Asian Indices:

- Australia's ASX 200 index rose by 44.8 points (0.65%) and currently trades at 6,893.50

- Japan's Nikkei 225 index has risen by 146.12 points (0.52%) and currently trades at 28,211.69

- Hong Kong's Hang Seng index has risen by 488.36 points (2.59%) and currently trades at 19,342.98

- China's A50 Index has risen by 205.23 points (1.56%) and currently trades at 13,400.31

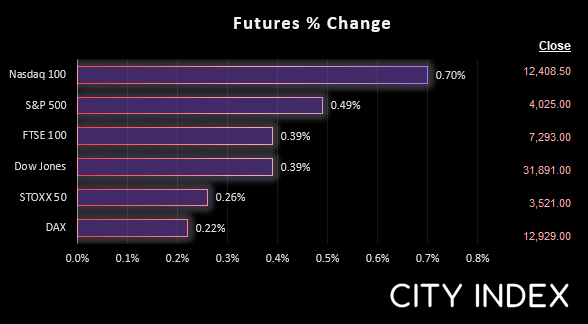

UK and Europe:

- UK's FTSE 100 futures are currently up 28.5 points (0.39%), the cash market is currently estimated to open at 7,290.56

- Euro STOXX 50 futures are currently up 10 points (0.28%), the cash market is currently estimated to open at 3,522.38

- Germany's DAX futures are currently up 30 points (0.23%), the cash market is currently estimated to open at 12,934.32

US Futures:

- DJI futures are currently up 128 points (0.4%)

- S&P 500 futures are currently up 88.25 points (0.72%)

- Nasdaq 100 futures are currently up 19.75 points (0.49%)

Asian equity markets were mostly higher a day after Jerome Powell reiterated the message that the Fed can fight inflation and also achieve a soft landing. China’s benchmark indices were the leaders of the session following soft inflation data which paves the way for more stimulus from Beijing.

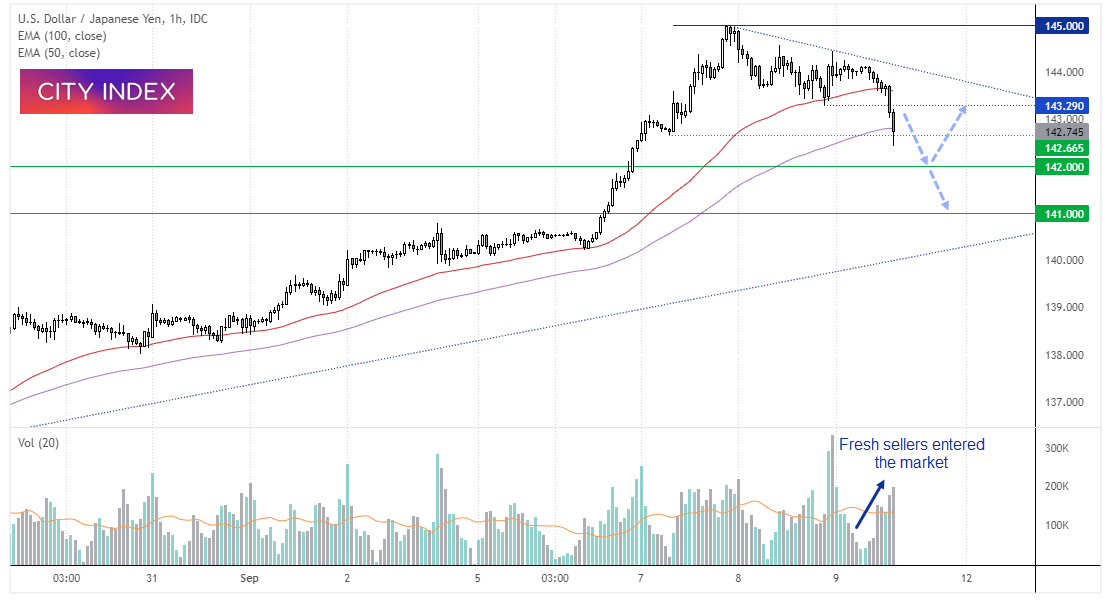

Yen traders (finally) take note of a BOJ official

The US dollar is the weakest major, and AUD is the strongest as it tracked Asian equities higher. BOJ Governor Kuroda hit the wires and managed to jawbone the yen, saying the rapid FX moves are undesirable. Following a meeting with the PM, he told reporters that the BOJ will “watch exchange rate moves carefully”. The Finance Minister of Japan also said separately that the government won’t rule out any options to help tame currency movements. The result was a rapid FX move on yen pairs and a -1% fall on USD/JPY (or -160 pips).

We can see on the 1-hour chart if USD/JPY that volumes increased as prices fell, which tells us that fresh sellers were entering the market. As trader across Europe of the US are yet to react to the news, perhaps we’ll see some bearish follow-through for the pair. Yet with central bank policies favouring a bullish trend on the yen, the current decline is assume to be corrective at this stage (and a much needed one at that, given the magnitude of recent gains). So heading into the weekend we’d prefer to fade into rallies below resistance and see if prices can build support around 142 or even 141.

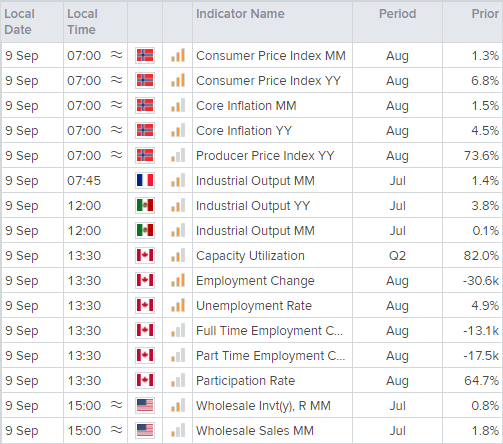

Canada’s employment figures for August at 13:30 BST

We’ve seen headline employment soften for the past two months (with both full and part-time jobs declining) but, with the unemployment rate steady at the record low of 4.9% we’d need to see an unexpected print for it to holt markets. The BOC raised interest rates by 75bp – and it looks like another 75bp hike is on the horizon, given that inflation is “still too high” and talk of “front-loading” interest rates after their 75bp hike this week.

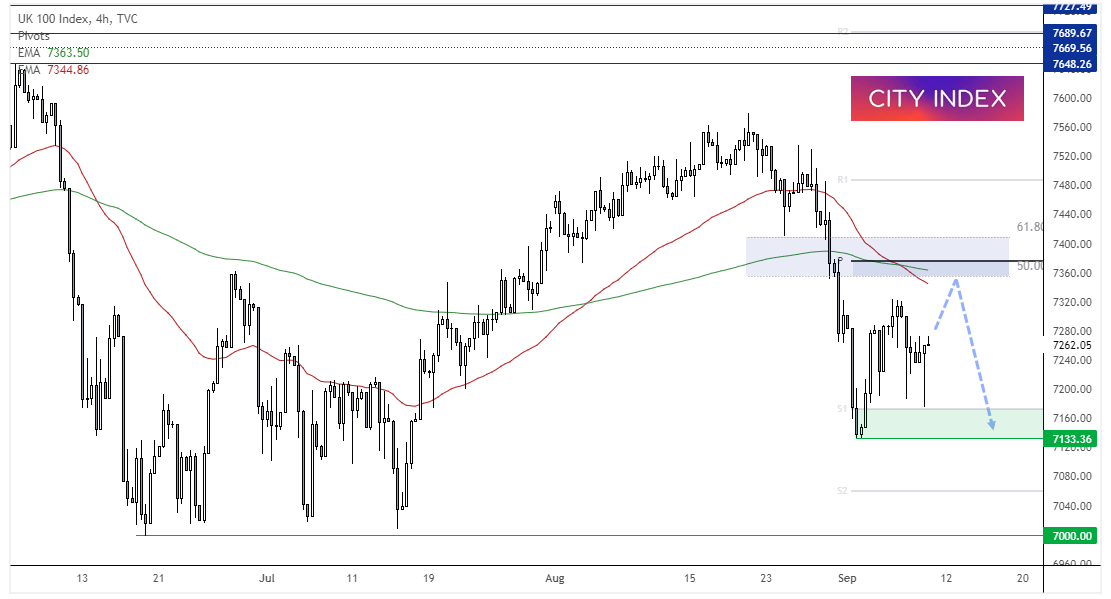

FTSE 100 daily chart:

With index futures and Asian equities pointing higher we’re looking for a bounce on the FTSE 100 today. Prices appear to be within a corrective phase against it fall from the August high, and a recent bullish hammer on the 4-hour chart above the monthly S1 pivot marks a potential swing low. The initial target for bulls to consider could be the 7360 area, near the 200 and 50-bar EMA’s and monthly pivot point.

FTSE 350 – Market Internals:

FTSE 350: 4025.18 (0.33%) 08 September 2022

- 155 (44.29%) stocks advanced and 183 (52.29%) declined

- 22.86% of stocks closed above their 200-day average

- 96% of stocks closed above their 50-day average

- 2.86% of stocks closed above their 20-day average

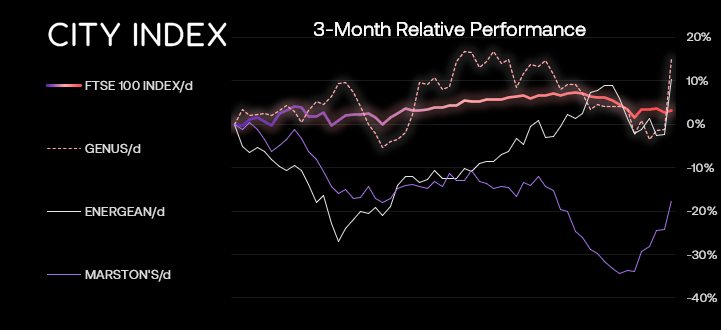

Outperformers:

- +9.43% - Genus PLC (GNS.L)

- +3.96% - Energean PLC (ENOG.L)

- +3.05% - Marston's PLC (MARS.L)

Underperformers:

- -15.04% - Melrose Industries PLC (MRON.L)

- -8.64% - Associated British Foods PLC (ABF.L)

- -5.62% - AJ Bell PLC (AJBA.L)

Economic events up next (Times in BST)

How to trade with City Index

You can easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade