Asian Indices:

- Australia's ASX 200 index fell by -294.7 points (-4.25%) and currently trades at 6,637.30

- Japan's Nikkei 225 index has fallen by -473.22 points (-1.75%) and currently trades at 26,514.22

- Hong Kong's Hang Seng index has fallen by -78.03 points (-0.37%) and currently trades at 20,989.55

- China's A50 Index has fallen by -103.82 points (-0.75%) and currently trades at 13,694.68

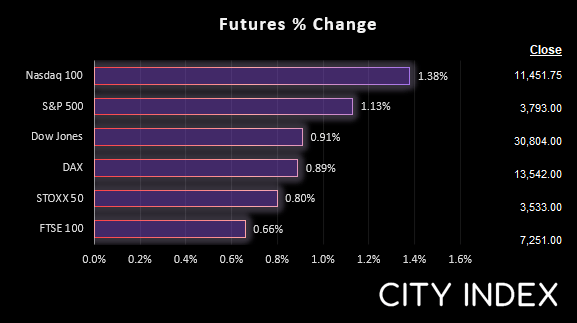

UK and Europe:

- UK's FTSE 100 futures are currently up 49 points (0.68%), the cash market is currently estimated to open at 7,254.81

- Euro STOXX 50 futures are currently up 28 points (0.8%), the cash market is currently estimated to open at 3,530.50

- Germany's DAX futures are currently up 120 points (0.89%), the cash market is currently estimated to open at 13,547.03

US Futures:

- DJI futures are currently up 281 points (0.92%)

- S&P 500 futures are currently up 156.25 points (1.38%)

- Nasdaq 100 futures are currently up 43 points (1.15%)

Asian equity markets were predictably lower as they tracked Wall Street, just a day after the S&P500 entered a technical bear market. And an inverted 10-2 yield curve – the harbinger of economic doom – nicely demonstrated how fears of a global recession have been exacerbated by a sudden realisation the Fed might actually hike by 75-bps tomorrow.

The ASX 200 had its worst day since the pandemic and is now clinging on to 6600 support for its dear life. Bears were clearly taking no prisoners with all sectors in the red, although we pity any bear who chose one of the few stocks to rise today. That said, the ASX had some catching up to do in regards todays selloff, after a 3-day weekend. And it certainly did its best to make up for lost time.

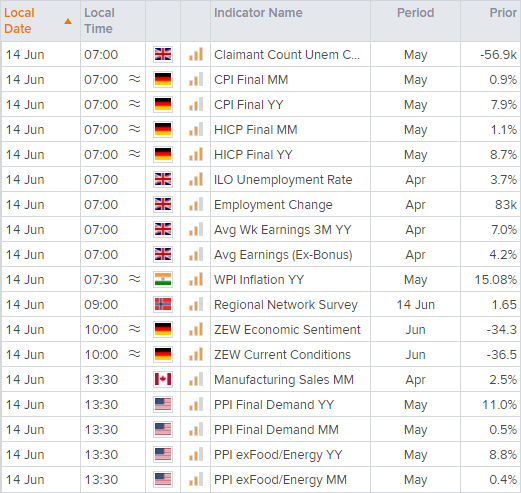

On the data front we have final CPI reads for Germany, CPI for India and producer prices for the US. Given how sensitive and on edge markets are for 75-bps hikes, then a hotter than expected PPI report for the US could surely wreak further havoc for sentiment.

Upon initial inspection one may think there’s was a risk-on tone overnight with AUD and NZD the strongest majors, and US index futures rising. But once taken in context of yesterday’s rout it is likely to be little more than technical repositioning from notably bearish moves.

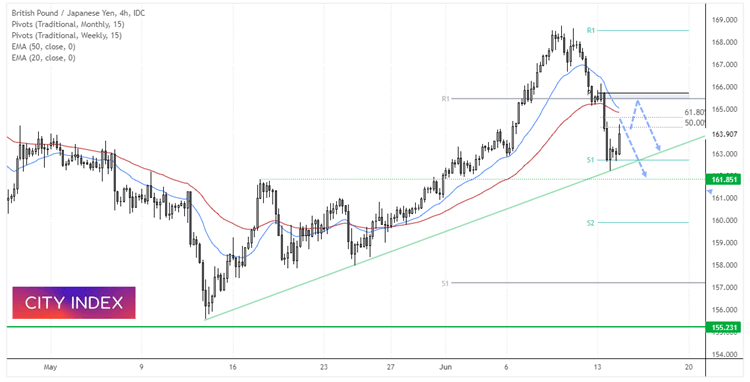

GBP/JPY 4-hour chart:

The US dollar and yen were lower, which was effectively a reversal of yesterday’s moves (and therefore likely part of a retracement). This has allowed GBP/JPY to rise from trend support which includes bullish trendline and the weekly R2 pivot. Should UK employment surprise to the upside then perhaps we can see it retrace further. But we suspect this is still part of a bearish move so will look out for signs of a lower high, in anticipation of a break of the trendline in due course.

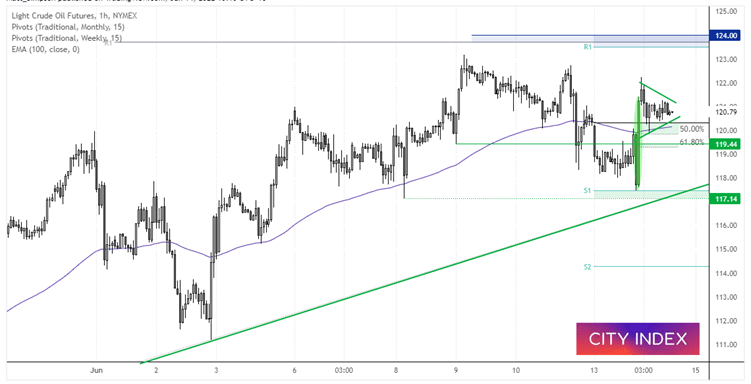

WTI 1-hour chart:

All things considered, WTI held up fairly well yesterday. Support was found above the 117.14 low, bullish trendline and weekly S1 pivot before prices rallied back above $120. Prices are now consolidating in a potential pennant pattern, so now looking for momentum to break higher and take WTI towards $123. If we instead so a low volatility downside break of the pennant, we’d look fort evidence of support around $120 near the50% retracement level and 100-bar eMA.

FTSE 100 market internals:

FTSE 350: 4007.68 (-1.53%) 13 June 2022

- 27 (7.71%) stocks advanced and 317 (90.57%) declined

- 1 stocks rose to a new 52-week high, 62 fell to new lows

- 21.71% of stocks closed above their 200-day average

- 17.43% of stocks closed above their 50-day average

- 7.71% of stocks closed above their 20-day average

Outperformers:

- +9.43% - Fresnillo PLC (FRES.L)

- +3.96% - National Express Group PLC (NEX.L)

- +3.05% - BH Macro Ltd (BHMG.L)

Underperformers:

- -15.0% - Aston Martin Lagonda Global Holdings PLC (AML.L)

- -8.64% - Ascential PLC (ASCL.L)

- -5.62% - Wizz Air Holdings PLC (WIZZ.L)

Economic events up next (Times in BST)

How to trade with City Index

You can easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade