DAX falls on China growth concerns & ahead of German inflation data

DAX falls for a third straight day and is falling for the sixth session out of seven. The DAX is falling, along with European equities, amid rising concerns over the health of the economic recovery in China and amid increased fears of a recession in the US.

Chinese manufacturing PMI fell by more than expected to 48.8 in May, a 5-month low. This was down from 49.2 in April. The level 50 separates expansion from contraction. The data suggests that the post-pandemic recovery in China is losing steam.

Separately, the debt ceiling deal which is making its way through Congress with a vote in the House of Representatives later today, giving the Senate plenty of time to consider the bill before voting on it before June 5th.

Unofficial estimates suggest that the deal sees the White House potentially reducing spending by $1 trillion, in a move that raises the prospect of a recession in the US.

In Europe, German inflation data is due and is expected to cool to 6.5% YoY in May, down from 7.6% in April. The data follows Spanish inflation yesterday, which cooled by more than expected.

Cooling inflation eases pressure on the ECB to hike rates aggressively to rein in inflation. The market is pricing in a further 50 basis points worth of hikes this year.

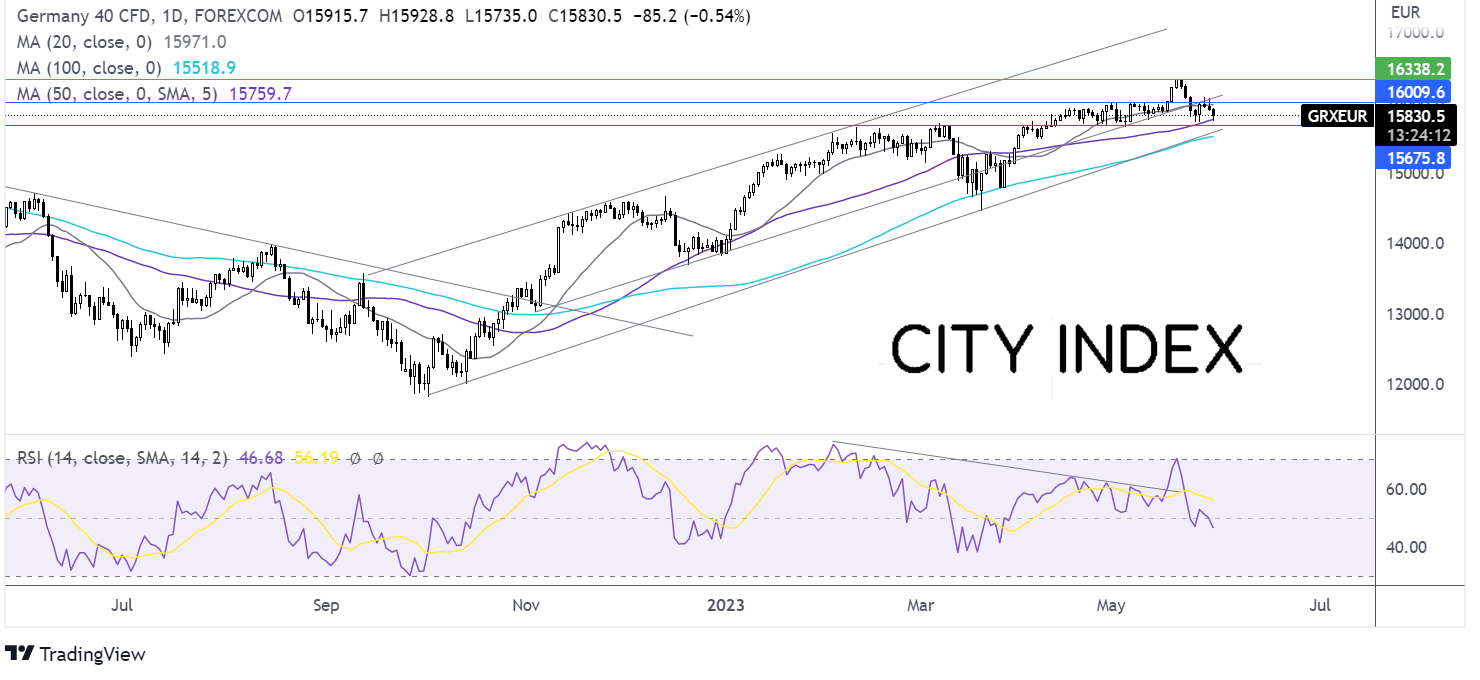

DAX outlook – technical analysis

After reaching an all time high of 16333 earlier in the month, the DAX has eased lower, breaking below a multi-month rising trendline and the 20 sma and is testing support on the 50 sma. The RSI below 50 supports further downside.

A break below the 50 sma at 15750 opens the door to 15650 the May low. A break below here exposes the 100 sma at 15170 and 15000 round number.

Should the 50 sma hold, buyers could look for a rise above 16000 round number and 16100 the rising trend line resistance to bring 16333 back into focus.

USD/JPY falls on intervention chatter & ahead of the US debt ceiling vote

After hitting a fresh 6-month high yesterday, USD/JPY is falling away from 140.00 after intervention from Japanese authorities and as the debt ceiling bill overcomes its first procedural hurdle in Congress.

Japan’s vice minister for financial affairs Masato Kanda hinted that Japanese authorities could intervene to support the falling yen, if necessary. He said that currency market moves will be watched closely and responded to as needed.

If authorities were to intervene, it wouldn’t be the first time. The BoJ intervened on several occasions last year.

While the BoJ’s dovish monetary policy remains in place and the Fed is still hiking rates, central bank divergence is supportive of the USD.

Still, gains in the yen could be limited by weaker-than-forecast data. Japanese industrial production fell -0.,4% MoM in April, defying forecasts of a rise to 1.4%. Retail sales also rose by less than forecast at 5%, down from 6.9%.

The USD is rising versus its major peers but falling versus the yen. The debt ceiling bill is progressing through Congress, with the House of Representatives voting later today. With the progress so far on track, and expectations that the bill will cross the line in time, investors will turn their attention back to the Fed and data.

Federal Reserve Cleveland President Loretta Mester said that there was no compelling reason to pause rate hikes. Following Friday’s hotter-than-expected inflation data, the market is now pricing in a 63% probability of a 25 bps rate hike in June.

Looking ahead, the US beige book and several Fed speakers are in focus, as well as the House debt ceiling vote.

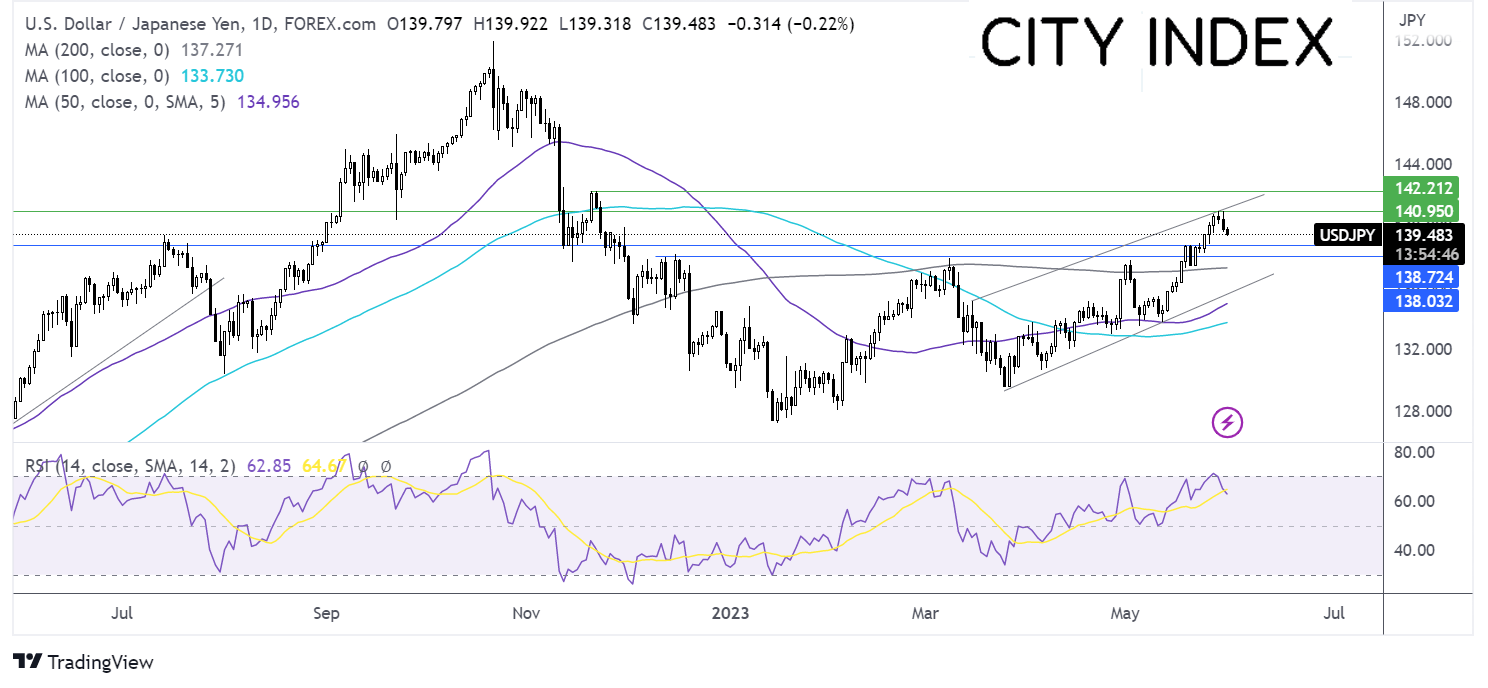

USD/JPY outlook -technical analysis

USDJPY trades within a rising channel since mid-March. The pair ran into resistance at 140.93 and has eased lower, pulling the RSI out of overbought territory. This 140.93 level could offer resistance, ahead of 142.25 the November 21 high.

On the flip side, support can be seen at 138.75 the mid-May high, with a break below here bringing 138.00 the March high into focus, ahead of the 200 sma at 137.25.