The Minutes from the December FOMC meeting showed that Fed members observed that a slowing of interest rate increases would allow the central bank to assess the progress on inflation and employment. Recall that the FOMC slowed the pace of interest rates increases to 50bps from 75bps the prior four meetings. However, that didn’t mean they were happy with the current situation. Members are still worried about the risk of persistent inflation. Powell mentioned in his press conference that they “welcome the reduction in the monthly pace of price increase, but it will take substantially more evidence to give confidence that inflation is on a sustained downward path.” In addition, the Summary of Economic Projections showed that no one expects rate cuts in 2023, as the median forecast for rates increased from 4.6% to 5.1%. As a result, participants felt that ongoing rate increases are “likely appropriate”. The committee also noted the need for flexibility and optionality in policy decisions and that unwarranted easing in financial conditions could complicate their effort to restore price stability.

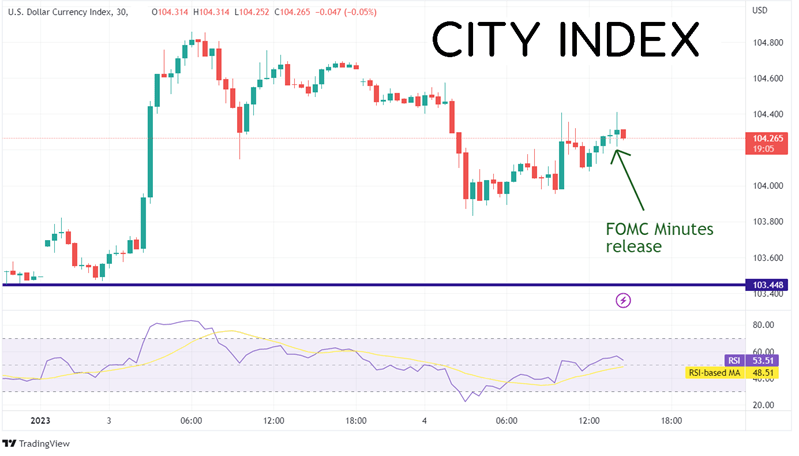

The US Dollar Index barely moved on the release of the Minutes, remaining within a range between 104.24 and 104.31.

Source: Tradingview, Stone X

Trade the DXY now: Login or Open a new account!

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

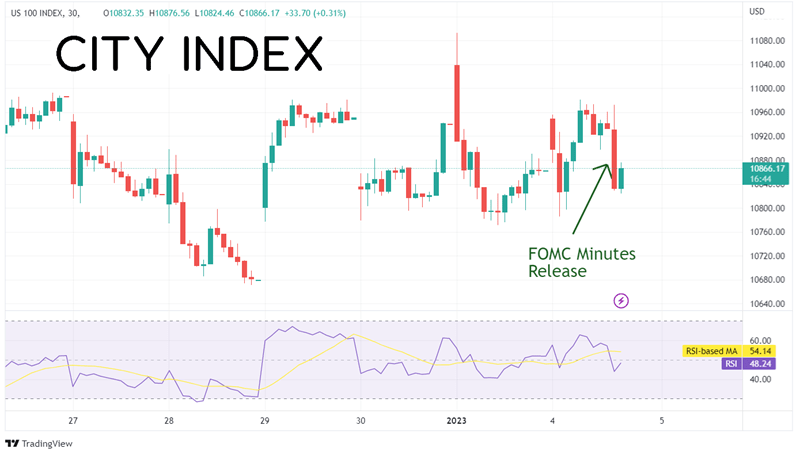

However, stock traders noticed the hawkishness that the message conveyed, and the NASDAQ 100 sold off nearly 1% within the first 30 minutes of the release.

Source: Tradingview, Stone X

Trade the NASDAQ 100 now: Login or Open a new account!

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

On a 240-minute timeframe, the NASDAQ 100 has been rangebound since mid-September, trading between the lows of October 13th and the 50% retracement from the highs of August 16th to the lows of October 13th, at 10440.64 and 12080.78 respectively. The hawkish Fed Minutes confirm the outcome of the meeting on December 15th, 2022. If the index continues to move lower, the first support is at the lows of December 28th at 10671. Below there, price can fall to the October 13th lows at 10440, then horizontal support dating to July 2020 at 9736.57. However, if the markets dismiss the hawkishness of the Minutes as “old news”, the NASDAQ 100 could catch a bid. First resistance is at the gap opening from December 22nd, 2022, at 11114.23, then the gap fill from the prior day at 11207.38. Above there, price can move to the gap opening from the highs of December 15th, 2022, at 11591.33.

Source: Tradingview, Stone X

Despite the hawkishness of the FOMC Minutes, the US Dollar barely budged. However, stock markets sold off, with the NASDAQ 100 falling nearly 1% on the release. Will the downtrend continue, or will the index move towards the gaps above? It may depend on the Non-Farm Payrolls report on Friday!

Learn more about forex trading opportunities.