European vaccines will eventually get there: EUR/GBP

In an internal memo seen by Bloomberg, the European Union expects to have most citizens vaccinated by the end of June. As discussed in the Week Ahead, France and Italy are under lockdown until nearly the end of April. There is also the possibility that Germany may be there soon. With the current lockdowns and restrictions, vaccinating nearly 70% of Europe’s population would be an impressive feat! The rollout has been extremely slow in Europe. This is partly due to the fits and starts of the AstraZeneca vaccine due to the possibility that is related to blot clots. It is also partly due to the UK gobbling up manufacturing contracts before the EU even had a chance. With the weak US Dollar over the past couple of days, it’s not a surprise EUR/USD would be stronger. However, the Euro is stronger vs other currencies as well, particularly the Pound.

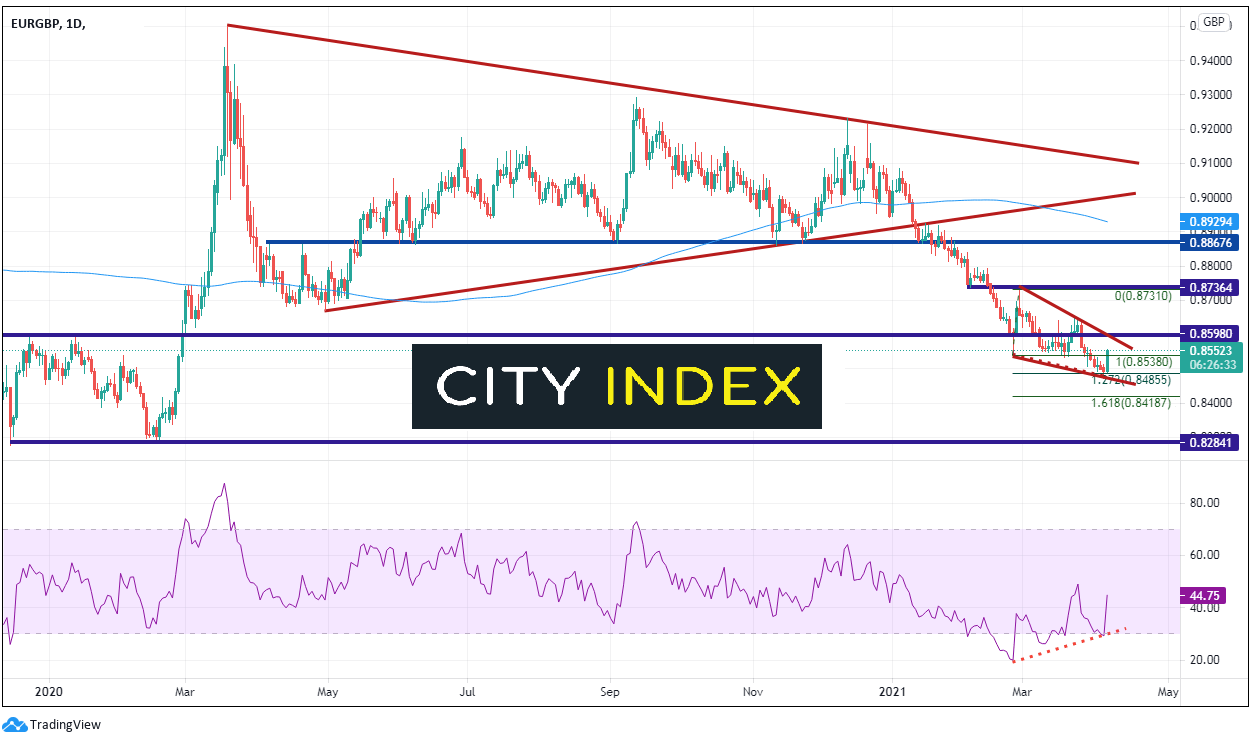

EUR/GBP had broken lower from a long-term symmetrical triangle on January 13th and has been moving modestly lower since. Price bounced from February 24th to February 26th and recently has been in a descending triangle. Yesterday, the pair reached the 127.2% Fibonacci retracement from the February 24th lows to the February 26th highs, near 0.8485. That support has held so far. The combination of the support, the price divergence with the RSI, and the hopeful vaccine news out of Europe, makes a perfect recipe for EUR/GBP to move higher and squeeze out shorts!

Source: Tradingview, City Index

Where can the pair run into resistance? The first level is the downward sloping trendline dating back to February 26th, near 0.8600. This is also the 50% retracement level from those same highs to yesterday’s lows. Horizontal resistance above there is near 0.8650 and then the February 26th highs near 0.8731. Horizontal support is just below at previous resistance near 0.8535 and then yesterday’s lows near 0.8472. If EUR/GBP breaks below there, price can fall to the 161.8% Fibonacci retracement extension from the previous mentioned timeframe near 0.8419. After that, there is a big drop down to previous lows from February 2020 near 0.8284 where bulls may be looking to buy (see daily).

Source: Tradingview, City Index

Traders are forward looking. Despite the current lockdowns in Europe, the vaccine news to is positive for the Euro. If the news continues to be positive, expect the Euro to continue higher, especially vs currencies which have already priced in positive vaccine news (EUR/GBP and EUR/USD). However, if the news turns negative (i.e., more negative news regarding AstraZeneca or a continued slow rollout), the short squeeze may be over, and the Euro may continue its recent trend lower.

Learn more about forex trading opportunities.