When will Coinbase release its Q2 results?

Coinbase, the world’s second largest cryptocurrency exchange by volume will publish Q2 on Tuesday after the closing bell and three months after its public debut on the Nasdaq.

What to expect

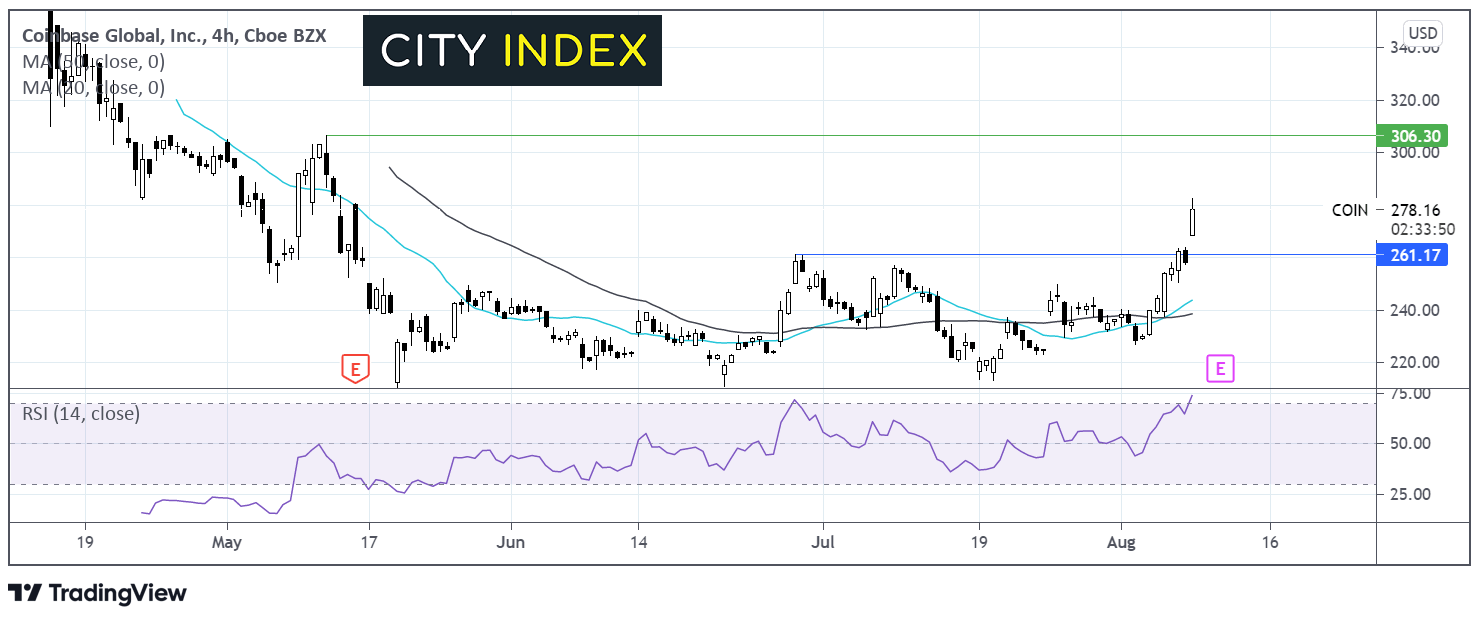

The earnings, the second earnings report for COIN, come after the share price performance has been less than impressive, declining to $270 a 35% from the high reached on the day of the IPO but also over 30% higher from July’s low. With shares down by such a large percentage, there is a chance we could see some re-engagement according to analysts at Goldman Sachs, who are expecting an upside surprise on Tuesday.

During the quarter in question the Bitcoin prices rose to an all time high before tanking $30,000. Volume in the sector declined as investors stepped out of the ring.

Despite the price of Bitcoin crashing in that quarter expectations are running high for a strong quarter with revenue forecasts at $1.7 billion. EPS is expected to drop from $3.05 in Q1 to $2.34 in Q2. Growth in the subscriptions and services revenue, which made $56 million in Q1, will be in focus as will the firms’ user growth. Guidance for the number of monthly transactions was upwardly revised to 7 million from 5.5 million earlier this year. Talk of regulation could be a headwind for results.

The Coinbase share price will also be reacting to crypto currency pricing after Bitcoin surged across the weekend piercing $45,000 for the first time in two months. The firm move higher in the cryptocurrency space is boosting the Coinbase share price heading towards the results.

Learn more about trading equities

Where next for the Coinbase share price?

The share price has broken above a key resistance level at $161 the June 29 high. This paves the way for further upside, although the RSI has tipped into overbought territory so a period of consolidation at these levels could be on the cards, or even a move lower. $161 now offers support on the downside. Meanwhile, bulls could be looking for a move higher towards $306 swing high May 12.

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels

- Place the trade.