Asian Indices:

- Australia's ASX 200 index rose by 25.7 points (0.39%) and currently trades at 6,534.20

- Japan's Nikkei 225 index has fallen by -25.66 points (-0.1%) and currently trades at 26,123.89

- Hong Kong's Hang Seng index has risen by 200.75 points (0.96%) and currently trades at 21,209.09

- China's A50 Index has risen by 75.31 points (0.53%) and currently trades at 14,251.86

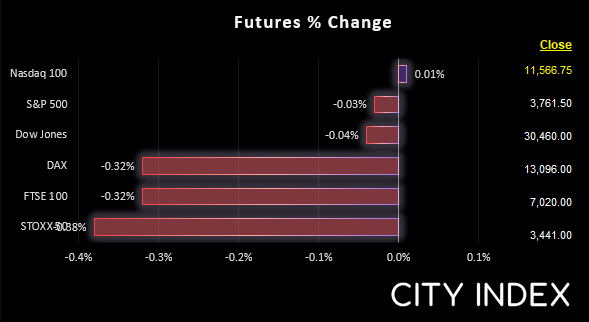

UK and Europe:

- UK's FTSE 100 futures are currently down -26.5 points (-0.38%), the cash market is currently estimated to open at 7,062.72

- Euro STOXX 50 futures are currently down -13 points (-0.38%), the cash market is currently estimated to open at 3,451.64

- Germany's DAX futures are currently down -32 points (-0.24%), the cash market is currently estimated to open at 13,112.28

US Futures:

- DJI futures are currently down -24 points (-0.08%)

- S&P 500 futures are currently down -6.75 points (-0.06%)

- Nasdaq 100 futures are currently down -3.25 points (-0.09%)

FTSE 350 – Market Internals:

FTSE 350: 3944.13 (-0.88%) 22 June 2022

- 151 (43.14%) stocks advanced and 188 (53.71%) declined

- 0 stocks rose to a new 52-week high, 68 fell to new lows

- 18.29% of stocks closed above their 200-day average

- 24% of stocks closed above their 50-day average

- 5.14% of stocks closed above their 20-day average

Outperformers:

- +9.43% - JD Sports Fashion PLC (JD.L)

- +3.96% - FirstGroup PLC (FGP.L)

- +3.05% - Drax Group PLC (DRX.L)

Underperformers:

- -15.04% - Micro Focus International PLC (MCRO.L)

- -8.64% - Glencore PLC (GLEN.L)

- -5.62% - Vesuvius PLC (VSVS.L)

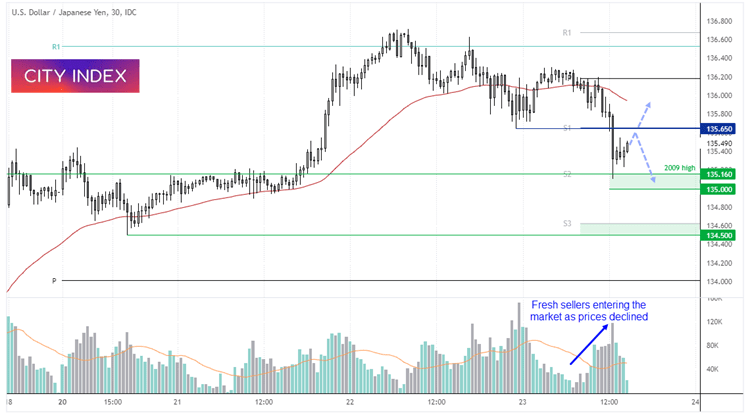

We noted a risk-off vibe earlier in the Asian session following Jerome’s comments on a US recession, which saw US futures and oil lower and money flow into the yen. Yet momentum towards the yen increased notably following two developments:

- Former FX official – Takehiko Nakao, who was instructing previous interventions – saying the yen weakness was not beneficial to the economy. This is stark contrast to the BOJ and government’s view that a weak yen is preferable.

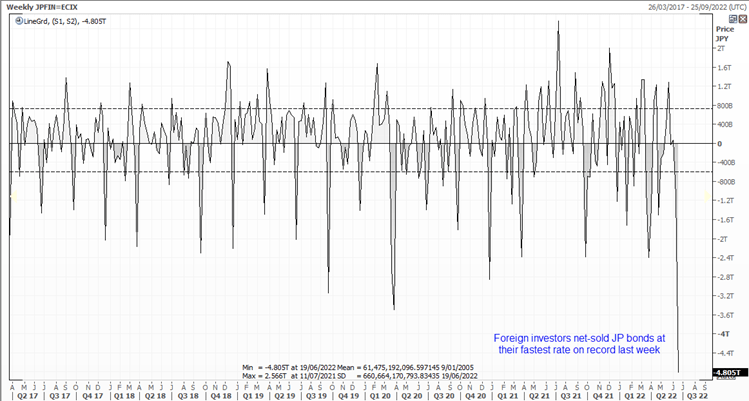

- The Ministry of Finance reported that foreign investors sold ¥4.8 trillion of Japanese bonds last week, its highest level on record. This could be as investors are (or were) anticipating the BOJ to succumb to market pressures and adjust their YCC which currently targets a 2.5% yield on the 10-year government bond.

USD/JPY fell back to the 2009 high of 135.16 on rising volume to suggest bears initiating interest. But we now need to see if there is a secondary reaction in the European and US sessions. On one hand it may be an over-reaction as the FX official is now retired and the backdrop has changed, which brings into question the relevance of his view. It’s also likely that a lot of the bond sales were ahead of the BOJ meeting, which resulted in no change of policy (or hint of one arriving soon). Either way, the 135 support zone is a pivotal level to monitor heading into these sessions.

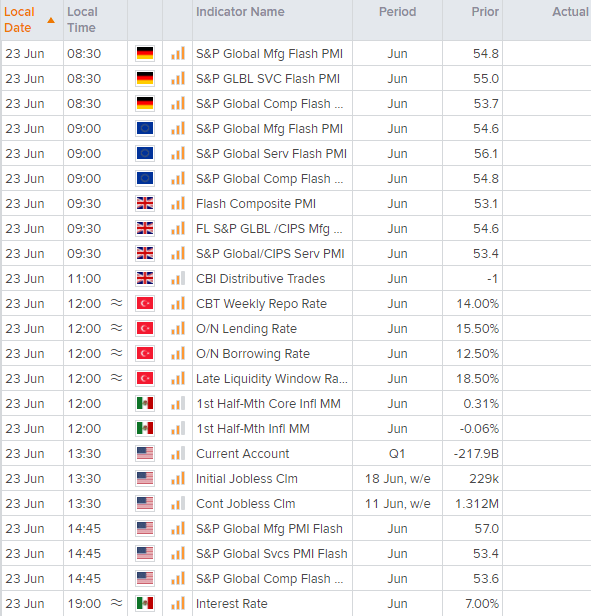

Economic events up next (Times in BST)

Flash PMI data for Europe and US are released today. The headline numbers are usually a traders favourite as they provide proxy for GDP potential (and therefore central bank policy), but the internal data points also warrant a look to help decipher supply chain issues, demand and inflationary pressures.

We also have two central bank meetings. Turkey’s central bank are expected to hold rates at 14% for a fourth consecutive meeting, although if they were to change rates it would likely be lower despite high levels of inflation. Whilst the Central Bank of Mexico are expected to follow the Fed and hike by a record 75-bps point, from 7% to 7.5%.

How to trade with City Index

You can easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade