Asian Indices:

- Australia's ASX 200 index fell by -31.7 points (-0.49%) and currently trades at 6,443.10

- Japan's Nikkei 225 index has fallen by -265.61 points (-1.02%) and currently trades at 25,697.39

- Hong Kong's Hang Seng index has risen by 34.16 points (0.16%) and currently trades at 21,109.16

- China's A50 Index has risen by 80.03 points (0.56%) and currently trades at 14,365.25

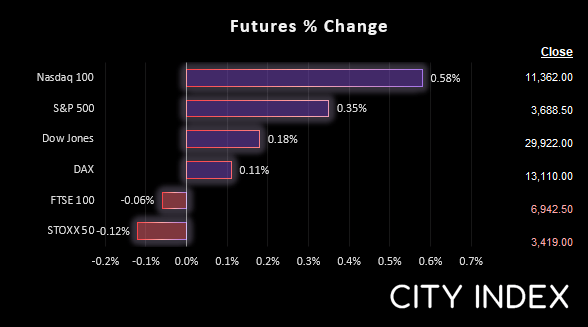

UK and Europe:

- UK's FTSE 100 futures are currently down -4.5 points (-0.06%), the cash market is currently estimated to open at 7,011.75

- Euro STOXX 50 futures are currently down -3 points (-0.09%), the cash market is currently estimated to open at 3,435.46

- Germany's DAX futures are currently up 9 points (0.07%), the cash market is currently estimated to open at 13,135.26

US Futures:

- DJI futures are currently up 60 points (0.2%)

- S&P 500 futures are currently up 67.25 points (0.6%)

- Nasdaq 100 futures are currently up 13.5 points (0.37%)

Asian equity markets were lower overnight as fears of a recession continued to weigh on sentiment. The Nikkei fell to a 3-month low and the ASX 200 dropped to a 17-month low. On Friday Jerome Powell suggested that the risk of a recession would not prevent the Fed from continuing to hike rates, to fight raging inflation.

German producer prices are in focus at 07:00. They reached a record high in April at 33.5% y/y, or 16.3% with energy and fuel excluded. Energy prices have skyrocketed 97.3% y/y and its likely to remain a strain on sentiment. With sentiment remaining fragile and inflation unlikely to recede then it leaves the DAX vulnerable to further losses.

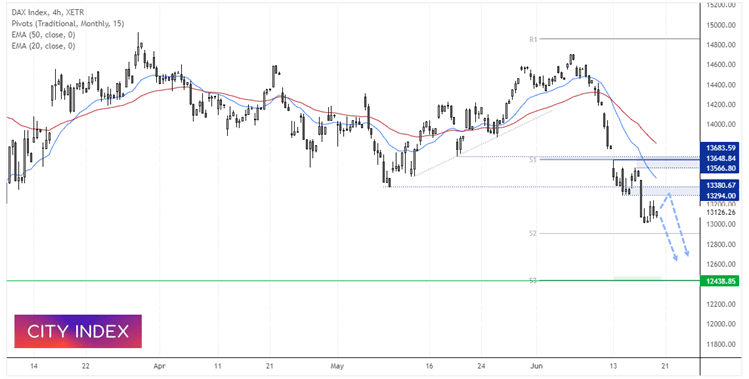

DAX 4-hour chart:

A strong bearish trend has formed on the4-hour chart, although Friday the DAX managed to hold above Thursday’s low and formed a small bullish inside candle. The 4-hour trend remains bearish below 13,566 although we would be keen to explore bearish opportunities below the 13,294 – 13,380 resistance zone.

The daily ATR is currently 259.83 which places a potential downside target around 12,866 using Friday’s close. However, the monthly S2 pivot resides at 12,903 which makes it a potential interim target. A break beneath which brings the 12,440 are into focus near the monthly S3 pivot and March low.

Commodities remain under pressure

Fears of a recession have slammed copper prices down to $4.00 – which is a key level of support for bulls to defend.

Gold has effectively been in a choppy range since the 19th of May between $1805 – $1880. And that makes it more of a trader’s market than an investors market. We think traders will opt to buy dips above 1800 and sell rallies below 1880. And as it now trades around the midway point of that range it feels like a coin toss as to which side of that range it could test next. But it is worth noting that traders are their least bullish on gold in 3-years according to the weekly COT report.

And WTI’s sell-off has shown signs of stability following Friday’s selloff. WTI currently trades at $107.85 and brent at $16.31.

FTSE 350 – Market Internals:

FTSE 350: 3910.86 (-0.41%) 17 June 2022

- 245 (70.00%) stocks advanced and 102 (29.14%) declined

- 2 stocks rose to a new 52-week high, 48 fell to new lows

- 17.43% of stocks closed above their 200-day average

- 23.14% of stocks closed above their 50-day average

- 4% of stocks closed above their 20-day average

Outperformers:

- + 12.76% - ASOS PLC (ASOS.L)

- + 9.92% - Aston Martin Lagonda Global Holdings PLC (AML.L)

- + 7.36% - FDM Group (Holdings) PLC (FDM.L)

Underperformers:

- -6.17% - BP PLC (BP.L)

- -5.72% - Diversified Energy Company PLC (DEC.L)

- -5.17% - Energean PLC (ENOG.L)

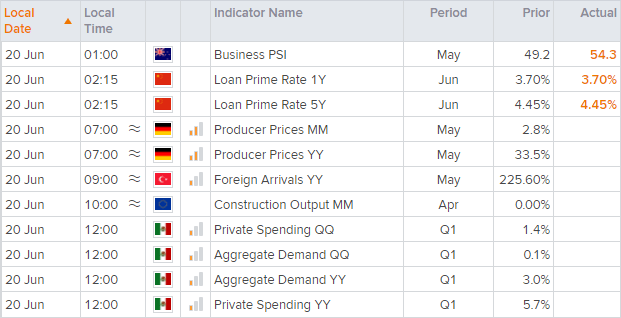

Economic events up next (Times in BST)

With the US on public holiday today, liquidity – and therefore volatility – might be lower without a fresh catalyst.

How to trade with City Index

You can easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade