Asian futures:

- Australia’s ASX 200 index rose by 116.3 points (1.74%) to close at 6,789.6

- Japan’s Nikkei 225 index rose by 597.66 points (2.06%) to close at 29,563.67

- Hong Kong’s Heng Seng index has risen by 344.29 points (1.19%) and currently trades at 29,324.5

FTSE 100:

- UK’s FTSE 100 futures are currently up 60.5 points (0.94%), the cash market is currently estimated to open at 6,543.93

European futures:

- Euro STOXX 50 futures are currently up 29 points (0.8%), the cash market is currently estimated to open at 36,65.44

- Germany’s DAX futures are currently up 101 points (0.73%), the cash market is currently estimated to open at 13,887.29

Friday US close:

- Dow Jones fell -469.64 points (-0.15%) to close at 30,932.37

- S&P 500 fell -18.19 points (-0.475017%) to close at 38,11.15

- Nasdaq 100 rose 81.84 points (0.63%) to close at 12,909.443

Over the weekend, Biden’s stimulus package was passed by the House and Johnson and Johnson’s vaccine was approved by the FDA. PMI data also improved in Australia and Japan which help maintain a positive open after Wall Street suffered another day of heavy losses on Friday. Investors hope the Asian PMI’s could be a shape of things to come later today, as manufacturing PMI is also reported across Europe and North America.

Index futures across Europe have opened higher, the FTSE is up 1% and Nasdaq 100 futures recouped over 1% of Friday’s losses. At the sector level, industrials and technology led equities higher, with utilities and energies being the laggards but still up for the session.

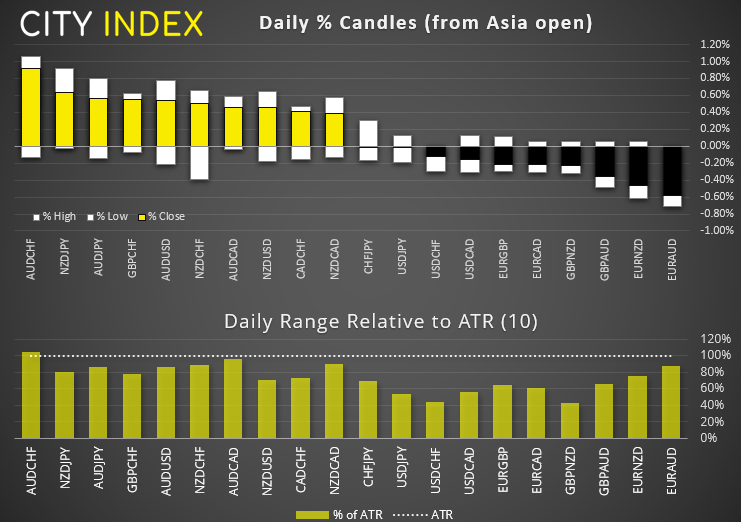

AUD and NZD were the strongest majors of the session and CHF and JPY were the weakest. This placed AUD/CHF as the strongest FX pair and reach its average true range (ATR 10). Overall, volatility across FX pairs remained contained.

The ASX 200 rose 1.7% and all sectors apart from materials posted gains. Real estate, information technology and healthcare were the strongest performers, rising 3.2%, 2.9% and 2.7% respectively. However, price action remains within Friday’s large bearish candle, and the monthly chart has now produced three bearish hammers, so downside risks remain.

February PMI data kicked off in Asia

Australia’s manufacturing PMI surprised to the upside in February, expanding at the faster rate of 58.8 versus 55.3 in January. Now at its highest level since March 2018, six of the seven sub-indices expanded (only metals contracted at -48.7), which suggest the recovery in manufacturing is advancing faster than originally expected. Job ads also accelerated 7.2% in February, despite Victoria and Western Australia entering a 5-day lockdown and house prices rose at their fasts pace in 17 years in February.

China’s manufacturing PMI data expanded but at a slower rate of 50.9, -0.6 points below the 51.5 forecast. Whilst softer overseas demand is a contributing factor, China’s Lunar New Year should also be factored into the softer data set.

South Korea’s exports rose 9.5% in February as expected, although imports increased by 13.9% versus 12.3% expected.

RBA double bond purchases

The Reserve Bank of Australia (RBA) intervened in the bond market today and doubled their purchase of Commonwealth bonds, at $4 billion compared with $2 billion previously.

RBA hold their monetary policy meeting tomorrow and are expected to hold rates at the record low of 0.1% and retain a patient stance over policy normalisation. We will be interested to hear any commentary about their intervention today to get a feel whether it is a one-off event or something we must get used to. The Australian 10-year has fallen to 1.65% and the 30-year down to 2.61% after bonds yields moved lower in the US on Friday.

Candle Scan

February has provided some interesting candlestick reversal patterns across indices and FX markets.

Indices:

- Monthly bearish hammers on the S&P 500, Nasdaq 100, Euro STOXX 600, DAX, FTSE 100, ASX 200, Nikkei 225

- Weekly bearish engulfing candles on the Hang Seng, Nikkei 225, FTSE 100 (also a evening star reversal)

- Bearish hammer (and outside week) on the CAC

- Daily bearish engulfing on the ASX 200

Forex:

- Monthly bearish hammers on AUD/USD, NZD/USD and a bullish hammer on USD/CAD

- Monthly morning star reversal on USD/CHF

- Bearish hammers on NZD/USD, EUR/USD, GBP/USD and a bearish outside week on AUD/USD

- Bullish outside week on USD/CAD and DXY (US dollar index)

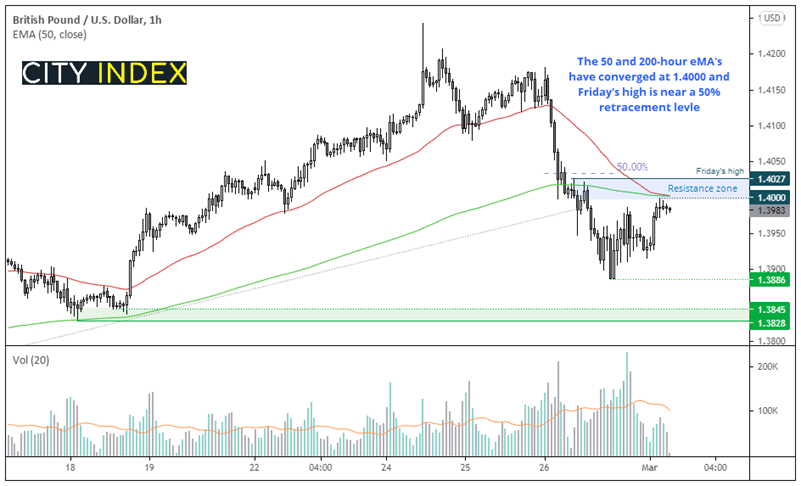

GBP/USD: Potential swing trade short

The weekly chart produced a bearish hammer after failing to hold above 1.4100. That it comes after rallying 25% from its March low and stalled beneath the 2018 high suggests cable may now enter a phase of mean reversion.

The daily chart saw two heavy days of selling after Wednesday’s bearish pinbar and Friday closed beneath a bullish trendline. After recouping some of Friday’s losses today, we are now seeking a potential short entry.

We can see on the hourly chart that price are correcting higher, although running into potential resistance around 1.4000. The 50 and 200-hour eMA’s have converged at 1.4000 and a 50% retracement level sits near Friday’s high.

- Our bias is bearish beneath 1.0435

- Trades could seek to fade into (short) around the resistance cluster and initially target Friday’s low and the lows around 1.3828/45

- A break above Friday’s high / 50% retracement level invalidates the short bias.

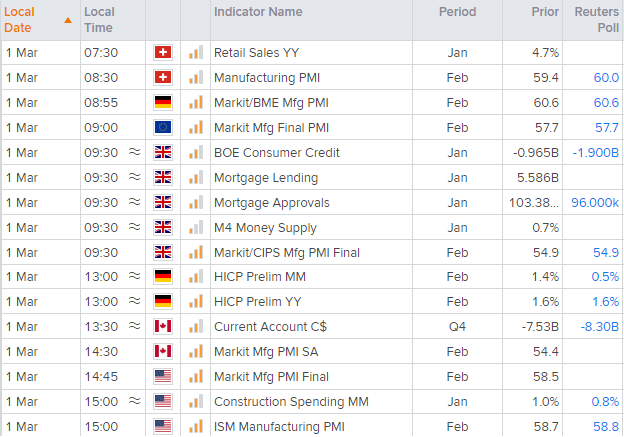

Up Next (Times in GMT)

You can view all the scheduled events for today using our economic calendar, and keep up to date with the latest market news and analysis here.

- German inflation rose to an 11-month high in January and expectations are for it to remain there in February.

- Markit’s flash PMI data for the UK, Switzerland, Germany, Euro Zone, Canada and the US are key data points today. However we also have the ISM manufacturing report to mull over, so there’s certainly the potential for pockets of volatility in the European and US sessions.