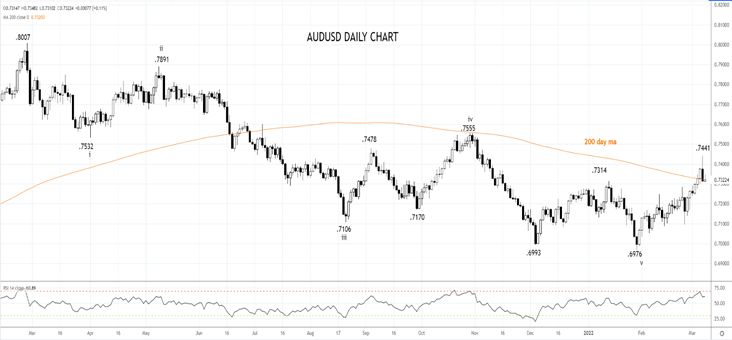

Notably, the previously Teflon coated AUDUSD that has for the past three weeks been able to shrug off those very same concerns, supported by surging commodity prices, returned to earth with a thud.

Today's solid consumer and business confidence data has prevented the AUDUSD from building on its overnight falls. The ANZ/Roy Morgan consumer confidence index rose by 0.9% last week to 100.1. A reading above 100 is considered positive, while below 100 is negative.

More importantly, the NAB Business Confidence index rose in February to 12.7 from an upwardly revised 4 in January. This was the highest reading in four months and showed broad-based improvement as the Omicron wave eased.

Turning now to offshore influences, while the commodity story is likely to remain supportive of the AUDUSD, the economic outlook has now firmly shifted towards stagflation, just as the Federal Reserve commence rates lift-off next week. Additionally, the risks are the conflict in Ukraine will get worse before it gets better.

This suggests that in the medium term, the AUDUSD should continue to find sellers on rallies ahead of resistance .7500/.7555 and at higher levels trade more akin to that of a risk currency.

Conversely, at lower levels, we would expect the AUDUSD to find buyers back towards ,7250, reflecting the likelihood of supportive inflows from higher commodity prices and a geographical safe haven bid, as viewed the past three weeks.

Source Tradingview. The figures stated areas of March 8th, 2022. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade