Asian Indices:

- Australia's ASX 200 index rose by 8.8 points (0.13%) and currently trades at 7,029.40

- Japan's Nikkei 225 index has fallen by -226.04 points (-0.8%) and currently trades at 28,023.20

- Hong Kong's Hang Seng index has risen by 173.27 points (0.86%) and currently trades at 20,219.04

- China's A50 Index has risen by 39.65 points (0.29%) and currently trades at 13,601.23

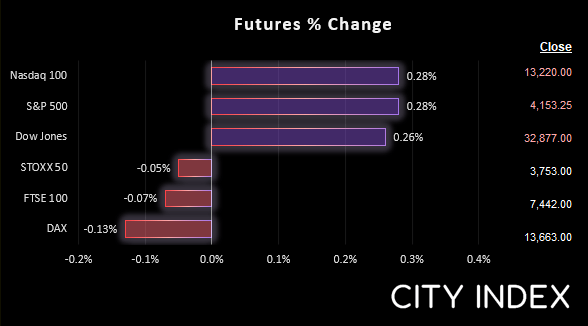

UK and Europe:

- UK's FTSE 100 futures are currently down -3.5 points (-0.05%), the cash market is currently estimated to open at 7,478.87

- Euro STOXX 50 futures are currently down -2 points (-0.05%), the cash market is currently estimated to open at 3,755.22

- Germany's DAX futures are currently down -21 points (-0.15%), the cash market is currently estimated to open at 13,666.69

US Futures:

- DJI futures are currently up 84 points (0.26%)

- S&P 500 futures are currently up 37 points (0.28%)

- Nasdaq 100 futures are currently up 11.5 points (0.28%)

Volatility remains low overall

Currency markets traded in tight ranges with lack of any market moving news. Equities were mixed across Asia but with an upside bias as traders are leaning into the potential for a soft inflation report from the US tomorrow.

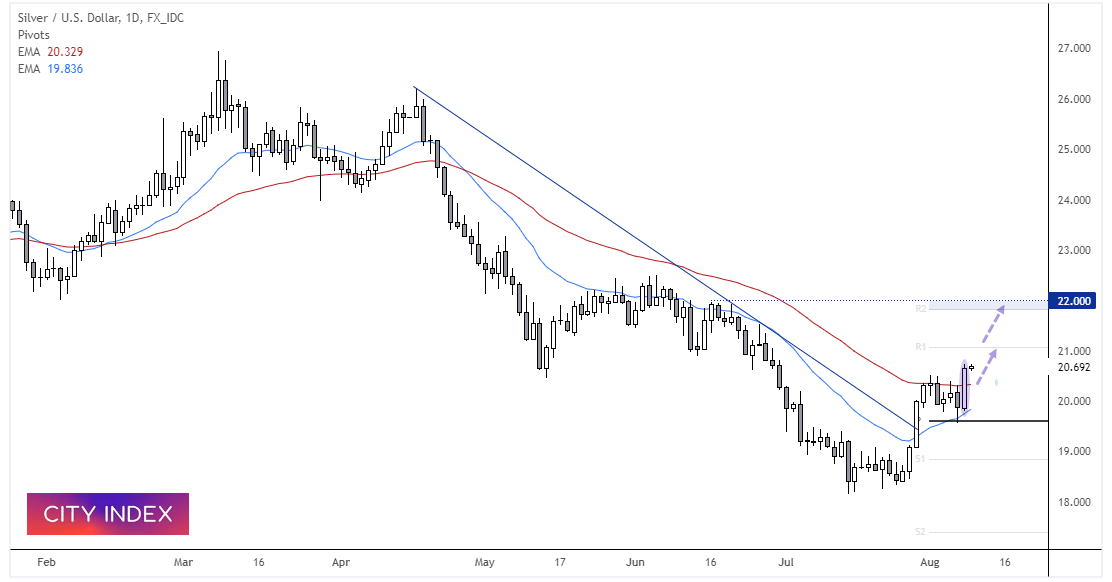

Gold shows the potential to push higher and gun for $1800, although trend resistance is also in the vicinity – and the reward to risk ratio from current levels on the daily chart seem inadequate. For this reason we prefer silver for potential longs over the near-term.

Silver daily chart (XAG):

We can see on the daily chart that spot silver prices have invalidated a bearish trendline. After a brief pullback support was found at the monthly pivot point and 20-day eMA, and yesterday’s bullish engulfing candle (its strongest in 7) helped it rise to a 5-week high and trades bac above the 50-day eMA. It appears that we have seen the corrective low and prices could now be headed for $21 (near the monthly S1), a break above which brings the resistance zone around $22 into focus.

How to start silver trading

FTSE 350 – Market Internals:

- FTSE 350: 4168.67 (0.57%) 08 August 2022

- 222 (63.43%) stocks advanced and 111 (31.71%) declined

- 7 stocks rose to a new 52-week high, 2 fell to new lows

- 34.57% of stocks closed above their 200-day average

- 81.14% of stocks closed above their 50-day average

- 18.29% of stocks closed above their 20-day average

Outperformers:

- + 7.18% - Hargreaves Lansdown PLC (HRGV.L)

- + 4.46% - Rolls-Royce Holdings PLC (RR.L)

- + 4.33% - Apax Global Alpha Ltd (APAX.L)

Underperformers:

- -7.22% - Pagegroup PLC (PAGE.L)

- -5.15% - Future PLC (FUTR.L)

- -4.88% - Hays PLC (HAYS.L)

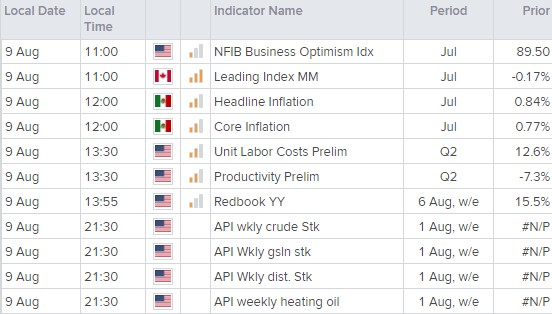

Economic events up next (Times in BST)

The economic calendar is on the quiet side today, with no top-tier data scheduled for the first half of the European session. The NFIB Business Optimism indices is released at 11:00 BST and focuses on small businesses across the US. At 89.5 it fell to its lowest level since January 2013 in June, with retail and finance being the most pessimistic industries. Business with 0-4 employees were also the most concerned.

Mexican inflation data is then released at 12:00 BST and a Reuters poll shows a consensus of it to rose to 8.1% y/y (a 22-year high) from 7.99%.

Later in the US session, energy traders will then be keeping a close watch on the weekly API report at 21:30

How to trade with City Index

You can easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade