Asian Indices:

- Australia's ASX 200 index rose by 15.8 points (0.22%) and currently trades at 7,244.90

- Japan's Nikkei 225 index has fallen by -155.3 points (-0.55%) and currently trades at 28,007.53

- Hong Kong's Hang Seng index has risen by 666.3 points (3.85%) and currently trades at 17,964.24

- China's A50 Index has risen by 440.12 points (3.64%) and currently trades at 12,533.57

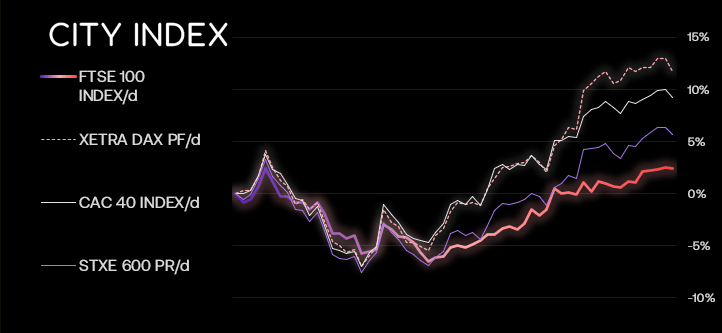

UK and Europe:

- UK's FTSE 100 futures are currently up 9.5 points (0.13%), the cash market is currently estimated to open at 7,483.52

- Euro STOXX 50 futures are currently up 2 points (0.05%), the cash market is currently estimated to open at 3,937.51

- Germany's DAX futures are currently up 2 points (0.01%), the cash market is currently estimated to open at 14,385.36

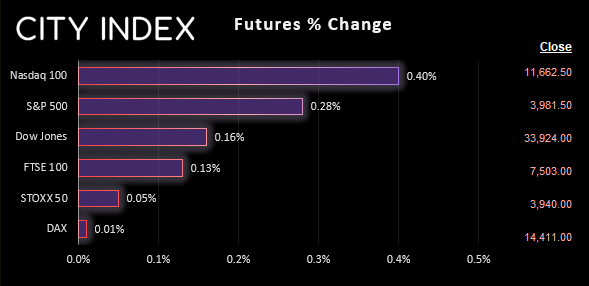

US Futures:

- DJI futures are currently up 52 points (0.15%)

- S&P 500 futures are currently up 46.75 points (0.4%)

- Nasdaq 100 futures are currently up 11.25 points (0.28%)

China’s equity markets surged overnight following news that China’s regulator lifted a ban on equity financing for listed property firms. Property companies were the top performers, and commodities and commodity currencies were also higher.

MPC committee member Catherine Mann speaks at a panel discussion at 15:00 GMT on "policy solutions, fiscal and monetary", hosted by the Conference Board. She has been one of the more hawkish BOE members in recent times.

New Zealand’s Institute of Economic Research (NZIER) expect the RBNZ to hike rates to 5% next year. In an interview yesterday, an RBNZ member said that they will be watching high frequency data (spending, business investment and housing) and January’s inflation print to determine how aggressive February’s hike will be.

Hawkish comments from Fed members threw some support under the US dollar. James Bullard said there is still “a way to go” in regards to reaching a pivot and the Fed could hike rates to 5 – 7% to fight inflation.

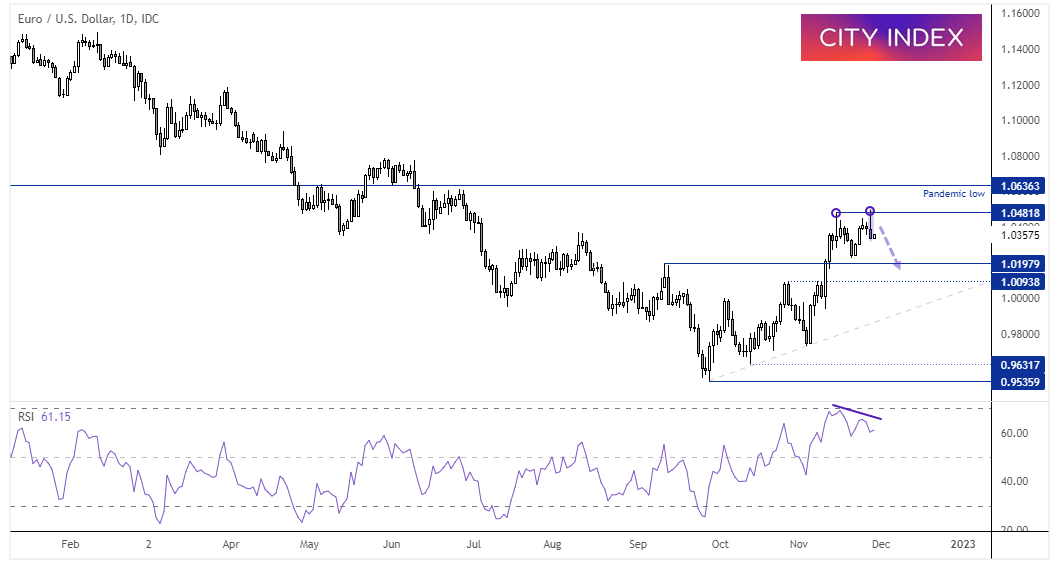

EUR/USD daily chart:

A bearish engulfing candle has formed on the daily chart, which is part of a double top at the 1.0482 high. The candle also has a large upper which to suggest strong supply at those highs, and a bearish divergence has also formed on the RSI (14). We are now looking for prices to retrace towards 1.0200 as part of a countertrend move.

FTSE market internals:

FTSE 350: 4138.23 (0.66%) 28 November 2022

- 229 (65.43%) stocks advanced and 112 (32.00%) declined

- 4 stocks rose to a new 52-week high, 0 fell to new lows

- 12.57% of stocks closed above their 200-day average

- 50.57% of stocks closed above their 50-day average

- 5.43% of stocks closed above their 20-day average

Outperformers:

- + 3.30% - Vietnam Enterprise Investments Limited (VEILV.L)

- + 2.93% - VinaCapital Vietnam Opportunity Fund Ltd (VOF.L)

- + 2.27% - Just Group PLC (JUSTJ.L)

Underperformers:

- -7.04% - Home REIT PLC (HOMEH.L)

- -6.99% - Dr Martens PLC (DOCS.L)

- -5.89% - Future PLC (FUTR.L)

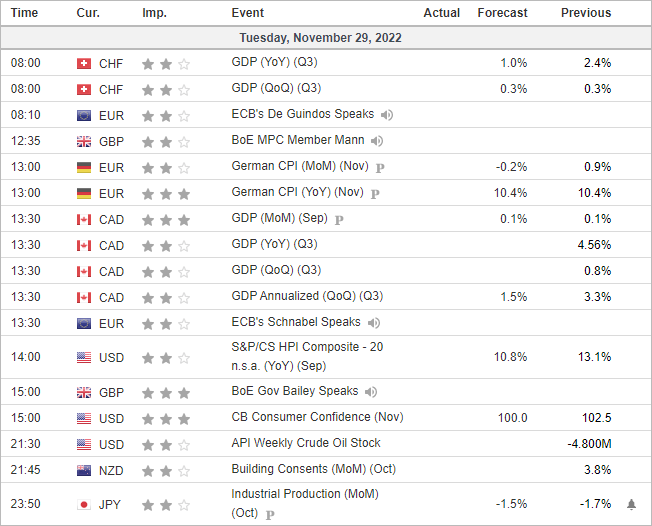

Economic events up next (Times in GMT)

How to trade with City Index

You can easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade