Asian Indices:

- Australia's ASX 200 index rose by 28.9 points (0.44%) and currently trades at 6,557.30

- Japan's Nikkei 225 index has risen by 278.13 points (1.06%) and currently trades at 26,449.41

- Hong Kong's Hang Seng index has risen by 309.16 points (1.45%) and currently trades at 21,583.03

- China's A50 Index has risen by 115.27 points (0.8%) and currently trades at 14,525.37

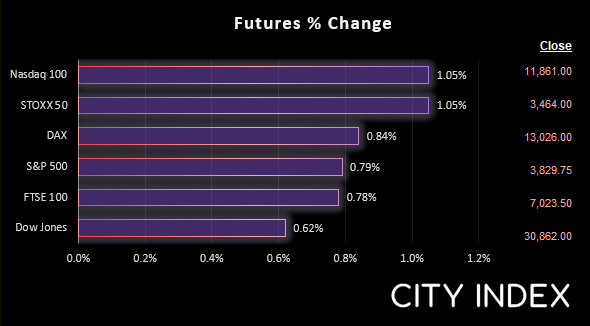

UK and Europe:

- UK's FTSE 100 futures are currently up 51.5 points (0.74%), the cash market is currently estimated to open at 7,071.95

- Euro STOXX 50 futures are currently up 37 points (1.08%), the cash market is currently estimated to open at 3,473.29

- Germany's DAX futures are currently up 109 points (0.84%), the cash market is currently estimated to open at 13,021.59

US Futures:

- DJI futures are currently up 182 points (0.59%)

- S&P 500 futures are currently up 115.25 points (0.98%)

- Nasdaq 100 futures are currently up 29 points (0.76%)

Japan’s CPI is one of the few global figures that is nowhere near double digits. It rose 2.5% y/y (core was up 2.1% and there was some excitement that it was above the BOJ’s 2% target for a second month in the row. But the reality is that it’s unlikely to move the dial for the BOJ’s monetary policy, and the focus remains on when (or if) they adjust their yield target, which would be the best indication that we’re in for a strong bullish rise of the yen.

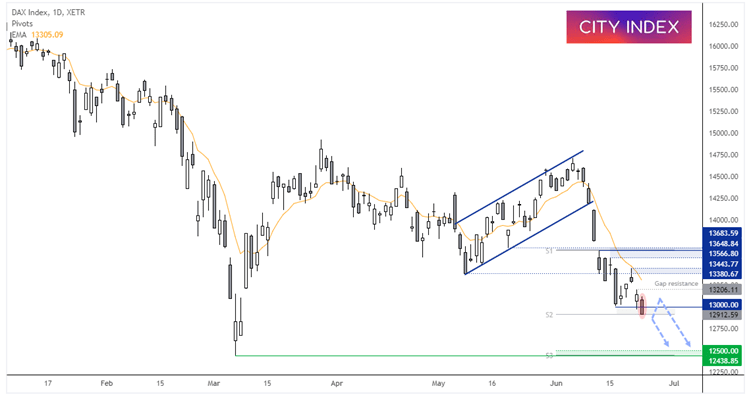

DAX daily chart:

European indices turned lower following a series of weaker than expected PMI reports. France’s manufacturing PMI barely expanded at 51, down from 54.6. German IFO is in focus for euro traders today to see if it backs up the weak prints from PMI reports.

The DAX fell to a 3-month low following weak PMI’s. A swing high respected the 10-day eMA, prices gapped lower and yesterday’s close was at the low of the day, on the monthly S2 pivot point. A break beneath 12,900 assumes bearish continuation and favours a moved down to the 12,500 support zone. Whilst our bias remains bearish below 13,443, the gap around 13,200 can also be used to fine-tune risk management.

DAX 30 trading guide

FTSE 350 – Market Internals:

FTSE 350: 3905.39 (-0.97%) 23 June 2022

- 77 (22.00%) stocks advanced and 266 (76.00%) declined

- 0 stocks rose to a new 52-week high, 44 fell to new lows

- 16.86% of stocks closed above their 200-day average

- 13.14% of stocks closed above their 50-day average

- 6% of stocks closed above their 20-day average

Outperformers:

- +9.43% - Ocado Group PLC (OCDO.L)

- +3.96% - Indivior PLC (INDV.L)

- +3.05% - abrdn Private Equity Opportunities Trust plc (APEO.L)

Underperformers:

- -15.04% - Trainline PLC (TRNT.L)

- -8.64% - 888 Holdings PLC (888.L)

- -5.62% - John Wood Group PLC (WG.L)

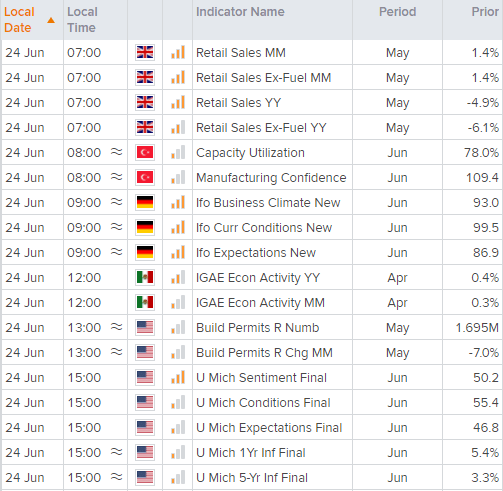

Economic events up next (Times in BST)

UK retail sales are released shortly and is always a good thing to check for consumer demand. And with inflation ripping higher and risks of a recession, a weak print here could weigh on the FTSE. SO a key level to watch for a potential breakdown is below 7,000.

DAX is in focus for the IFO report, as mentioned above.

The University of Michigan release their final report for consumer sentiment. The preliminary report saw a record low print for current conditions and sentiment fell to record low whilst expectations hit a 10-year low. The final report includes a lot more information which always warrants a look, and with fears of a recession then traders are likely sensitive to bad news over good.

How to trade with City Index

You can easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade