Asian Indices:

- Australia's ASX 200 index rose by 13.4 points (0.18%) and currently trades at 7,516.60

- Japan's Nikkei 225 index has risen by 123.1 points (0.45%) and currently trades at 27,707.17

- Hong Kong's Hang Seng index has fallen by -51.99 points (-0.2%) and currently trades at 26,374.56

UK and Europe:

- UK's FTSE 100 futures are currently up 2.5 points (0.04%), the cash market is currently estimated to open at 7,126.36

- Euro STOXX 50 futures are currently up 3.5 points (0.08%), the cash market is currently estimated to open at 4,148.40

- Germany's DAX futures are currently up 10 points (0.06%), the cash market is currently estimated to open at 15,702.13

US Futures:

- DJI futures are currently down -323.73 points (-0.92%)

- S&P 500 futures are currently up 17.75 points (0.12%)

- Nasdaq 100 futures are currently up 7.25 points (0.16%)

Learn how to trade indices

Asian indices hold onto gains

Asian equities held onto gains despite hawkish comments from Fed members yesterday. Positive earnings supported Japan’s equity markets which were the strongest of the session. The Nikkei is up 0.35% and the TOPIX is trading 0.3% higher. The Hang Seng is up just 0.15% but holding steady around 26,400 after its volatile ride last week and the ASX 200 touched a new record high during a low-volatility session. Futures markets are currently pointing to a slightly higher open for Europe.

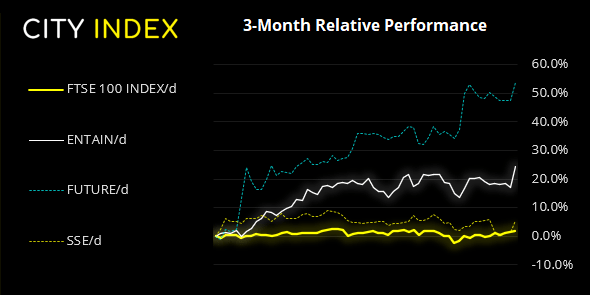

The FTSE is grinding higher in its usual fashion. Although with each cycle higher seen with lower momentum, and prices now reaching resistance around 7150, we have our eyes on a potential bearish wedge pattern.

However, a word of caution with such patterns; wedges do have the ability to extend in the direction of the underlying trend and squeezing out ‘one more high’ before finally breaking counter to the trend. So, it could in fact rise towards the 7170 high and still put in upper spikes before reversing (assuming it does at all). Therefore, waiting for a break of a swing low and / or trendline can help reduce false breaks.

Also keep on mind the BOE meeting today at 12:00 BST which leaves the FTSE vulnerable to spikes of volatility. But, for now, a break below 7100 may be enough to confirm a near-term bearish reversal.

FTSE 350: Market Internals

FTSE 350: 4101.64 (0.26%) 04 August 2021

- 219 (62.39%) stocks advanced and 126 (35.90%) declined

- 48 stocks rose to a new 52-week high, 2 fell to new lows

- 77.49% of stocks closed above their 200-day average

- 70.94% of stocks closed above their 50-day average

- 24.5% of stocks closed above their 20-day average

Outperformers:

- + 6.10% - Entain PLC (ENT.L)

- + 4.11% - Future PLC (FUTR.L)

- + 4.03% - SSE PLC (SSE.L)

Underperformers:

- -9.33% - Ferrexpo PLC (FXPO.L)

- -6.56% - Morgan Sindall Group PLC (MGNS.L)

- -4.35% - Dr Martens PLC (DOCS.L)

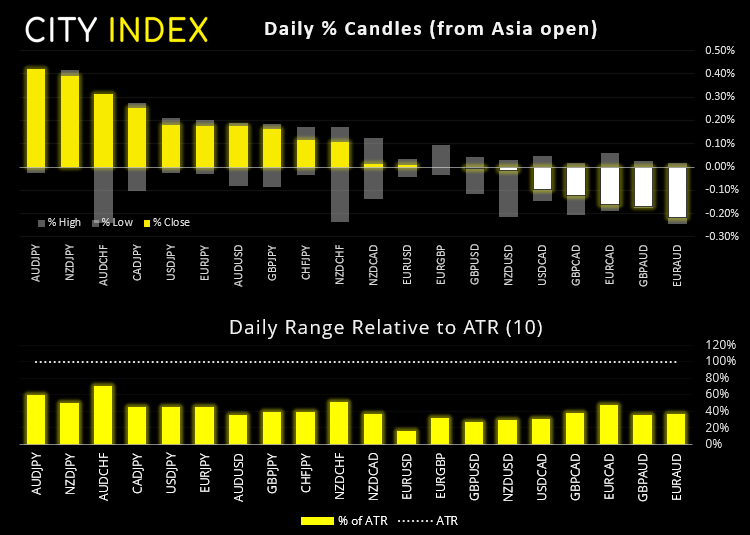

Forex pairs remain in tight ranges:

It was minor ranges for currencies with a slight air of risk-on, with AUD and NZD currently the strongest majors and JPY and CHF the weakest. So far this week, NZD and AUD are the strongest (thanks RBNZ) and CAD is the weakest as it remains pressured from lower oil prices.

EUR/GBP is holding above key support the key support zone around 0.8500. A bullish pinbar formed a slightly higher low above it yesterday, although prices are coiling up on the four-hour chart and its breakout direction is a flip of the BOE coin at this stage. 0.8500 remains a pivotal level.

GBP/USD broke out of a bullish channel on the four-hour chart last week and has been meandering around 1.3900 since. However, a strong bearish candle formed yesterday and prices and now trying to hold above the weekly pivot point at 1.3873 which is clearly the pivotal level for today.

A bearish outside candle formed on EUR/USD yesterday and prices have been anchored to its lows overnight. Whilst it is vulnerable to some intraday bullish spikes out bias remains bearish below 1.1900.

Learn how to trade forex

Commodities basked falls for fourth day:

The Thomson Reuters CRB commodity basket fell for a fourth day and closed beneath its (now invalidated) bullish hammer, although found support at the 50% retracement level. The daily trend remains bullish above 204.93 (which leaves plenty of downside) but we appear no closer to a trough as of yet. And that paints a potentially bearish picture for energy markets.

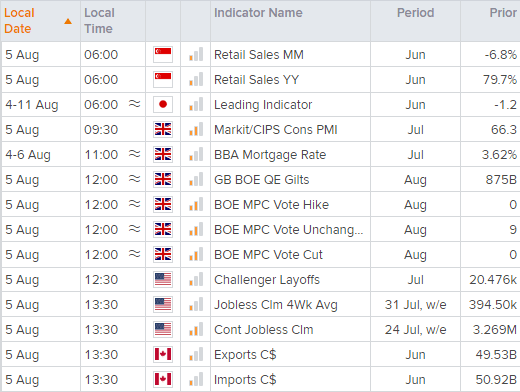

Up Next (Times in BST)

You can view all the scheduled events for today using our economic calendar, and keep up to date with the latest market news and analysis here.

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels.

- Place the trade.