Asian Indices:

- Australia's ASX 200 index rose by 52.1 points (0.71%) and currently trades at 7,356.80

- Japan's Nikkei 225 index has fallen by -29.37 points (-0.11%) and currently trades at 26,818.53

- Hong Kong's Hang Seng index has risen by 137.15 points (0.66%) and currently trades at 21,006.67

- China's A50 Index has risen by 41.6 points (0.31%) and currently trades at 13,557.90

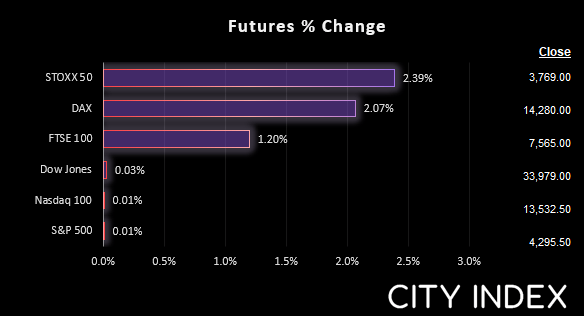

UK and Europe:

- UK's FTSE 100 futures are currently up 85.5 points (1.14%), the cash market is currently estimated to open at 7,578.95

- Euro STOXX 50 futures are currently up 88 points (2.39%), the cash market is currently estimated to open at 3,812.99

- Germany's DAX futures are currently up 286 points (2.04%), the cash market is currently estimated to open at 14,256.82

US Futures:

- DJI futures are currently up 4 points (0.01%)

- S&P 500 futures are currently down -2.25 points (-0.02%)

- Nasdaq 100 futures are currently down -1.25 points (-0.03%)

Not so long ago the prospects of the Fed hiking by 50-bps was a daunting prospect for equity markets. Not any more though, as they continued to rebound overnight across Asia as investors are just grateful its not 75-bps. The Nifty was a top performer with a 1.4% rally with China’s SSE composite in 2nd place at 1.1%. European futures are also trading higher as they closed the gap with Wall Street’s firm close yesterday following the FOMC meeting.

FTSE: Market Internals

The FTSE failed only made a minor effort to break above last week’s high before reversing sharply lower and closing beneath 7500. The 50-day eMA and Tuesday’s hammer low is the next line of defence at 7476, a break beneath which opens up a run towards 7400. However, futures markets are pointing to a higher open in Europe, so don’t yet write-off its potential to have another crack at testing 7600.

FTSE 350: 4177.02 (-0.90%) 04 May 2022

- 65 (18.57%) stocks advanced and 276 (78.86%) declined

- 7 stocks rose to a new 52-week high, 38 fell to new lows

- 27.14% of stocks closed above their 200-day average

- 100% of stocks closed above their 50-day average

- 13.14% of stocks closed above their 20-day average

Outperformers:

- + 6.74% - Aston Martin Lagonda Global Holdings PLC (AML.L)

- + 5.14% - Flutter Entertainment PLC (FLTRF.L)

- + 3.69% - Johnson Matthey PLC (JMAT.L)

Underperformers:

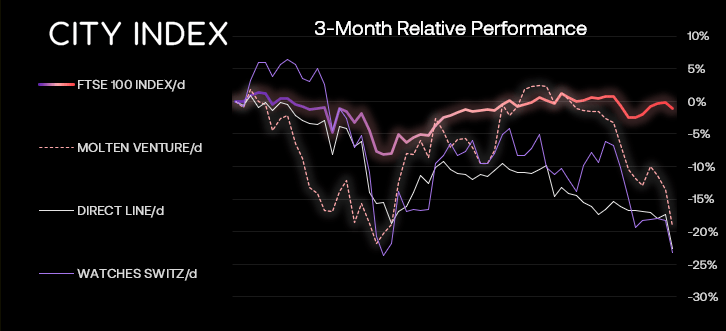

- -6.51% - Molten Ventures PLC (GROW.L)

- -6.26% - Direct Line Insurance Group PLC (DLGD.L)

- -6.00% - Watches of Switzerland Group PLC (WOSG.L)

The Bank of England are expected to hike their interest rate by 25-bps to 1.00%, which would be its highest level since 2009. However, with this now fully expected we will have to assess the likelihood of further hikes via the policy statement and amount of MPC members dissenting. Should 2 or more descent today (up from one last month) it further signals unease over the UK’s outlook and could weigh on the pound accordingly. At their last meeting they said that “some further modest tightening may be appropriate in the coming months”, so the question is whether today’s expected hike is enough, or whether they signal there is another hike in the horizon.

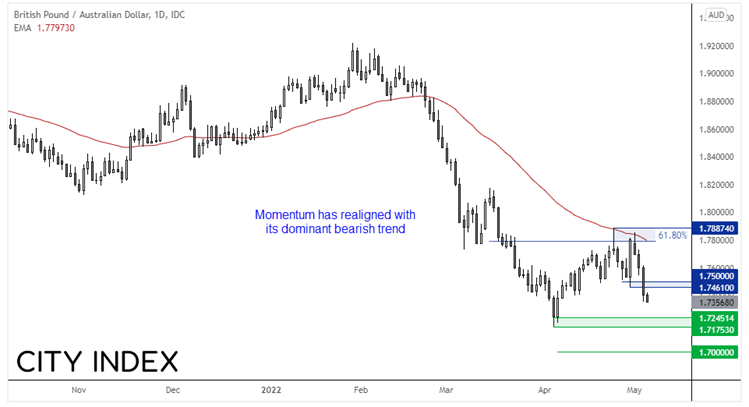

Given the increased strength of the Australian dollar in recent session, we prefer GBP/AUD shorts should today’s meeting be tilted towards a dovish hike. It remains in a clear downtrend on the daily chart and momentum has turned lower having met resistance around its 50-day eMA as it correction completed. Today’s bias remains bearish beneath 1.7500 and initial targets include 1.7300 and the 1.7200 support zone, a break of which brings the big 1.70 into focus if the trend develops further out.

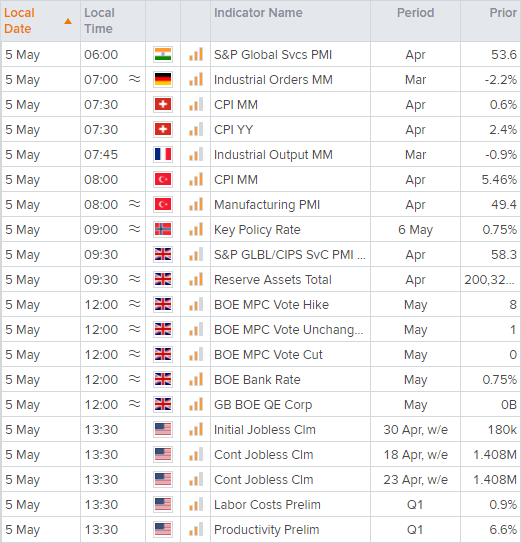

Up Next (Times in GMT)