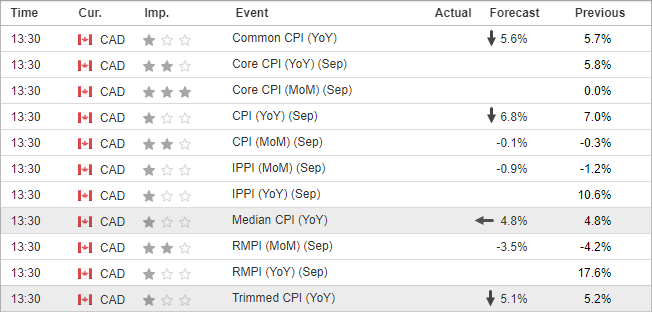

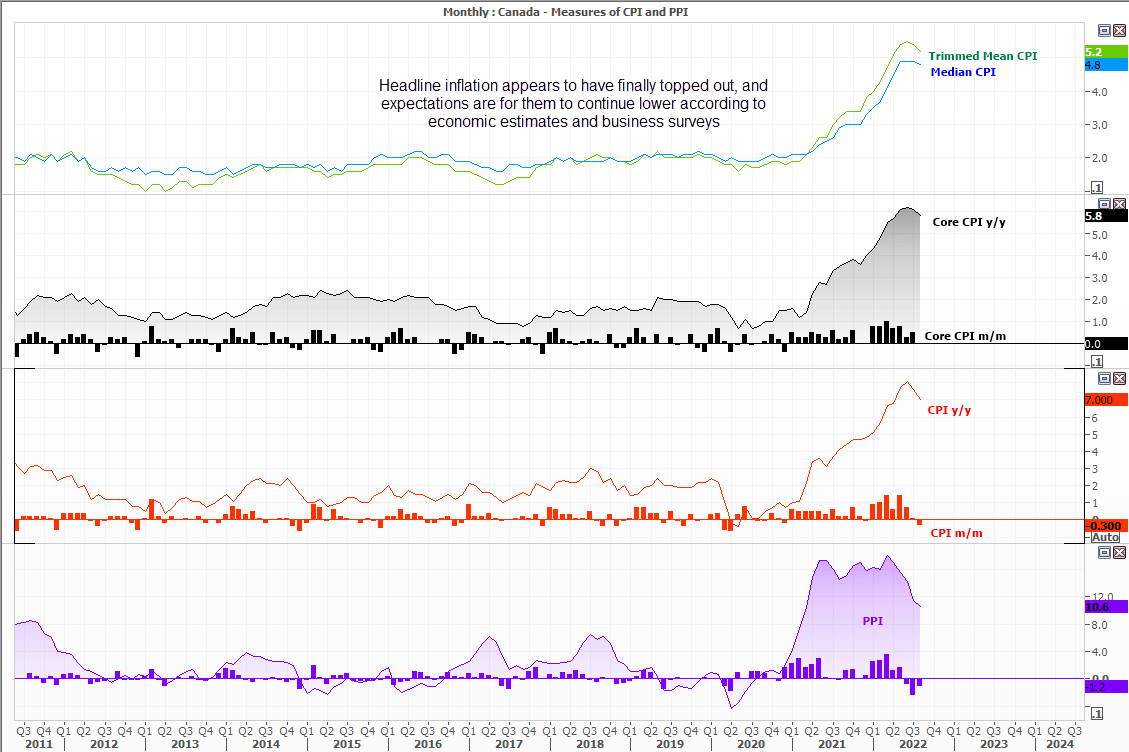

Canadian inflation data is in focus later today, and there are expectations for further signs of disinflation. Headline inflation cooled faster than expected in August, which is something I don’t get to write much on these days. CPI ‘only’ rose 7% y/y compared with 7.3% expected, and both Trimmed and Mean CPI (the BOC’s preferred measures) also moved lower.

Today’s estimates are for Trimmed Mean to drop to 5.1% (5.2% prior) and Median to stay flat at 4.8%. As much as we’d like to see the data drop, the BOC also pay very close attention to the business outlook survey which was released earlier this week.

Overall, firms expect price pressures to ease although they remain elevated and far above the BOC’s target. Growth is expected to suffer and 35% of firms expect a 50-80% chance of a recession. Whilst unpleasant, it is also another form is disinflation.

How CPI impacts forex

Summary of the Q3 Business Outlook Survey

- Business sentiment is trending lower.

- Most businesses think a recession is likely (due to rising interest rates and high prices).

- Labour and supply chain bottlenecks may have peaked.

- Businesses expect price increases to moderate due to lower commodity prices and other input goods.

- Wage growth also expected to soften.

- Short-term inflation expectations have edged down but remain elevated (and above the BOC’s target).

- Sales outlook has softened.

- Rising interest rates are weighing on business sales linked to housing activity and household consumption.

- Other firms expect healthier sales but below pre-pandemic levels.

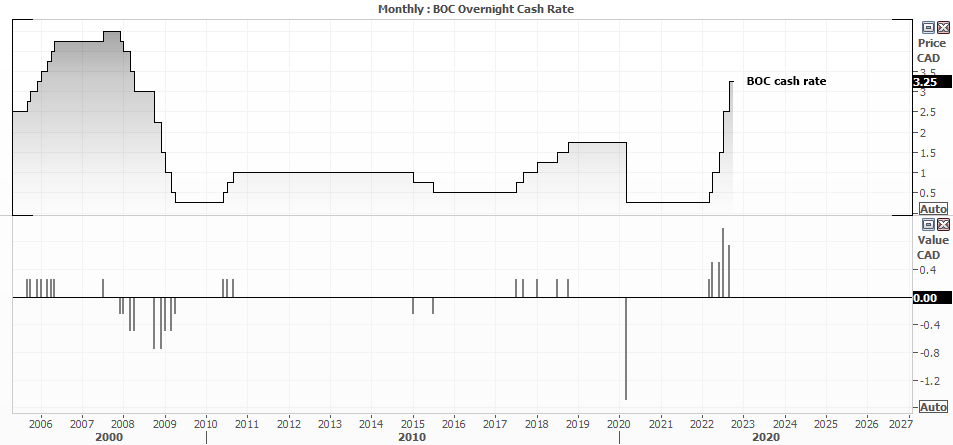

The BOC are on track for a 50bp hike next week

Irrespective of the Canadian economy, BOC Governor Macklem said that the central bank may be forced to continue hiking rates due to the stronger dollar. USD/CAD has risen over 9% from the August low, and the dollar’s strength is showing little signs of softening amidst hawkish talk from Fed members. So whilst today’s inflation report is unlikely to prevent the BOC from tightening further, it could begin to build a case for smaller increments as we enter 2023.

Economists currently expect the BOC to hike rates by 50bps next week to take rates to 3.75%, and to raise by another 25bp in December to take rates to 4% by the year end. The 1-month OIS places an 86% probability of a 50bp hike, and a 90% chance of a 25bp hike in December.

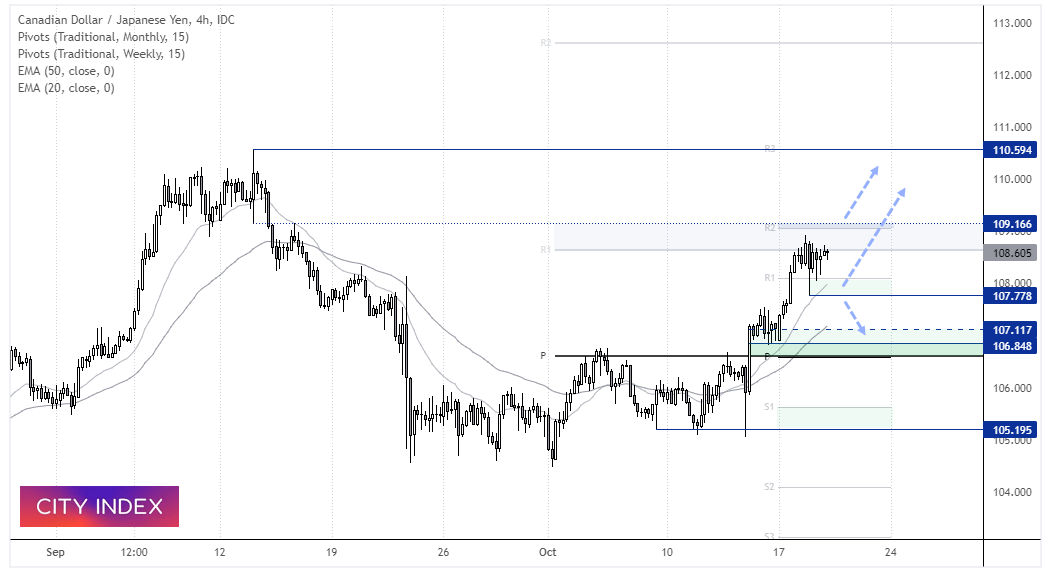

CAD/JPY 4-hour chart:

CAD/JPY remains within a strong uptrend on the 4-hour chart despite weaker oil prices, supported by higher equity prices and of course the weaker yen. Prices are now consolidating around the monthly R1 and weekly R2 pivot, as break above which assumes bullish continuation. Should prices initially retrace then we’d consider bullish setups above the 107.78 low, a break beneath which switches to a near-term bearish bias.

How to trade with City Index

You can easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade