Banxico Preview: Higher inflation, but can they leave rates unchanged?

As mentioned in the Week Ahead, it’s a slow week for Central Bank meetings. However, the Bank of Mexico (Banxico) meets on Thursday to discuss interest rate policy. Banixco has been lowering rates since before the pandemic began. When the coronavirus hit in the spring of last year, they began to cut more aggressively (as did most central banks). Interest rates in Mexico are currently at 4% and the central bank is expected to leave rates unchanged when they meet this week.

However, Mexico is faced with rising inflation. Last week, Mexico’s inflation rate for April was released and the print was 6.08%, the highest since December 2017! At the Mexico’s last interest rate decision meeting in March, members noted that although inflation increased to 4.12% in March, they expected inflation on converge at 3% in Q2 of 2022. With inflation now at 6.08%, will they change their target date for convergence at 3% or will they need to hike rates at some point to meet that goal?

What about the coronavirus?

The country remains at level Orange, one level below the top tier. Roughly 15% of the population has been vaccinated and there are supply issues with the Russian Sputnik vaccine. Banixco must try to balance monetary policy between the on-going coronavirus problem and rising inflation.

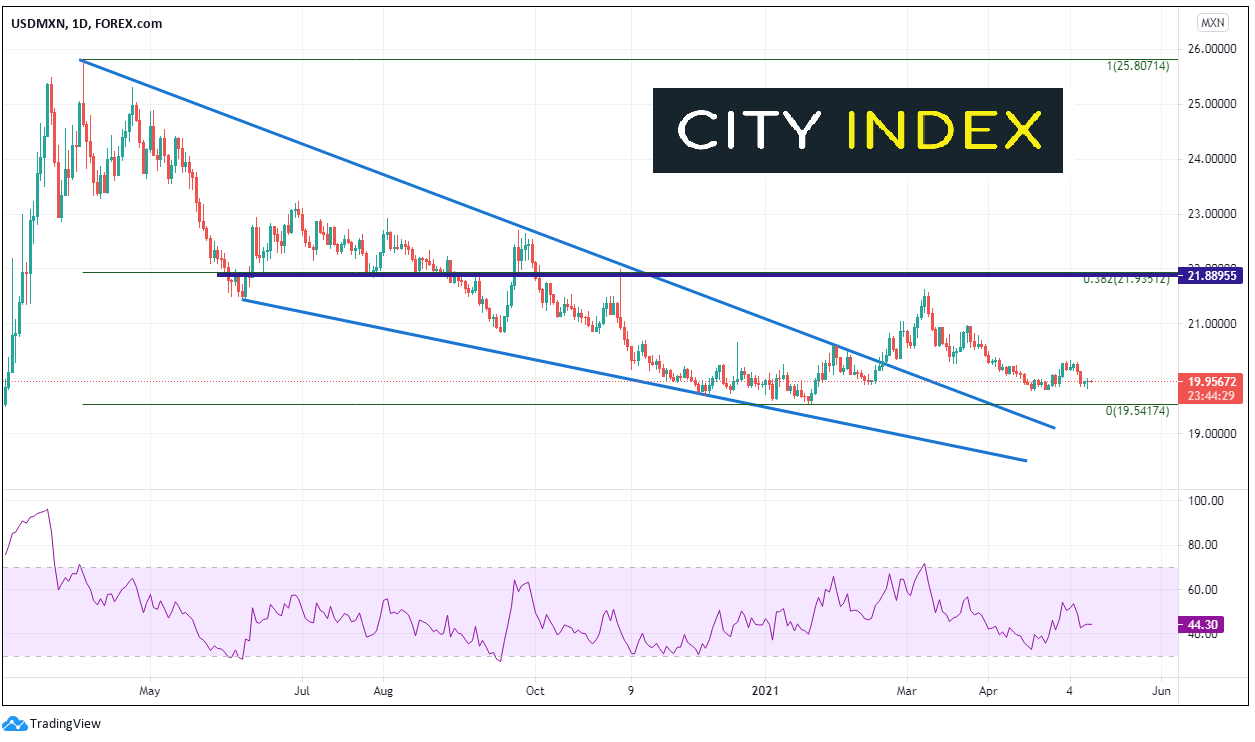

USD/MXN

USD/MXN had been moving lower since the pandemic highs in April 2020. The pair formed a bearish wedge, putting in a low on January 20th. USD/MXN moved higher and broke out of the top of the wedge but couldn’t even retrace to the 38.2% Fibonacci level from the April 2020 highs to the January 20th lows at 21.9351. The pair corrected to a high of 21.6355 on March 8th and began moving lower again. USD/MXN is currently trading near 19.9560, just pips above the January 20th lows of 19.5417.

Source: Tradingview, City Index

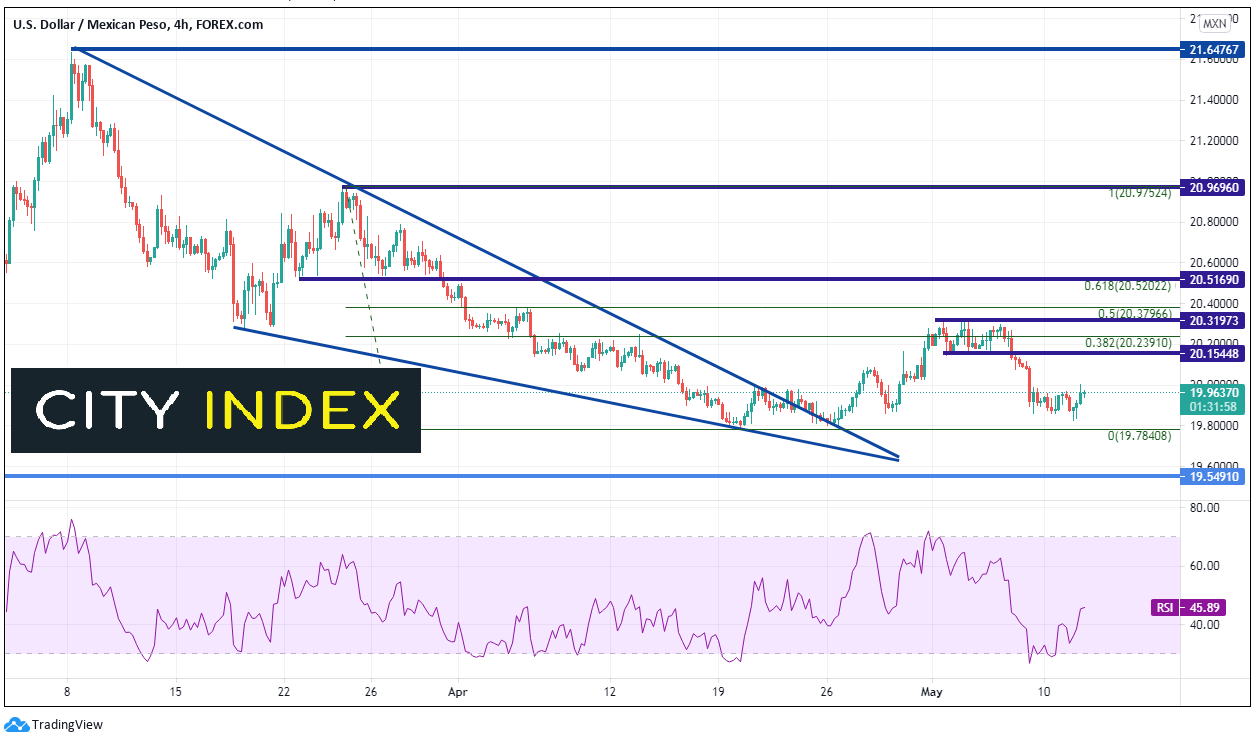

On a 240-minute timeframe, horizontal resistance is above at 20.1545, then the 38.2% Fibonacci retracement level from the March 24th highs to the April 29th lows near 20.2391. If price moves above that, the May 4th highs are at 20.3197. Support below is at the April 29th lows of 19.7841, then horizontal support at the January 20th lows near 19.5491.

Source: Tradingview, City Index

The expectations are for the Bank of Mexico to leave rates unchanged on Thursday. However, with inflation at 3-year highs and the coronavirus still prevalent, the statement will be closely watch for clues as to the next move for Banxico.

Learn more about forex trading opportunities.