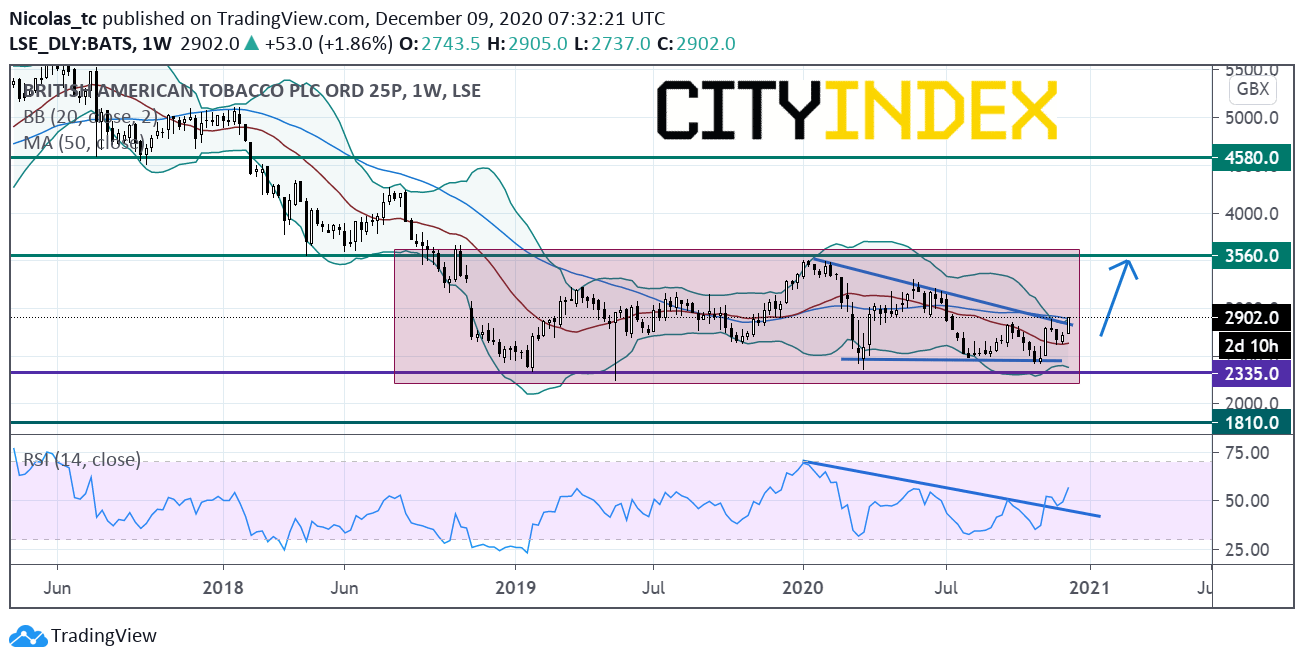

British American Tobacco: range-bound trading strategy

British American Tobacco, the cigarettes manufacturer, said in its 2H trading update that constant currency adjusted revenue growth is now estimated to be at the high end of the 1-3% range, and a mid-single figure constant currency adjusted diluted EPS growth is expected.

From a chartist point of view, the stock price has landed on a technical support at the lower end of the short term trading range (2335p) and may post a rebound thanks to the upside breakout of an intermediary declining trend line. The daily RSI (14) is gaining upward momentum (> 50%). Readers may want to consider the potential for opening Long positions above the support level at 2335p with 3560p as target (upper end of the trading range). Caution: a break below 2335p would call for a reversal down trend.

Source: TradingView, Gain Capital

Latest market news

Yesterday 08:33 AM