- Recession confirmed for US economy

- Forget about hattrick of 75bp hikes from Fed

- BoE could deliver 50 bp hike next week

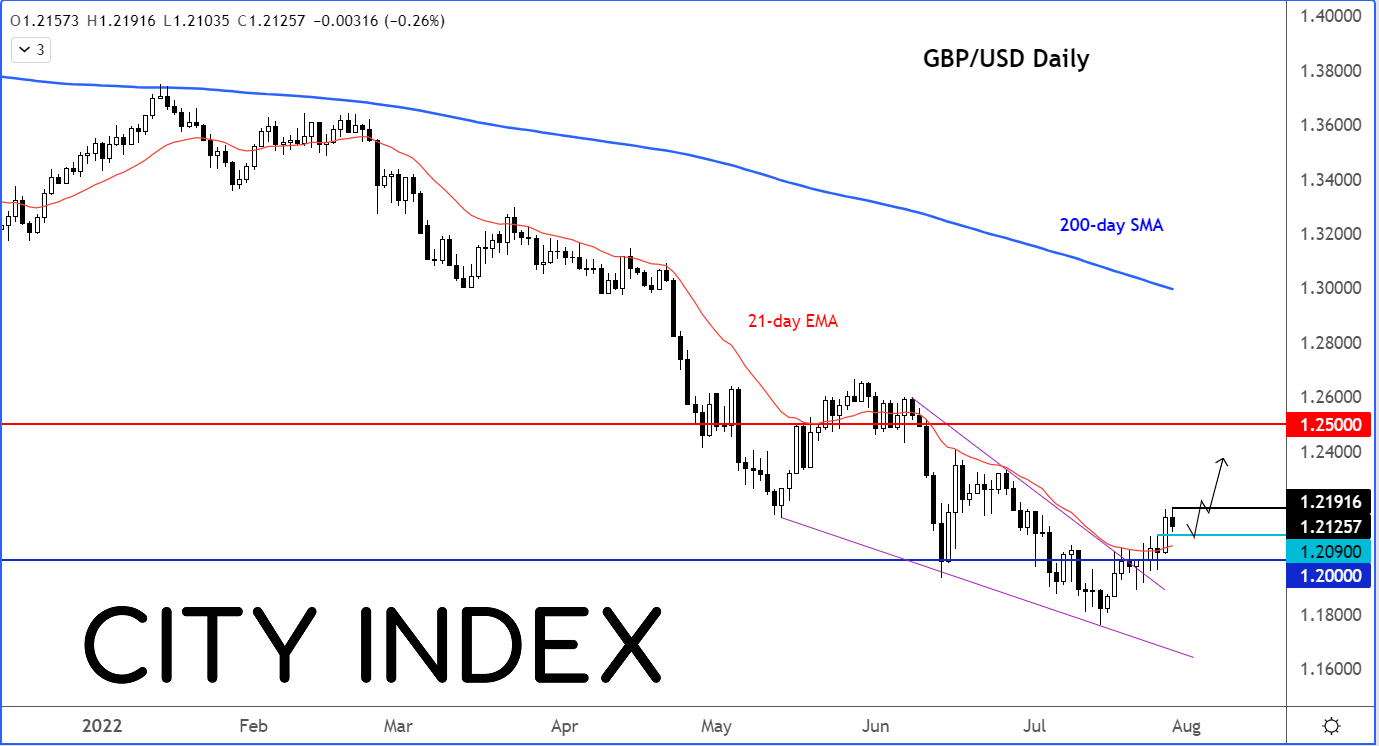

- GBP/USD path of least resistance to upside

The big macro news today was that from the US where the first estimate of the second quarter GDP confirmed the US was in a recession. Although the dollar fell against some currencies, most notably the yen, it held its own relatively well against the euro and pound, although I reckon it is only a matter of time before these currencies also find some buying interest.

US recession confirmed

Contrary to expectation of +0.5%, US second quarter GDP came in at an annual rate of -0.9%, which thus confirmed the US was in a recession after output had fallen by 1.6% in Q1, sending both gold and silver sharply higher. Gold prices rallying was a straight-forward reaction in response to the disappointing data, as bond yields slumped.

The greenback fell from its earlier highs, most notably against the Japanese yen and Swiss franc, although other currencies struggled.

Forget about hattrick of 75bp hikes from Fed

The US GDP data has re-affirmed my view that the Fed will have to slow down the pace of the hikes and potentially go in reverse in early 2023. After all, that is what the Fed chair had implied the day before. Powell indicated at the FOMC press conference on Wednesday that the pace of interest rates hikes will slow, and that future hikes will depend on incoming data. “While another unusually large increase could be appropriate at our next meeting, that is a decision that will depend on the data,” Powell said.

Well, GDP was quite poor, so there won’t be a hattrick of 75 basis point hikes in September, that’s for sure.

Against this backdrop, gold should be able to find buyers on the dips, given how much it has fallen already this year. In FX, I reckon we will see the likes of GBP and EUR, currencies that have performed very poor so far this year, stage a recovery against the greenback – especially if we see further evidence of a struggling US economy.

Could BoE finally deliver 50 bp hike?

The GBP/USD will be in the spotlight in the next week and a half as we look forward to a busy week for both the pound and dollar in the week ahead. The Bank of England’s “steady as she goes” approach to interest rate hikes (25 basis points) has been heavily criticized as inflation in the UK surged to new 40-year high of 9.4%. Will it finally join the rest of central banks with a bigger hike of 50 basis points this time on Thursday?

If it does, then expect the GBP/USD to climb towards mid-1.20s, possibly reaching 1.2500 by Friday, especially if we also see further weakness in US macro data as well.

GBP/USD path of least resistance to upside

After breaking out of a falling wedge pattern to the upside, the GBP/USD was up for the second consecutive week, at the time of writing. The short-term path of least resistance was therefore to the upside.

As such, I am expecting the GBP/USD to climb higher. Short-term support at 1.2090 needs to hold on a daily closing basis to keep the bulls happy.