Asian Indices:

- Australia's ASX 200 index fell by -12.8 points (-0.18%) to close at 6,986.00

- Japan's Nikkei 225 index has risen by 120.79 points (0.41%) and currently trades at 29,829.77

- Hong Kong's Hang Seng index has fallen by -204.16 points (-0.7%) and currently trades at 28,803.91

UK and Europe:

- UK's FTSE 100 futures are currently up 12.5 points (0.18%), the cash market is currently estimated to open at 6,954.72

- Euro STOXX 50 futures are currently up 4 points (0.1%), the cash market is currently estimated to open at 3,981.83

- Germany's DAX futures are currently up 8 points (0.05%), the cash market is currently estimated to open at 15,210.68

Thursday US Close:

- The Dow Jones Industrial rose 57.27 points (0.17%) to close at 33,503.57

- The S&P 500 index rose 17.22 points (0.43%) to close at 4,097.17

- The Nasdaq 100 index fell -19.71 points (-0.14%) to close at 13,758.51

The Nasdaq 100 closed in on its record high after breaking out of its 2-day consolidation, thanks to dovish comments from Jerome Powell which sent yields lower and Wall Street higher. It’s a new record for the Dow Jones and S&P 500, and futures are ticking higher ahead of today’s open. The STOXX 50 and CAC closed to new cycle highs the DAX is trying to build a base above 51,100 gap support. We suspect the low could be in pace.

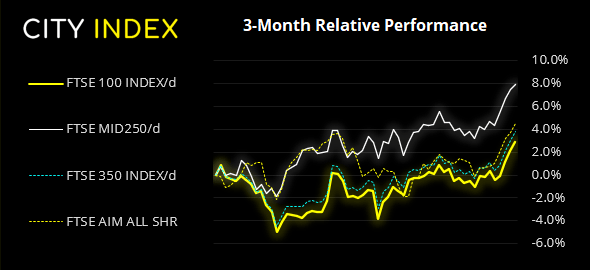

FTSE 100: Market Internals

It’s been a great week for the FTSE 100, currently 3.1% higher and now sitting firmly at a 13-month high. It has been up for four consecutive days and closed yesterday’s session at the high of the day. Key support today is the 6908.22 breakout high and its next target is 7,000, a level it hasn’t touched since crashing below it at the height of the pandemic. Roll on April 12th!

FTSE 100 (0.83%) 08 April 2021:

- 75 (74.26%) stocks advanced and 26 (25.74%) declined

- 85.15% of stocks closed above their 200-day average

- 84.16% of stocks closed above their 50-day average

- 92.08% of stocks closed above their 20-day average

- 3 hit a new 52-week high, 0 hit a new 52-week low

Outperformers

- Experian PLC (EXPN.L) +4.38%

- Sage Group PLC (SGE.L) +4.1%

- AVEVA Group PLC (AVV.L) +3.99%

Underperformers:

- Aviva PLC (AV.L) -3.09%

- Smurfit Kappa Group PLC (SKG.L) -2.45%

- DS Smith PLC (SMDS.L) -2.38%

China producer prices fly out the factory gates

China’s PPI (producer price index) rose 4.4% YoY in March to see prices at their highest level since July 2018 to further underscore how strong the post-pandemic recovery is. It’s yet to seep through into consumer prices but, with numbers like this, it only seems like a matter of time. Chinese shares are trading lower with the CSI300 down -1.3% and the weakest index overnight, followed by the Hang Seng which currently trades -0.9% lower.

