Asian Indices:

- Australia's ASX 200 index fell by -5.2 points (-0.07%) and currently trades at 7,275.50

- Japan's Nikkei 225 index has fallen by -53.84 points (-0.2%) and currently trades at 28,174.46

- Hong Kong's Hang Seng index has fallen by 0 points (0%) and currently trades at 24,962.59

UK and Europe:

- UK's FTSE 100 futures are currently down -3 points (-0.04%), the cash market is currently estimated to open at 7,127.23

- Euro STOXX 50 futures are currently up 5 points (0.12%), the cash market is currently estimated to open at 4,060.09

- Germany's DAX futures are currently up 25 points (0.17%), the cash market is currently estimated to open at 15,171.87

US Futures:

- DJI futures are currently down -117.72 points (-0.34%)

- S&P 500 futures are currently down -32.25 points (-0.22%)

- Nasdaq 100 futures are currently down -5 points (-0.12%)

Learn how to trade indices

Indices

China’s property related companies were in the red again as fears of contagion stemming from Evergrande’s missed bond payments weighed on sentiment. The CSI300 property index is currently down around -1.5%. The Hang Seng was closed for the afternoon session due to a level 8 Typhoon warning. Futures markets are a little mixed but no major moves occurred at the open, with US indices around -0.1% lower and European futures between 0.1% - 0.2% higher.

We outlined a potential inverted head and shoulders on the FTSE 100 yesterday, and it remains a breakout to monitor. Technically it closed yesterday with a bearish outside day, although it could also be a bullish hammer should prices break above its high (as the lower wick shows sentiment reversing to bull’s favour by the end of the session).

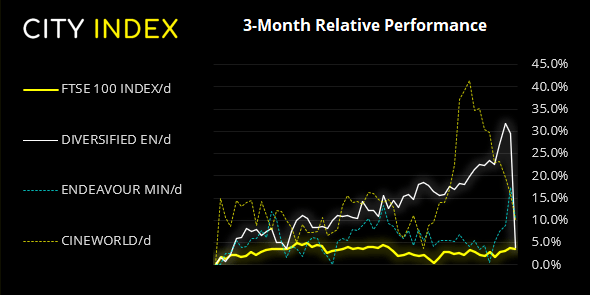

FTSE 350: Market Internals

FTSE 350: 4076.68 (-0.23%) 12 October 2021

- 151 (43.02%) stocks advanced and 185 (52.71%) declined

- 9 stocks rose to a new 52-week high, 16 fell to new lows

- 51.57% of stocks closed above their 200-day average

- 20.23% of stocks closed above their 50-day average

- 8.83% of stocks closed above their 20-day average

Outperformers:

- + 7.61%-Petropavlovsk PLC(POG.L)

- + 5.37%-Ocado Group PLC(OCDO.L)

- + 4.99%-Hipgnosis Songs Fund Ltd(SONG.L)

Underperformers:

- -19.9%-Diversified Energy Company PLC(DEC.L)

- -5.79%-Endeavour Mining PLC(EDV.L)

- -4.94%-Cineworld Group PLC(CINE.L)

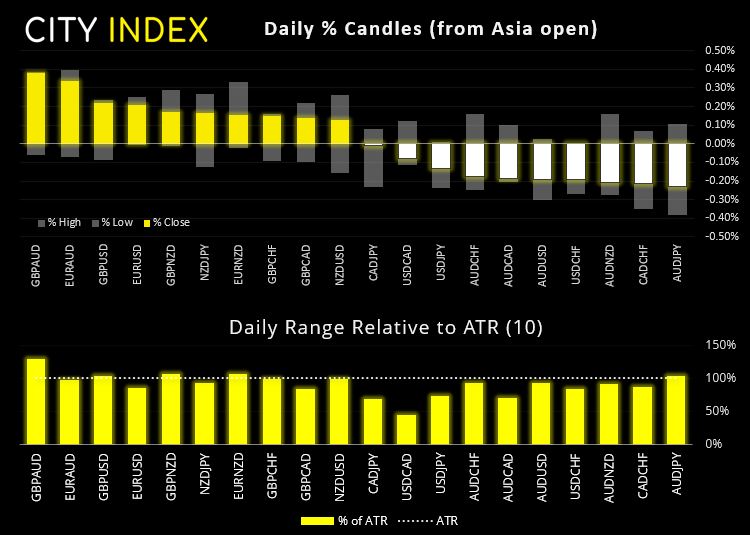

Forex:

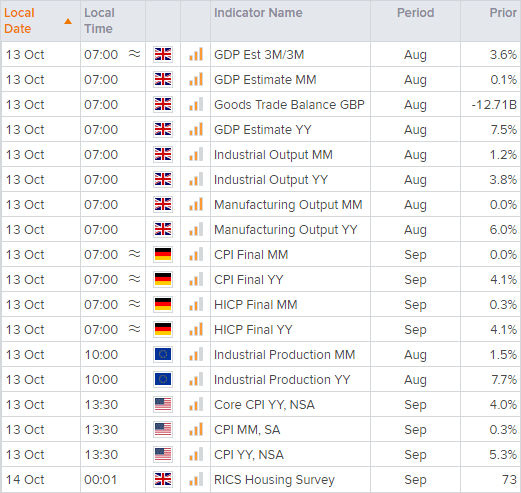

A host of UK data at 07:00 BST places GBP pairs into focus for traders this morning. However, as noted by my colleague Joe Perry, the British pound has failed to rise on hawkish comments from BOE and growing expectations of a rate hike. Yet with the energy crisis still in play, any BOE hike could be seen as a defence against inflation and not one to celebrate a strong economy. So that could mean that weak economic data has a greater impact on the pound than any upside surprises. Today the UK release GDP estimate, industrial and manufacturing output. GDP m/m is expected to rise by 0.5% (0.1% prior), industrial production is expected to rise to 0.2% (1.2% prior) and manufacturing production is expected to remain flat at 0%.

Then at 13:30 BST US release inflation data which remains a ‘hot topic’. At 4% it remains well above the Fed’s 2% average target, but it did fall below expectations and is down from its 4.5% peak the prior month. With two Fed members endorsing tapering at their November meeting, perhaps today’s CPI read is a moot point in the grand scheme of things. Although a higher read does pile further pressure on the Feed to act and will likely send the dollar higher as traders bring forward expectations of a hike. Conversely, a weaker print could weigh on the dollar today.

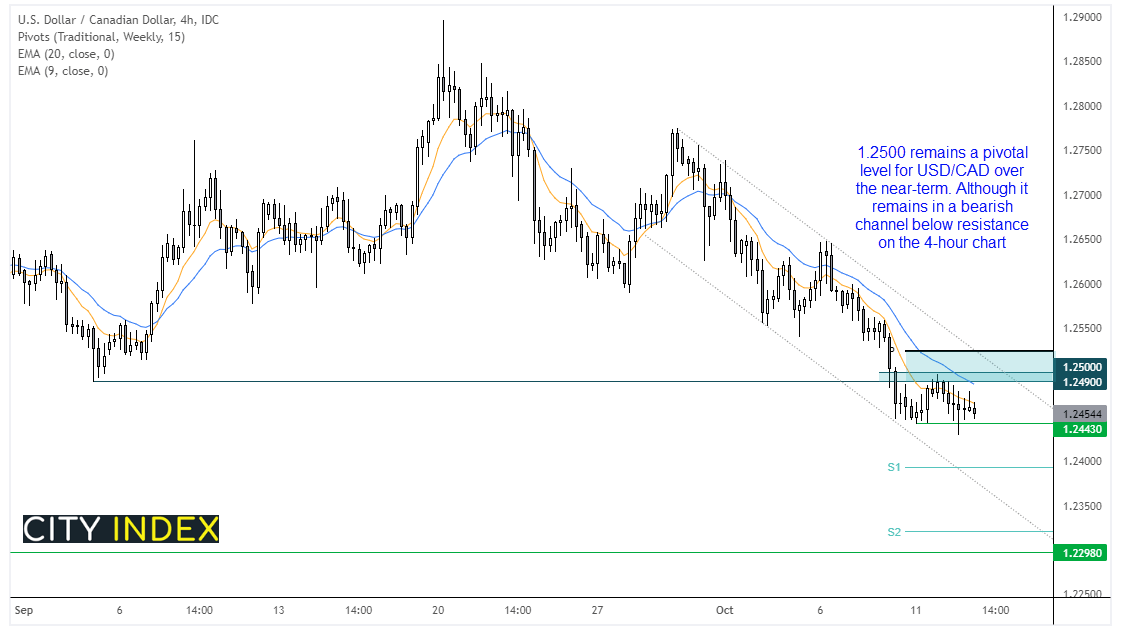

USD/CAD has fallen around 3.5% since its September high. The trend on the four-hour chart is clearly bearish although prices have consolidated at their lows over the past two days. That said, yesterday formed a bearish outside day after respecting 1.2500 resistance, so our bias remains bearish beneath that pivotal level.

Learn how to trade forex

Commodities:

WTI remains above $80 yet trades in a very tight range ahead of today’s CPI data. Also take note that the weekly EIA (Energy Information Administration) and FOMC minutes could wake the oil market from its current lull.

Up Next (Times in BST)

How to trade with City Index

You can trade easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade