The FOMC Minutes showed the markets what many investors have already known, in particular:

- Many Fed officials said 1 or more 50bps hikes may be warranted

- FOMC backs roll off cap phase-in of 3 months or modestly longer

- $95 billion month cap for asset runoff likely appropriate (markets were looking for $80-$100 billion)

However, this seems to be old news as Fed member after Fed member has been more “hawkish leaning” since the March 16th meeting. Fed Chairman Powell spoke in mid-March and said that “if the Fed needs to tighten above neutral rate, it will do so.” In addition, when asked what would prevent a 50bps hike at the May meeting, Powell replied “nothing!”. Yesterday, the Fed’s Brainard said that the “Fed is prepared to take strong action if inflation and inflation expectation indicators suggest a need for such action”. Regarding the balance sheet, she indicated that the Fed could begin to reduce at a “rapid” pace. In addition, the Fed’s George said that a 50bps hike is an option we have to consider. Today, the Fed’s Harker and Barkin echoed these same sentiments.

Everything you need to know about the Federal Reserve

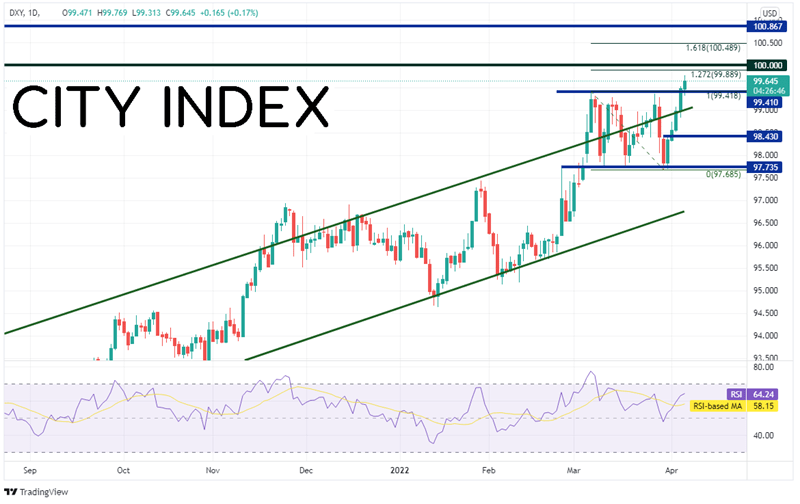

The DXY continued its assault higher towards the 100 level. First resistance is at the 127.2% Fibonacci extension from the high of March 7th to the lows of March 30th, at 99.89. If price can trade above there, the next resistance level is psychological round number resistance level at 100.00, then the 161.8% Fibonacci extension from the same recently mentioned timeframe at 100.49. First support is at today’s low near 99.31, then the top, upward sloping trendline of the long-term channel near 99.00. Below there, the DXY can fall to horizontal support at 98.43.

Source: Tradingview, Stone X

Trade DXY now: Login or Open a new account!

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

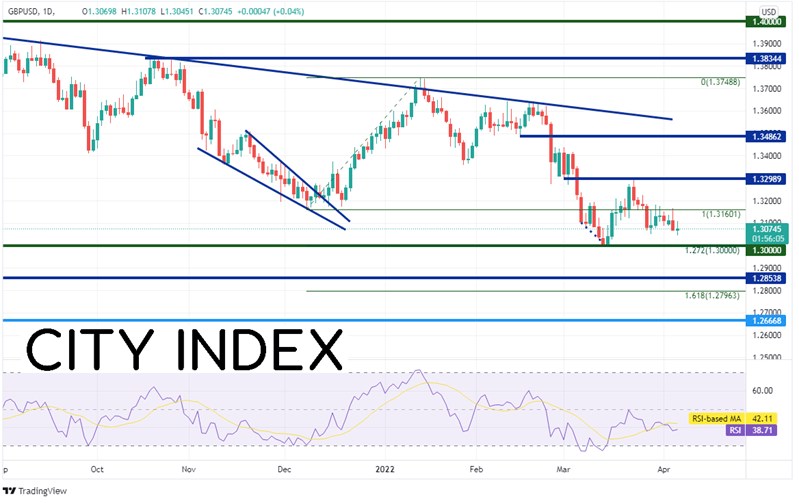

GBP/USD has been moving lower aggressively lower since making a near-term high on January 13th at 1.3788. On March 14th, the pair tested the 127.2% Fibonacci extension from the lows of December 8th, 2021 to the highs of January 13th, near 1.3000. Price failed to break below and bounced to resistance near 1.3273. GBP/USD is now moving lower and appears to be trying to test the 1.3000 level once again. If price breaks below, horizontal support from November 2020 is at 1.2854, then the 161.8% Fibonacci extension from the same timeframe near 1.2793. Resistance is at the March 23rd highs of 1.3298, then horizontal resistance at 1.3486.

Source: Tradingview, Stone X

Trade GBP/USD now: Login or Open a new account!

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

The Minutes from the March 16th FOMC meeting had some good information, however they were a bit stale, as almost all Fed speakers have been hawkish lately. However, the DXY did continue its move towards 100.00 and GBP/USD tried to get near 1.3000. If the hawkish signals continue from Fed officials, prices may reach those levels soon.

Learn more about forex trading opportunities.