Asian Indices:

- Australia's ASX 200 index rose by 44.5 points (0.64%) and currently trades at 7,009.00

- Japan's Nikkei 225 index has risen by 56.26 points (0.2%) and currently trades at 28,596.66

- Hong Kong's Hang Seng index has risen by 79.2 points (0.41%) and currently trades at 19,441.45

- China's A50 Index has risen by 146.92 points (1.1%) and currently trades at 13,563.79

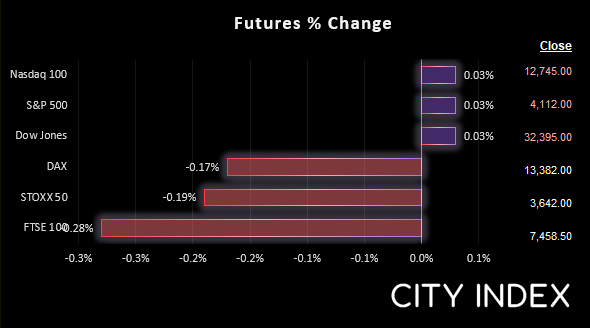

UK and Europe:

- UK's FTSE 100 futures are currently down -21.5 points (-0.29%), the cash market is currently estimated to open at 7,451.53

- Euro STOXX 50 futures are currently down -7 points (-0.19%), the cash market is currently estimated to open at 3,639.51

- Germany's DAX futures are currently down -24 points (-0.18%), the cash market is currently estimated to open at 13,378.27

US Futures:

- DJI futures are currently up 13 points (0.04%)

- S&P 500 futures are currently up 7.75 points (0.06%)

- Nasdaq 100 futures are currently up 2.25 points (0.05%)

Today’s US inflation report is the key event this week. We’ve already seen pre-emptive bets that it will continue to soften – which has placed pressure on the US dollar and allowed commodities and equities to rise. The ASX has rallied alongside US markets these past four days, as investors see the potential for less aggressive tightening from the RBA and Fed, and for inflation to soften. News that Ukraine regained some key battleground has also lifted sentiment.

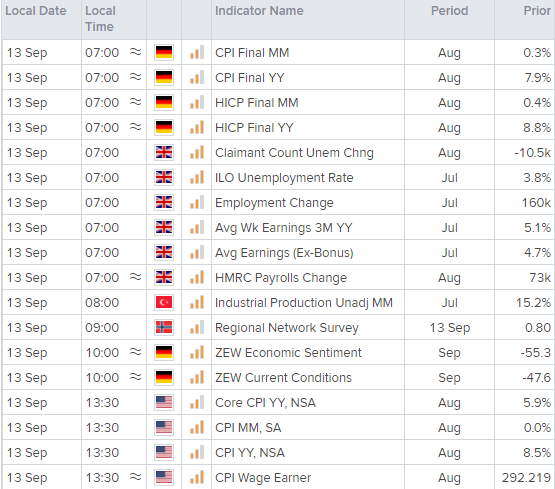

A host of data points at 07:00 BST includes final inflation reads for Germany and employment figures for the UK. In July we saw signs of the UK’s hot inflation market cooling, as businesses were more cautious hiring into an inevitable recession with double-digit inflation. The 160k jobs added was by no means bad but quite a bit below the 260k expected and expected to soften to 128k today. The 3.8% unemployment rate remains historically low, which leaves plenty of time for it to rise of or when the wheels fall off.

Germany’s annual inflation rate currently sits at 7.9% y/y or 0.3% m/m, so any print lower than these could fan hopes that inflation has peaked. Then at 10:00 BST Germany’s ZEW economic report is expected to fall to -52.2 from -47.6, which will be its most pessimistic level since February 2021.

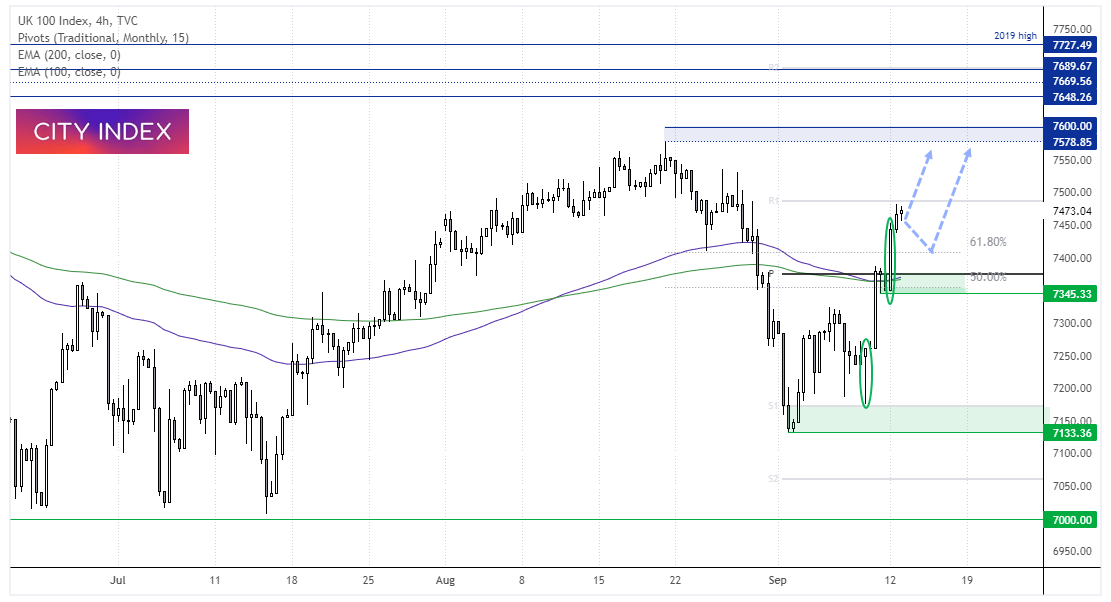

FTSE 100 daily chart:

On Friday we outlined a bullish bias for the FTSE 100 towards 7360, at which point we suspect it may find resistance and continue lower. We can see the first phase played out very well with an immediate rally out of the gates but, after a short pause, cut through several resistance levels.

A bullish engulfing candle formed on the 4-hour chart and closed firmly above the monthly pivot point, 100 and 200-bar EMA’s and its rally has paused around the monthly R2 pivot. From ere the bias remains bullish above the 7345 low and for a move higher towards the 7600 resistance zone.

FTSE 350 – Market Internals:

FTSE 350: 4144.91 (1.66%) 12 September 2022

- 313 (89.43%) stocks advanced and 29 (8.29%) declined

- 10 stocks rose to a new 52-week high, 0 fell to new lows

- 31.43% of stocks closed above their 200-day average

- 97.43% of stocks closed above their 50-day average

- 15.43% of stocks closed above their 20-day average

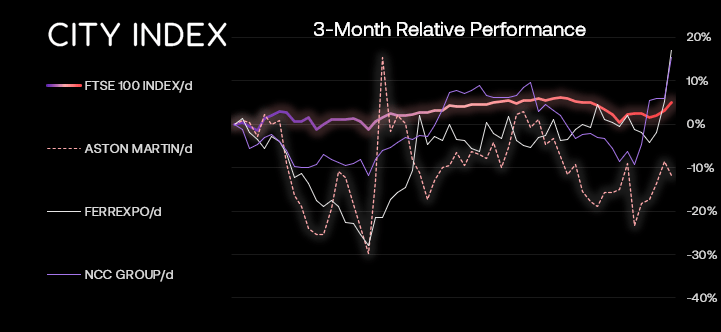

Outperformers:

- + 153.74% - Aston Martin Lagonda Global Holdings PLC (AML.L)

- + 11.28% - Ferrexpo PLC (FXPO.L)

- + 9.34% - NCC Group PLC (NCCG.L)

Underperformers:

- -6.77% - Serco Group PLC (SRP.L)

- -5.09% - abrdn Private Equity Opportunities Trust plc (APEO.L)

- -4.80% - Network International Holdings PLC (NETW.L)

Economic events up next (Times in BST)

How to trade with City Index

You can easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade