While most of China’s population is vaccinated, officials are tackling the outbreaks with mass testing and targeted lockdown, presenting a significant downside threat to the economy. Other headwinds have also emerged this month, including the recent regulatory crackdown and weak business confidence and trade data for July.

In response to these headwinds, several banks have revised their 3Q China GDP forecasts, including Goldman Sachs. They cut their Q3 forecast by 3.5pp to 2.3% (quarter-on-quarter annualized) and full-year 2021 growth by 0.3pp to 8.3%, while highlighting risks remain to the downside.

Authorities are expected to respond with increased policy support, including two more 50bp RRR cuts and increasing aggregate finance and fiscal support, which does make the release a few moments ago of lower than expected aggregate financing data for July at 1.06 trillion yuan vs. 3.67 trillion yuan in June somewhat baffling.

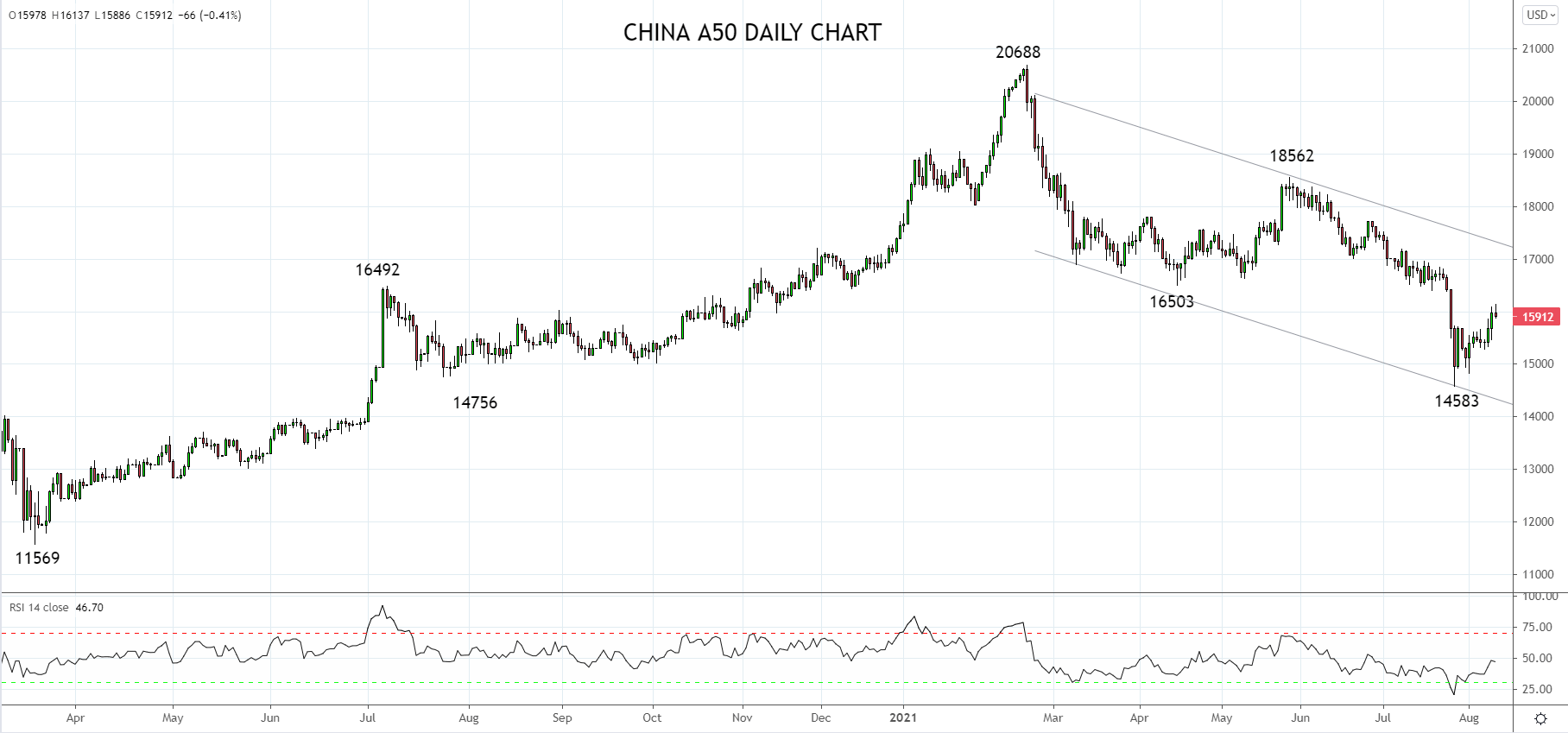

Turning to the chart of the China A50, the decline from the February 20688 high to the recent 14583 low appears to be a multi-month correction after a strong run higher in the two years beforehand.

An indication the correction is complete at the 14583 low and that the uptrend has resumed would be an ability to reclaim the band of resistance, formerly support at 16,500/17,000. Until this occurs, a retest of the 14853 low remains possible.

Source Tradingview. The figures stated areas of 11th of August 2021. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation