Today the ASX200 briefly reclaimed 7400, erasing all last week's losses and a smidgen more. Behind the turnaround is a combination of international and domestic factors.

A strengthening belief that Chinese authorities will carefully manage an Evergrande default is on the international side of the equation. Along with some relief that the more hawkish than expected FOMC last week passed without event.

A recovery in the iron ore price has helped improve sentiment towards battered iron ore mining heavyweights BHP (BHP), Rio Tinto (RIO), Fortescue Mining (FMG), and the broader index. Iron ore futures on the Singapore exchange are trading 8.5% higher today at $120.45 p/t.

Today the NSW Government provided details of the next phase of the reopening once 80% of the population has received two shots at the end of October. Including the ability to travel freely within the state, the resumption of community sport, and eased limits on the number of guests to visit homes.

Based on forecasts of increased vaccination rates in Victoria, Qantas today bought forward its reopening date for travel between Victoria and New South Wales from December 1 to November 5. This coincides with the date the U.S. intends to open its borders to vaccinated travellers from 33 countries.

Travel stocks have been amongst the day’s best performers. Flight Centre (FLT) is +6.70%, Webjet (WEB) is trading +4.40% higher, and Qantas (QAN) is +3.40% on the session.

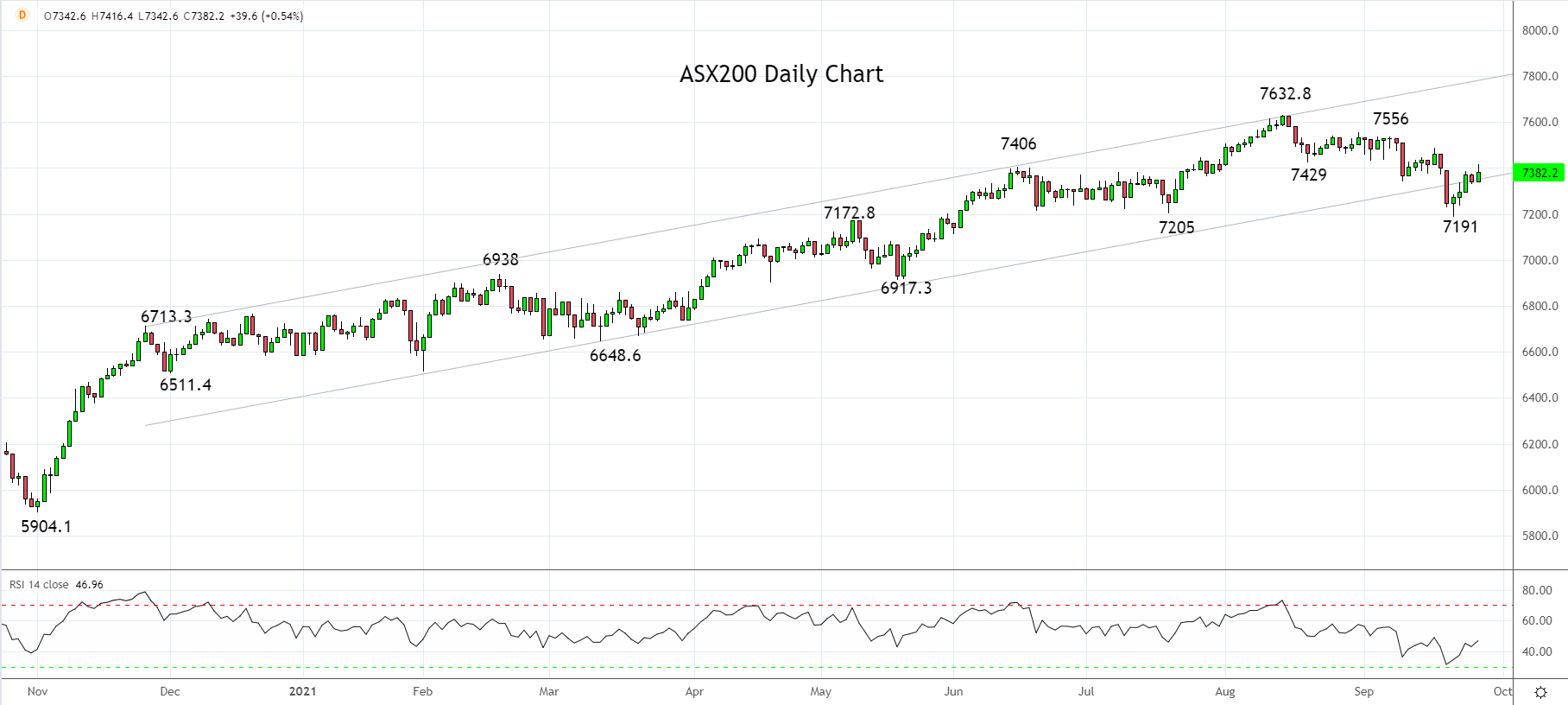

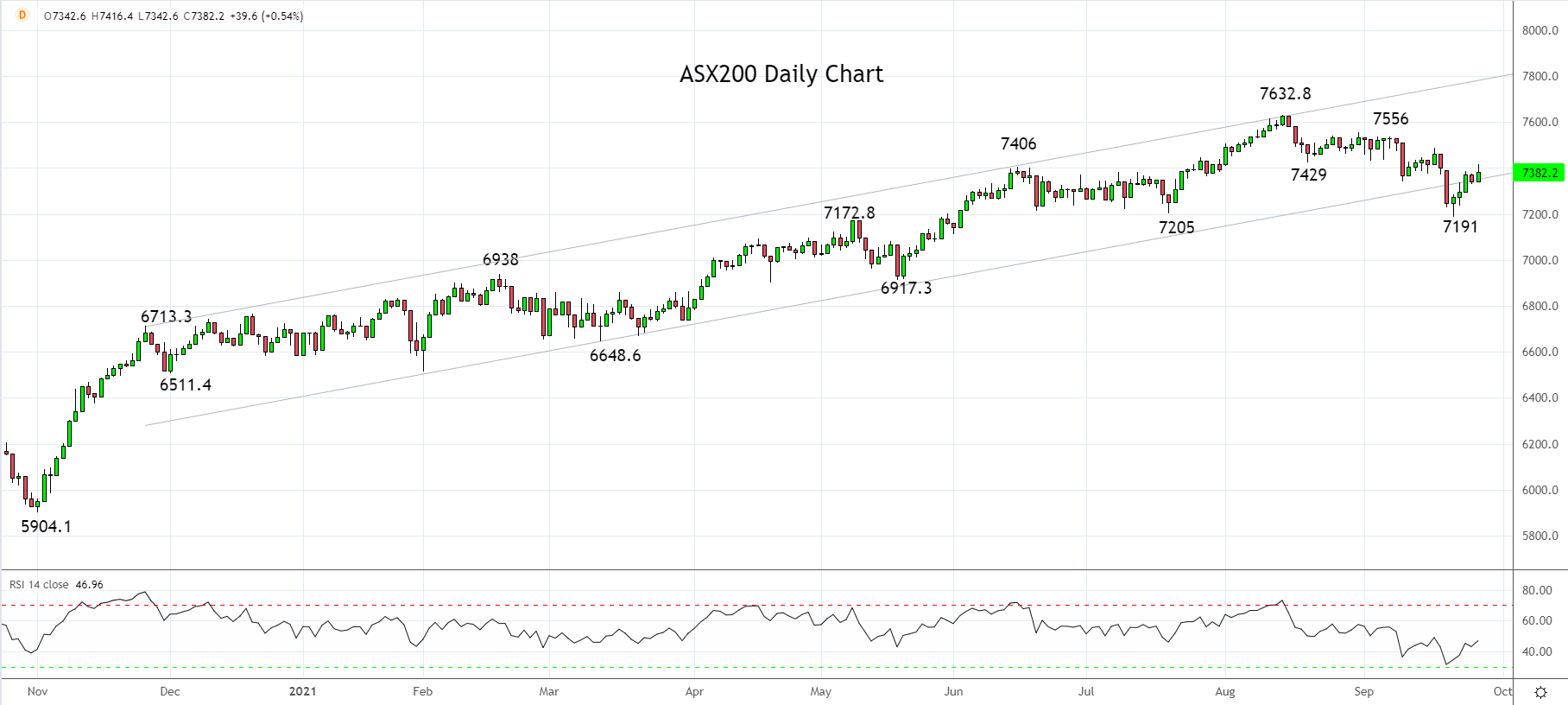

Returning to the index, the ASX200's 6% decline from the August 7632.8 high is viewed as a corrective pullback, not a change of trend.

Last Thursday's daily close back within the 9 month uptrend at 7340ish was an initial indication that the correction was complete at the 7191 low.

From here a daily close above 7400 would be further confirmation that the correction is complete and that the ASX200 has the potential to rally towards 7800 into year-end.

Source Tradingview. The figures stated areas of September 27, 2021. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

Latest market news

Today 11:14 AM

Today 08:28 AM

Yesterday 03:30 PM