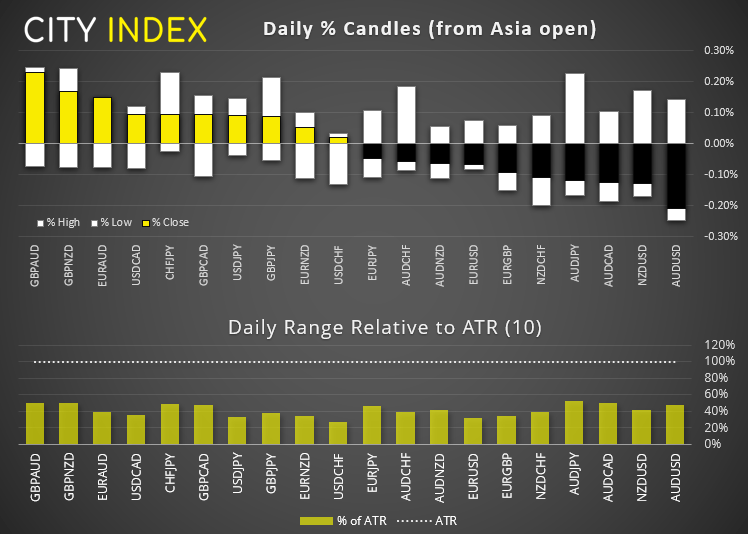

Forex: The pound sticks to its lows

Outside AUD, volatility remained low overnight. The US dollar index (DXY) found support at 92.00 yesterday after 92.50 caped as resistance. The bias remains bearish below 92.50 and a break below 92.00 assumes bearish continuation. And the Australian dollar, which could become increasingly sensitive to strong data from China, is currently the weakest pair overnight and is off by -0.22% as Australia’s (already delayed) vaccine rollout gets further delayed.

Going into the European open, all eyes are on GBP pairs to see if they can drag themselves form the lows else bears drive them lower for a fourth session.

GBP/CHF has been the biggest casualty this week for pound traders, falling -3% from its Monday peak and not really showing any signs of a base forming. It has clung onto 1.2700 support overnight but, if the last two sessions are anything to go by, it remains a pair for bears to fade into. A clear break to new lows brings 1.2576 low into focus, and the bias remains bearish beneath 1.2790-1.2800.

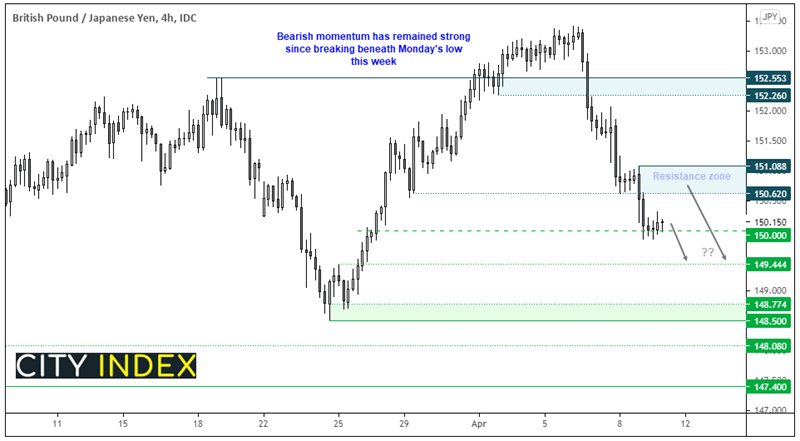

GBP/JPY has fallen -2.3% from since Monday’s high and is now meandering around the 150.00 handle. A series of indecision candles formed overnight at 150.00, so we see the potential for a bounce from current levels. Yet the bias remains bearish beneath the 151.09 high, but 150.62 may also provide resistance assuming bulls cannot regain control. See last night’s Asian Open report for a look at GBP/AUD.

- The bias is for a minor bounce toward the 150.62 – 151.09 zone before breaking below 150.00.

- 149.44 is an interim downside target, before the 148.50/78 zone.

- All of this assumes upside volatile remains tame – therefore a bullish momentum shift is unappealing for short, and a break above 151.09 assumes the downside move is complete.

Gold rises to a technical juncture

Gold rose to the lower bound of the 1755 – 1764 resistance cluster yesterday. It’s an important area, and likely to be a zone which tempts bears to load up, although this could prove futile if the US dollar continues to fall. It has traded slightly lower overnight to around 1751 and a minor retracement from current levels seems almost like a given due to the importance of overhead resistance. So we’ll keep a close eye on the US dollar for clues as to which way this may break.

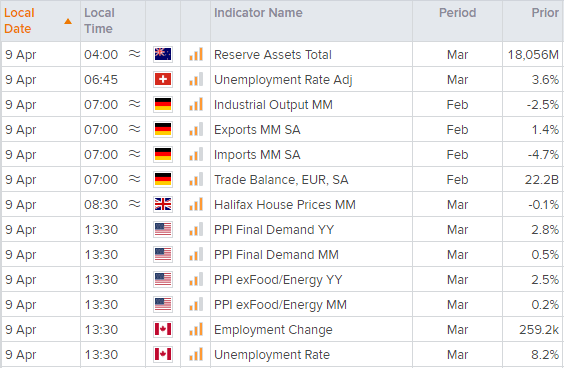

Up Next (Times in BST)

You can view all the scheduled events for today using our economic calendar, and keep up to date with the latest market news and analysis here.