Asian Indices:

- Australia's ASX 200 index fell by 0.1 points (0%) and currently trades at 6,523.90

- Japan's Nikkei 225 index has risen by 247 points (0.01%) and currently trades at 26,248.80

- Hong Kong's Hang Seng index has fallen by -267.84 points (-1.24%) and currently trades at 21,291.75

- China's A50 Index has fallen by -60.99 points (-0.43%) and currently trades at 14,275.34

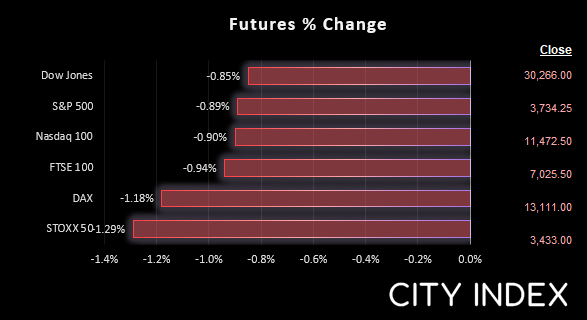

UK and Europe:

- UK's FTSE 100 futures are currently down -66 points (-0.93%), the cash market is currently estimated to open at 7,086.05

- Euro STOXX 50 futures are currently down -45 points (-1.29%), the cash market is currently estimated to open at 3,449.00

- Germany's DAX futures are currently down -155 points (-1.17%), the cash market is currently estimated to open at 13,137.40

US Futures:

- DJI futures are currently down -260 points (-0.85%)

- S&P 500 futures are currently down -105.5 points (-0.91%)

- Nasdaq 100 futures are currently down -34 points (-0.9%)

Sentiment in Asia was given a knock following a UBS report revealing that over 500 senior executives see COVID disruptions to business in April and May as being worse than in 2021. The Hang Seng fell round -1.5% and the CSI 300 by -0.5%. US futures are also down around -0.9%.

JPY is the strongest major as it attracted safe-haven flows, and the US dollar was a close second on yield differentials. NZD and AUD were the weakest majors.

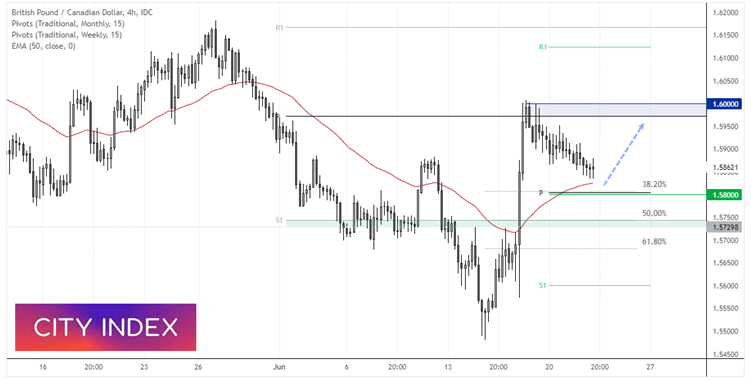

UK inflation data is up shortly where a 9.1% y/y print or higher likely piles further pressure on the BOE to hike rates and stimmy growth. GBP/JPY has retraced from yesterday’s 7-day high but shows the potential for form a base above 166 should sentiment improve alongside a hot inflation report. Canadian inflation is also scheduled for 13:30 which places GBP/CAD into focus for news traders.

GBP/CAD in focus for UK and CA inflation

GBP/CAD has retraced around a quarter of its rally from 1.55 to 1.60. Given the strong momentum leading into 1.600 our bias is for another leg higher. Take note that prices are holding above the 50-bar eMA, weekly pivot point and 38.2% Fibonacci retracement, a zone of support our bias remains bullish above whilst prices remain above it.

FTSE 350 – Market Internals:

FTSE 350: 3975.58 (0.42%) 21 June 2022

- 158 (45.01%) stocks advanced and 176 (50.14%) declined

- 1 stocks rose to a new 52-week high, 19 fell to new lows

- 19.37% of stocks closed above their 200-day average

- 45.3% of stocks closed above their 50-day average

- 4.84% of stocks closed above their 20-day average

Outperformers:

- +9.43% - Baltic Classifieds Group PLC (BCG.L)

- +3.96% - PZ Cussons PLC (PZC.L)

- +3.05% - DS Smith PLC (SMDS.L)

Underperformers:

- -15.04% - Coats Group PLC (COA.L)

- -8.64% - Wizz Air Holdings PLC (WIZZ.L)

- -5.62% - TUI AG (TUIT.L)

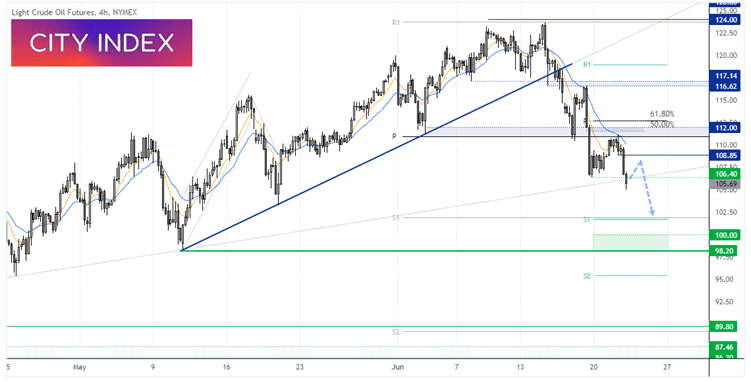

WTI slips ahead of the open

Oil prices were sent to a 1-month low as they tracked Asian equity markets and US futures. It seems there is already a little hesitancy as to how bullish traders want to be. WTI fell below $105 and is attempting to break trend support on the 1-hour chart, in line with it bearish trend. As we approach the open we’d expect some volatility around current levels and, if anything, bias towards a retracement towards the $108 level. But if we see further signs of weakness below such a resistance level we’d prefer to see bearish opportunities and target the $102 support zone, near the monthly and weekly S1 support levels.

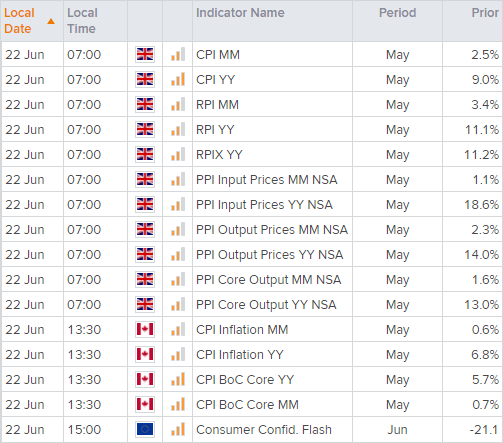

Economic events up next (Times in BST)

How to trade with City Index

You can easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade