European markets look set to follow Wall Street and Asia higher, as the risk tone in the market has improved slightly after another volatile week. The dollar is pausing for breath after its 8 day surge.

The coronavirus outbreak continues to escalate, with Italy experiencing more deaths than China, California ordering people to stay at home and London looking towards an imminent lock down.

Yet despite the rapidly growing numbers and stricter measures being implemented to contain the virus outbreak, there is a calmer mood among traders today. This comes after a week where central banks across the globe have shown that they are willing to do whatever it takes to help their economies cope with the impact of coronavirus.

Rishi Sunak Next?

Following on from the BoE’s second emergency cut on Thursday, which has brought interest rates to their lowest level in the bank’s 325 year history, UK Chancellor is expected to unveil a vast rescue packages aimed a protecting workers’ jobs and wages as the coronavirus pandemic continues to hit businesses. This comes after the £330 bailout blowout announced Sunak earlier in the week.

Following on from the BoE’s second emergency cut on Thursday, which has brought interest rates to their lowest level in the bank’s 325 year history, UK Chancellor is expected to unveil a vast rescue packages aimed a protecting workers’ jobs and wages as the coronavirus pandemic continues to hit businesses. This comes after the £330 bailout blowout announced Sunak earlier in the week.

The US Senate was also debating a trillion-dollar package that would include direct help for Americans and relief for small business; steps to stabilise the economy. China could also be set to release trillions of yuan in fiscal stimulus to revive the economy.

The speed with which the central banks have brought in measures, and the depths that they have shown that they are willing to go to, to cushion the economic impact from coronavirus is easing fears. Cautious hopes of a relatively quick recovery are growing.

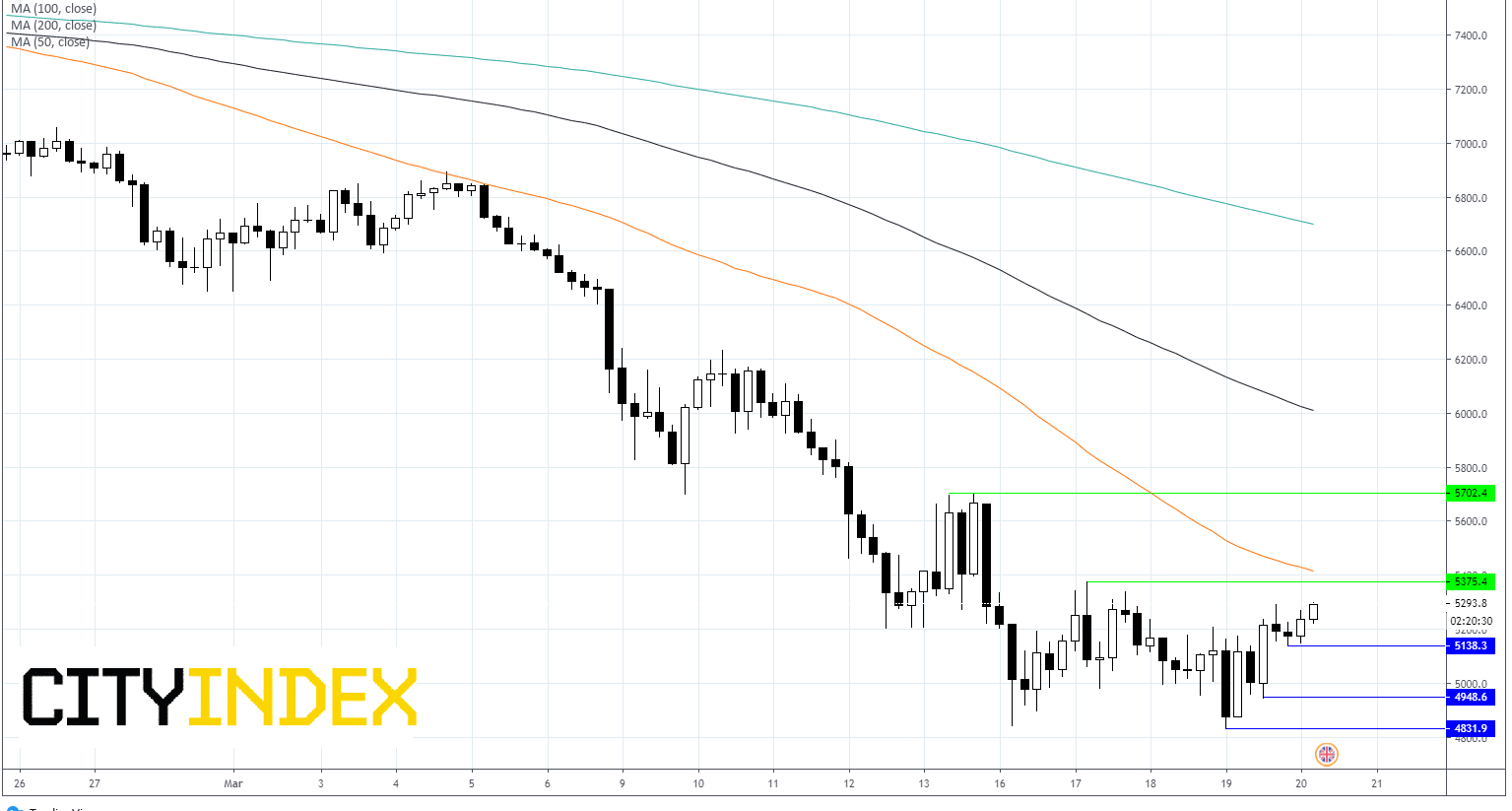

FTSE Levels to watch

FTSE futures are pointing to a 3% jump on the open. On the 4 hour chart the FTSE is approaching the 50 sma. A break above here could see more bulls jump in.

Resistance can be seen at 5375 (today futures high), prior to 5420 (50 sma) and 5700 (high 13th March).

Support can be seen at 5142 (today’s futures low) prior to 4945 and 4831 (yesterday’s low).

Latest market news

Today 08:15 AM

Today 05:45 AM

Yesterday 11:09 PM

Yesterday 11:01 PM