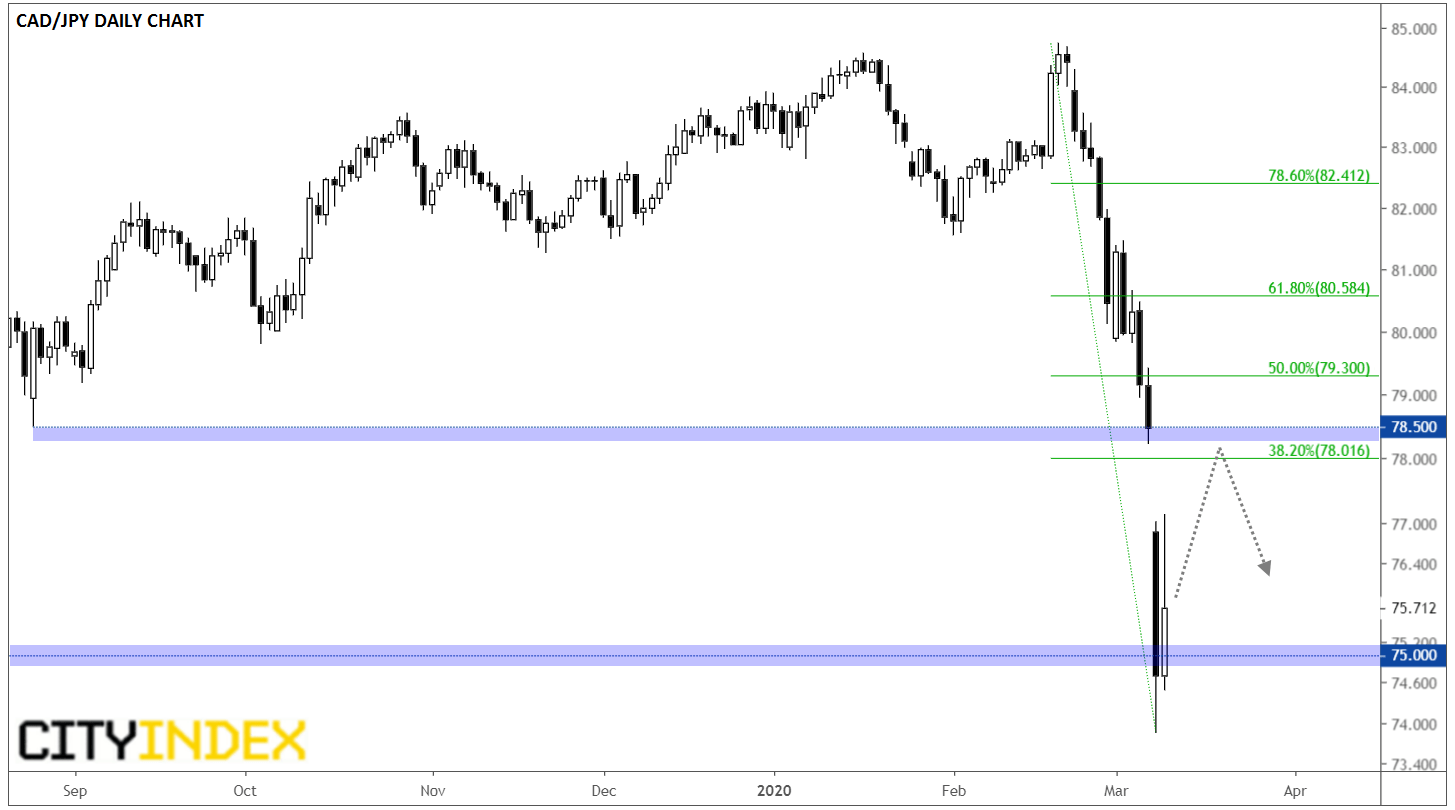

CAD/JPY: “Ground Zero” for Coronavirus and the Oil War

Generally speaking, currency markets tend to move more slowly than equity markets. After all, it’s more reasonable that an unexpected development could change the value of a single company by 20% in a week than that any event could cause a 20% revaluation of an entire developed country’s economy.

However, there are rare occasions where the short-term volatility in a given currency pair could approach that of a typical stock. Such is the case with CAD/JPY over the last couple of weeks, which faces a “perfect storm” of collapsing oil prices (from the unprecedented “price war” between Saudi Arabia and Russia) and a strong bout of risk aversion yen buying (on fears of coronavirus spreading):

Source: TradingView, GAIN Capital

Again, that’s not a chart of some cruise company or airline; the value of the entire Canadian economy has fallen by more than 10% against Japan’s in a little over two weeks (though it is bouncing back more than 2% as of writing today).

Of course, after such a dramatic drop, the question on every FX trader’s mind is “Where will CAD/JPY go next?” Following huge moves, many traditional technical analysis tools are less useful: of course price is below every meaningful moving average and any oscillator will show that price is oversold, but that doesn’t mean as much as it would in a more traditional market move.

It is worth noting that the pair is testing previous support from the Q4 2016 low around 95.00, which could give bulls some semblance of optimism and an area to try to defend. The unit has already bounced more then 300 pips off yesterday’s intraday low, and even that rally has started to fade along with the market’s general risk appetite.

Moving forward, a recovery rally off yesterday’s lows is the most likely scenario, with near-term bulls eyeing the 38.2% Fibonacci retracement near 78.00, previous-support-turned-resistance at 78.50, or the 50% retracement of the entire drop at 79.30. On the other hand, continued negative fundamental news, including recent headlines that Saudi Arabia is drawing down reserves to flood the market and that Italy has been placed on a complete lockdown to contain the spread of coronavirus, could overcome technical support in the 75.00 and lead to a deeper selloff, perhaps toward the 2011 lows near 71.00 in time.