Asian Indices:

- Australia's ASX 200 index rose by 31.8 points (0.42%) and currently trades at 7,601.00

- Japan's Nikkei 225 index has risen by 249.59 points (0.71%) and currently trades at 35,160.79

- Hong Kong's Hang Seng index has fallen by -224.07 points (-1.07%) and currently trades at 20,720.60

- China's A50 Index has risen by 2.55 points (0.02%) and currently trades at 13,555.26

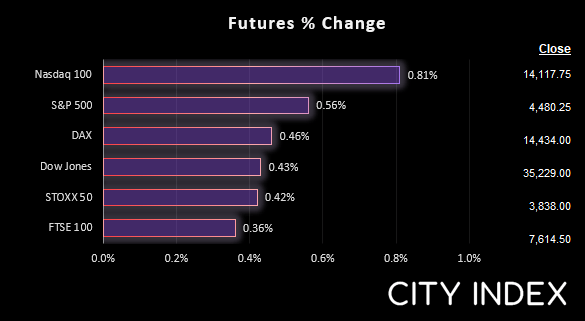

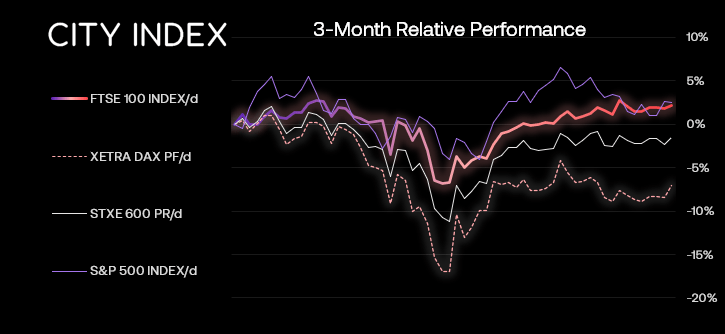

UK and Europe:

- UK's FTSE 100 futures are currently up 27.5 points (0.36%), the cash market is currently estimated to open at 7,656.72

- Euro STOXX 50 futures are currently up 16 points (0.42%), the cash market is currently estimated to open at 3,912.81

- Germany's DAX futures are currently up 69 points (0.48%), the cash market is currently estimated to open at 14,431.03

US Futures:

- DJI futures are currently up 153 points (0.44%)

- S&P 500 futures are currently up 119.25 points (0.85%)

- Nasdaq 100 futures are currently up 25.75 points (0.58%)

Asian equities were mostly higher overnight as they tracked sentiment from Wall Street. The tech sensitive Nikkei was the session’s leader and the ASX 200 has so far defied our call to mean revert. Instead is has tried to have another crack at its record high. A close above 7600 would be constructive, but if we see a break of yesterday’s low then it confirms the bearish reversal (bearish pinbar) and could trigger some mean reversion. A break above 7633 takes it to a new record high and assumes trend continuation.

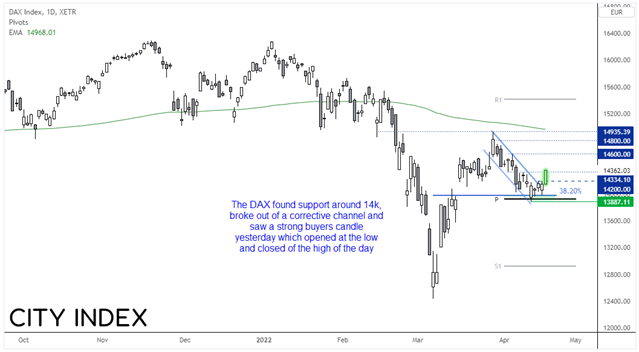

DAX turns higher form support

Yesterday we were looking for the DAX to break of 14,200 resistance to signal its next leg higher, and it achieved that goal with style as it hit our initial target around 14,360. Furthermore, by opening at the session low and closing at the high of the day it was a breakout with conviction. However, yesterday’s chart was on the intraday chart, but we can now zoom out to the daily and look at the bigger picture.

We can see on the daily chart that its retracement from the 14,935 high found support at the monthly pivot point and 38.2% Fibonacci ratio. Whilst prices consolidated before the breakout, each candle was bullish to show demand was in the area, and prices have now broken higher from a corrective channel. Our bias remains bullish above 13,885 although yesterday’s low can also be used to fine-tune risk management. Initial target is 14,600, 14,800 then the highs just below 15,000.

FTSE: Market Internals

FTSE 350: 4268.5 (0.40%), 21 April 2022

- 6 stocks rose to a new 52-week high, 4 fell to new lows

- 231 (68.14%) stocks advanced, 108 (31.86%) stocks declined

Outperformers:

- +7.03% - Darktrace PLC (DARK.L)

- +7.02% - Jtc PLC (JTC.L)

- +5.88% - CRH PLC (CRH.L)

Underperformers:

- -5.38% - Ocado Group PLC (OCDO.L)

- -5.47% - Centamin PLC (CEY.L)

- -14.71% - Oxford BioMedica PLC (OXB.L)

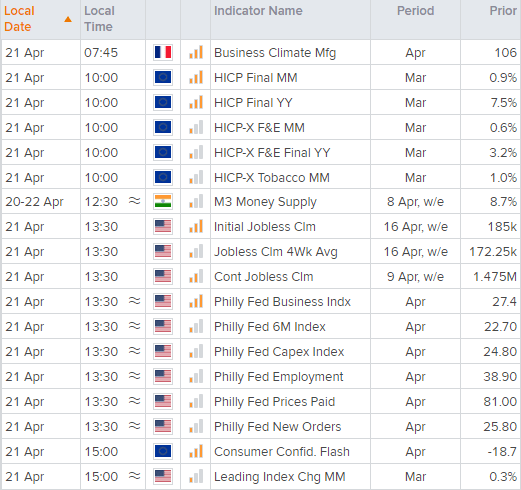

Up Next (Times in GMT)

How to trade with City Index

You can easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade