Asian Indices:

- Australia's ASX 200 index rose by 79.3 points (1.14%) and currently trades at 7,059.60

- Japan's Nikkei 225 index has risen by 176.7 points (0.71%) and currently trades at 24,974.65

- Hong Kong's Hang Seng index has fallen by -454.64 points (-2.19%) and currently trades at 20,311.23

- China's A50 Index has fallen by -102.19 points (-0.74%) and currently trades at 13,620.68

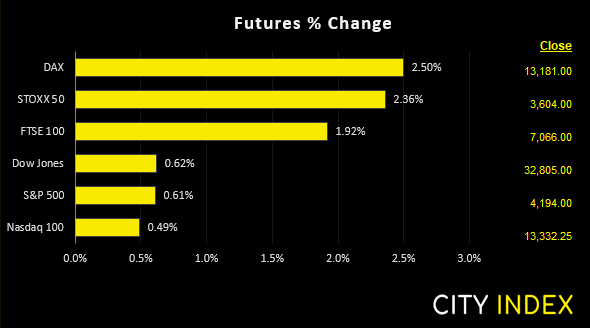

UK and Europe:

- UK's FTSE 100 futures are currently up 133 points (1.92%), the cash market is currently estimated to open at 7,097.11

- Euro STOXX 50 futures are currently up 77 points (2.19%), the cash market is currently estimated to open at 3,582.29

- Germany's DAX futures are currently up 310 points (2.41%), the cash market is currently estimated to open at 13,141.51

US Futures:

- DJI futures are currently up 197 points (0.6%)

- S&P 500 futures are currently up 62.75 points (0.47%)

- Nasdaq 100 futures are currently up 23.75 points (0.57%)

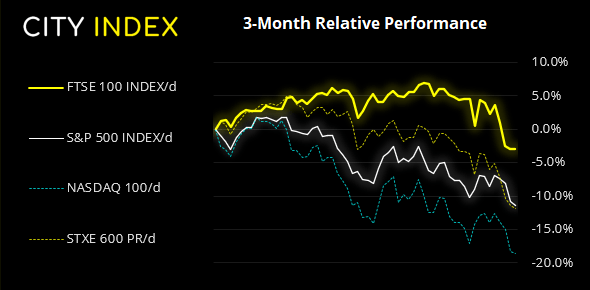

However, what may try and stop gold simply breaking higher is the illusion of risk-on trade across futures markets. US and European futures all point to a higher open, although without an apparent catalyst as the trigger we suspect it is more a case of traders having less appetite to short oversold markets. Especially when they have held above key levels of support like seen in the US.

With that said, we can make a case for gold to remain at least supported (not fall if equities rise) or even rise alongside indices today. Equities look oversold, yet gold is likely to remain a hedge against Russia-related headlines over the foreseeable future.

The ASX 200 is on track to close above 7,000 with conviction, led by tech stocks which snapped a 4-day losing streak and is today’s strongest sector. Given the today’s range ‘engulfed’ Tuesday’s and has rallied from 7k, there’s clearly less appetite to run this market into the ground, compared to what we’ve seen across Asia today.

China’s factory gate prices ease (for now)

China’s producer prices slowed to an 8-month low, although the holiday from the lunar new year is suspected to have been a main factor. But with surging commodity prices, particularly in the agricultural and energy sectors, don’t worry - we strongly suspect inflationary pressures to return.

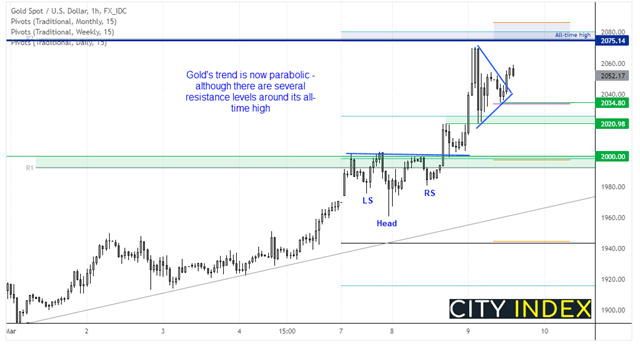

Gold bugs eye a break of its all-time high

The yellow metal has continued to dazzle amidst this inflationary, risk-off environment. It blew past our 2020 and 2050 targets yesterday with ease, stopped just $5 from its record high, and overnight trade suggests it wants another crack at the milestone level today. Whether it can close above that level likely today likely hinges upon whether traders can withstand the temptation to book a profit early, after such a great run. As the odds stock in its favour of breaking higher at some point.

Gold has broken out of a triangle/pennant on the hourly chart. It’s trying to form a bearish outside bar so perhaps we’ll see a pullback prior to a move towards 2075, but to be tempted by dips on this timeframe we’d like to see a higher low form around or above 2034.

FTSE 350: Market Internals

FTSE 350: 3895.27 (0.07%) 08 March 2022

- 166 (47.29%) stocks advanced and 176 (50.14%) declined

- 3 stocks rose to a new 52-week high, 40 fell to new lows

- 15.1% of stocks closed above their 200-day average

- 30.77% of stocks closed above their 50-day average

- 10.83% of stocks closed above their 20-day averag

Outperformers:

- + 20.00% - Petropavlovsk PLC (POG.L)

- + 18.53% - Hochschild Mining PLC (HOCM.L)

- + 15.03% - M&G PLC (MNG.L)

Underperformers:

- -46.7% - Polymetal International PLC (POLYP.L)

- -7.35% - TI Fluid Systems PLC (TIFS.L)

- -6.45% - Capricorn Energy PLC (CNE.L)

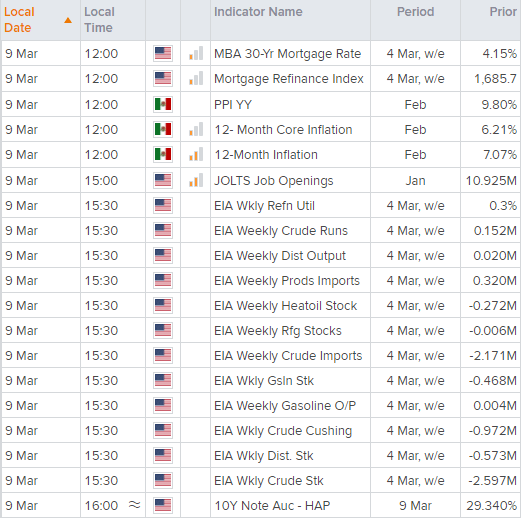

Up Next (Times in GMT)

With little in the way of European data today it will likely be updates surrounding UK’s stance (or not) on the phasing out of Russian energy.

How to trade with City Index

You can easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade