As noted here last week, the AUDUSD has (for now) thrown off its tag as a risk currency and is being supported by dividend repatriation flows for the shareholders of the three big Australian mining companies and as the Russian Ukraine crisis aggravates the energy and commodity crisis.

Aluminium again made fresh record highs overnight at $3,525, iron ore closed over 4% higher near $140 p/t. At the same time, BHP CEO Mike Henry noted that Russia’s invasion of Ukraine could cause supply shocks in nickel.

Providing further support for the AUDUSD, the Russian invasion of Ukraine and subsequent sanctions has been the catalyst for a dovish reassessment of the Federal Reserve’s hiking cycle overnight. U.S yields fell 12-17bp across the curve, all but pricing out the possibility of a 50bp hike in March.

Post the monthly RBA Board meeting today, the next economic test for the AUDUSD will be tomorrow’s Australian Q4 GDP data. In Q3, the impact of Delta lockdowns along the Eastern Seaboard resulted in a -1.9% q/q fall.

The release of the final partials today in the form of trade and government spending along with yesterday’s robust retail sales data provides upside risks to the market’s expectation for Q4 GDP to rise by 3%q/q, or 3.7% y/y.

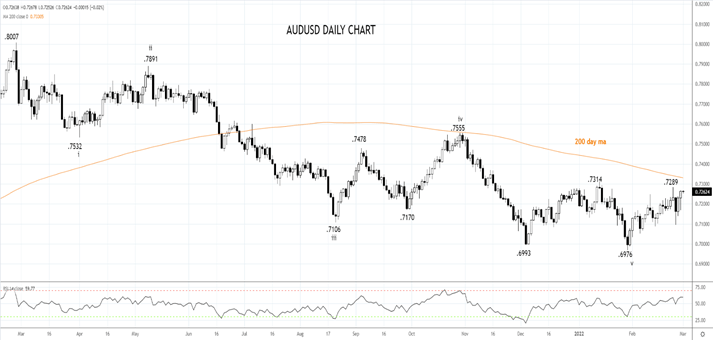

The AUDUSD’s strong rebound from support at .7100c, along with the supportive factors outlined above, sets the AUDUSD up for a test of the band of solid resistance between .7290 (last week’s high) and .7330, the 200-day moving average.

As the dividend repatriation flows subside over the next week and the uncertainty of the Russia-Ukraine geopolitical situation continues, this resistance zone is expected to cap the AUDUSD’s advance. Aware that if the AUDUSD sees a sustained break above .7330, allow for a test of the October .7555 high.

Source Tradingview. The figures stated areas of Mar 1st, 2022. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade