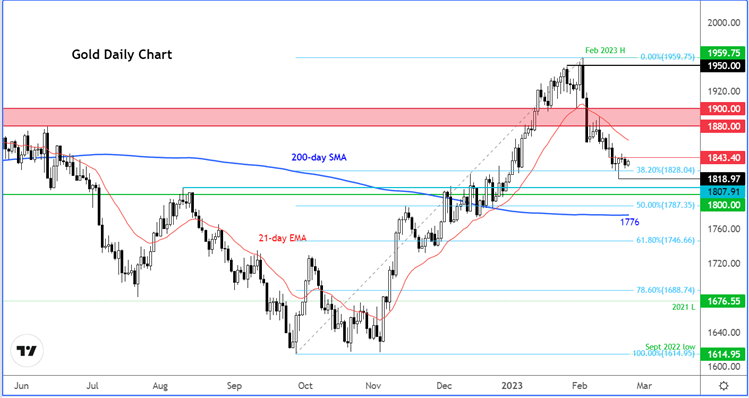

This is especially the case after gold failed to hold its breakout above that key $1880 to $1900 resistance area earlier this month. The breakdown has clearly disappointed the bulls, some of whom were looking for a move north of $2K and now find themselves wondering whether the metal has topped out again.

Recent price action has been bearish and for that reason we continue to favour the bearish setups over bullish.

Source: StoneX and TradingView.com

Gold on TradingView

If the FOMC minutes and other incoming data fuel hawkish fed bets, then gold could drop to the next potential support area around $1800 next. Otherwise, if the FOMC minutes appear to be rather dovish then we could see a relief recovery towards that noted $1800 to $1900 resistance range again. Whatever happens, gold bulls will need to see a confirmed reversal signal before looking to step back on the long side as the risks remain tilted to the downside amid the recent developments across the financial markets.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade