Asian Indices:

- Australia's ASX 200 index rose by 77.9 points (1.1%) and currently trades at 7,183.80

- Japan's Nikkei 225 index has risen by 183.14 points (0.69%) and currently trades at 26,787.98

- Hong Kong's Hang Seng index has risen by 556.6 points (2.77%) and currently trades at 20,672.80

- China's A50 Index has risen by 145.53 points (1.11%) and currently trades at 13,314.17

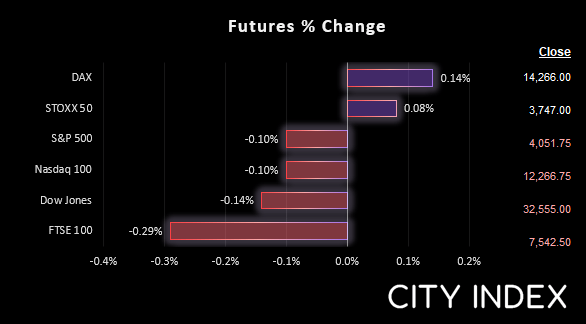

UK and Europe:

- UK's FTSE 100 futures are currently down -22.5 points (-0.3%), the cash market is currently estimated to open at 7,542.42

- Euro STOXX 50 futures are currently up 3 points (0.08%), the cash market is currently estimated to open at 3,743.31

- Germany's DAX futures are currently up 20 points (0.14%), the cash market is currently estimated to open at 14,251.29

US Futures:

- DJI futures are currently down -43 points (-0.13%)

- S&P 500 futures are currently down -15 points (-0.12%)

- Nasdaq 100 futures are currently down -3.75 points (-0.09%)

NZD and AUD were the strongest majors overnight, partly due to a weaker USD but also down to favourable economic data. Australian retail sales rose 0.9% which plays well ahead of next week’s GDP data, and whilst NZ consumer confidence was slightly lower inflation expectations were also down (down to 5.1% from 5.6%). AUD/USD and NZD/USD both rose to a 3-week high.

The US dollar index fell to a 5-week low overnight and is now trying to find support at its 50-day eMA. EUR/USD has teased us with a break of 1.0757 resistance and USD/CHF also broke lower. The FOMC minutes may have confirmed another 100-bps of hikes over the next two meetings, but murmurs of a ‘pause’ in September suggests the Fed are already having second thoughts about such an aggressive rate hike trajectory. The fact is that the dollar is limping its way to the weekend in hope of a break of its recent selloff. And with the ECB and SNB central banks being uncharacteristically hawkish (relative to the past decade, that is) we see the potential for euro and the Swiss franc to break higher against the US dollar.

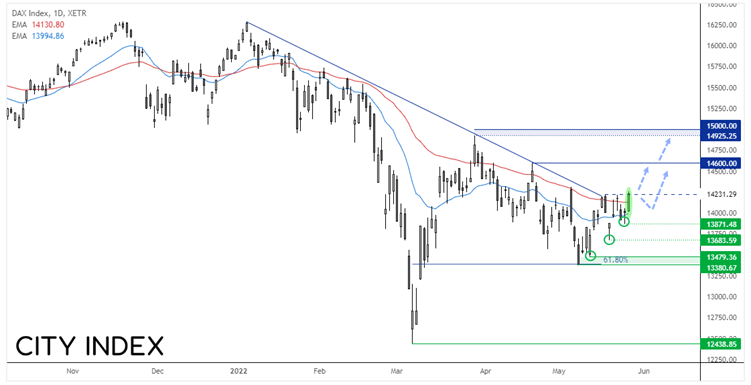

DAX daily chart

Just under a couple of weeks ago I outlined a bullish case for the DAX on the monthly and weekly charts. Whilst the daily chart was on the choppy side, I’ve continued to monitor its potential to turn higher and we suspect we’re now close to the breakout. The bearish trendline from the record high has been invalidated and three higher lows have formed since the 13,380 low. Furthermore, yesterday’s bullish candle closed above the 20 and 50-day eMA’s, and slightly above the prior swing high.

Just under a couple of weeks ago I outlined a bullish case for the DAX on the monthly and weekly charts. Whilst the daily chart was on the choppy side, I’ve continued to monitor its potential to turn higher and we suspect we’re now close to the breakout. The bearish trendline from the record high has been invalidated and three higher lows have formed since the 13,380 low. Furthermore, yesterday’s bullish candle closed above the 20 and 50-day eMA’s, and slightly above the prior swing high.

The bias is bullish above the 13,871 low, but should we see a decent breakout then this can be raised to yesterday’s low around 14,000. The initial target is 14,600 but, if this really is part of a larger trend reversal, we should be treated to a run for 15,000 sooner than later.

DAX 30 trading guide

FTSE: Market Internals

FTSE 350: 4211.67 (0.56%) 26 May 2022

- 298 (85.14%) stocks advanced and 45 (12.86%) declined

- 10 stocks rose to a new 52-week high, 4 fell to new lows

- 29.14% of stocks closed above their 200-day average

- 94.57% of stocks closed above their 50-day average

- 21.43% of stocks closed above their 20-day average

Outperformers:

- + 11.54% - Ocado Group PLC (OCDO.L)

- + 9.75% - Serco Group PLC (SRP.L)

- + 9.67% - Aston Martin Lagonda Global Holdings PLC (AML.L)

Underperformers:

- -18.66% - IntegraFin Holdings plc (IHP.L)

- -7.24% - Centrica PLC (CNA.L)

- -6.61% - United Utilities Group PLC (UU.L)

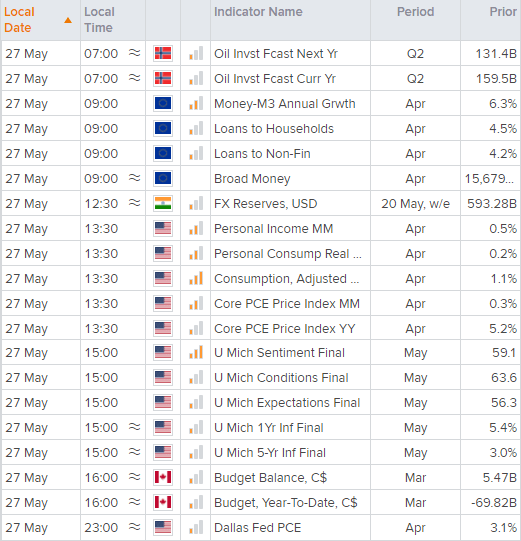

Up Next (Times in GMT)

How to trade with City Index

You can easily trade with City Index by using these four easy steps:

- Open an account, or log in if you’re already a customer

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade