However, the latest Omicron variant has prompted a different reaction, with its arrival coming when economic growth is slowing, and monetary policy is tightening.

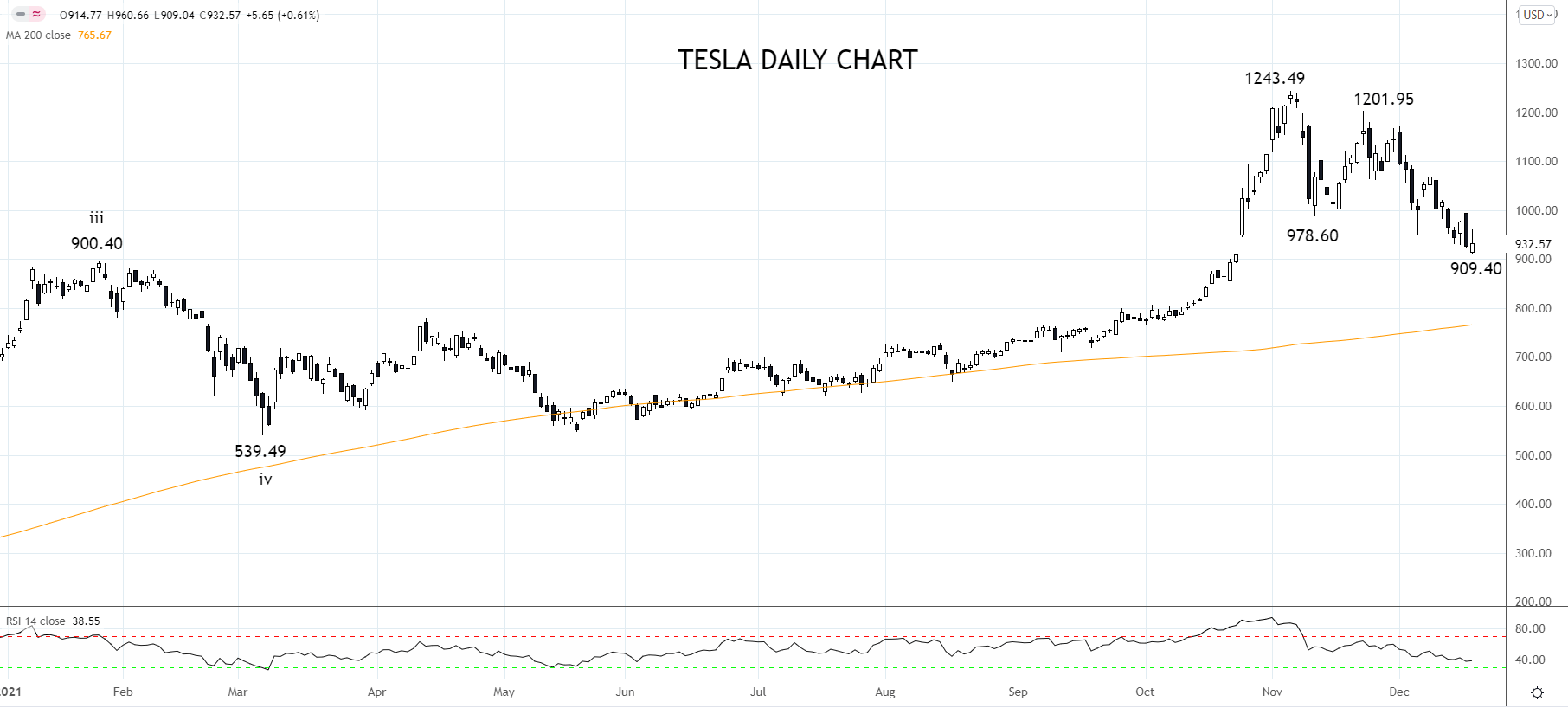

The result has been a sharp downturn in several popular growth stocks, including Tesla, now trading 25% below its early November $1243.49 high.

As those who follow Tesla closely would know, the sell-off in the Tesla share price kicked off in earnest in early November after Elon Musk polled his Twitter followers if they supported him selling 10% of his Tesla stock.

The poll went in Musk’s favour, and soon after, he preceded to offload billions of dollars of stock, just weeks before the arrival of Omicron that prompted another leg lower in Tesla stock towards $900.

Despite the sell-off, Telsa remains light years ahead of its competitors in chips and batteries and is likely to retain leadership in the rapidly growing EV market for the next few years.

As viewed on the chart below, after an impulsive rally higher, the share price of Telsa has declined from the $1243.90 high in a corrective fashion to test the support provided from the late January $900.40 high.

At this point, there is no concrete evidence the correction is complete. However should the share price of Tesla rally and close above last week’s $995 high, it would be the first indication that a late Christmas rally has commenced.

To take advantage of this possibility, consider buying Telsa if the share price closes back above $1000 with a protective stop loss placed at $899.

The first profit target is near the mid-November $1201.95 high, and the final target is near the $1243.49 all-time high, providing a trade with a better than 2:1 risk-reward ratio.

Source Tradingview. The figures stated areas of December 20th, 2021. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade