If you placed your first trades in 2021, as so many cooped-up, bored individuals did, you may have gotten the wrong idea about how volatile indices could be. After all, Germany’s widely-followed DAX index of 40 large companies went the entire year without seeing a 10% peak-to-trough pullback.

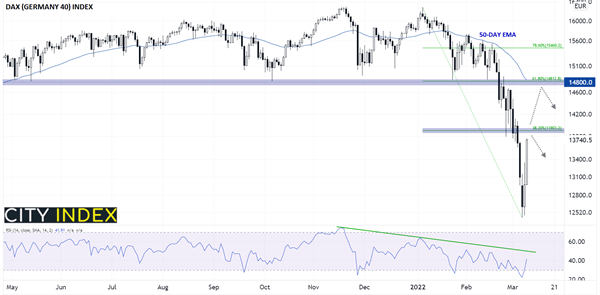

For those traders, the first couple of months in 2022 has served as visceral reminder of how volatile indices can be in times of global tumult. In a sharp contrast to last year, the DAX (Germany 40) has already seen a nearly -25% peak-to-trough pullback to Monday’s lows, unwinding all of the strong gains seen throughout 2021.

Just when traders were losing hope though, we’ve seen an incredible reversal in the DAX through the middle of the week. As we go to press, Germany’s benchmark index is trading up more than 10% from the lows set less than 48 hours ago, prompting traders to wonder…

Has the DAX bottomed?

With the obvious disclaimer that it’s impossible to know the future with certainty, and that headlines out of Ukraine will play a major role in how all global markets trade in the coming weeks, we’re still skeptical that the DAX has seen a durable bottom.

An old trading axiom states that “Tops are an event; bottoms are a process.” In essence, this quote gets at the idea that it typically takes a longer period of time for bear markets conclude, whereas bull markets are more likely to accelerate to extreme levels before abruptly reversing. While recent events have shown that this maxim is not infallible, it has historically been a good guideline.

In that light, we wouldn’t be surprised to see the DAX drop back below 13,000 in a retest of the lows at a very minimum. As far as logical areas where short-term bulls may want to consider taking profits or bears may consider establishing new short positions, the key levels to watch will be the 38.2% Fibonacci retracement of this year’s drop at 13,900 or, if the near-term bullish momentum is able to overcome that zone, the confluence of the 61.8% Fibonacci retracement, 50-day EMA, and previous-support-turned-resistance around 14,800. Only a break back above 14,800 would erase the medium-term bearish bias on the index and give traders confidence that a durable bottom has formed.

Source: TradingView, StoneX

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade