According to the latest reports, the fire appears contained, and the reactors are being shut down safely. The IAEA’s Twitter account has communicated that no change in radiation levels at the power plant is evident, easing fears of contamination and a volatility episode into the weekend.

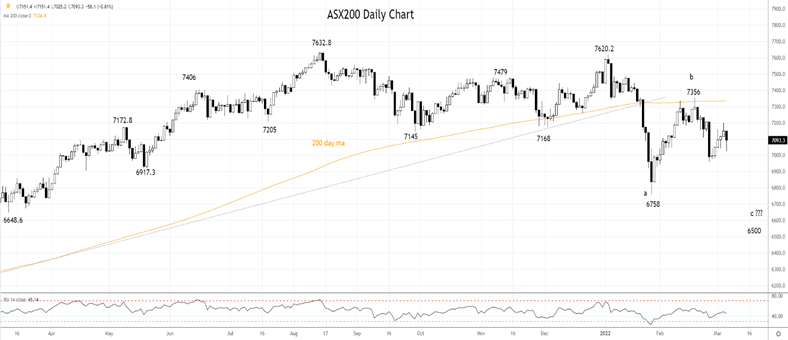

For the week, the ASX200 locked in a 1.61% gain, a commendable performance compared to moves in other regional markets. The bellwether Japanese stock index, the Nikkei, looks set to close the week ~2% lower. Hong Kong’s stock market, the Hang Seng, looks set to close the week 3.75% lower, tallying up a combined three-week loss of more than -12% as its Omicron surge spirals out of control.

Yesterday the mad panic by traders for commodity and energy supply was evident in the coal, iron ore and crude oil markets. Today panic is apparent in the wheat futures market, where Russia is the number one wheat exporter, and Ukraine is amongst the top five exporters. Wheat futures on the Chicago Board of Trade (CBOT) are locked limit up during the Asian session and have rallied almost 30% over the first four days of March.

Apart from a brief spike higher on news of the Ukraine nuclear power plant fire, crude oil is trading below $110.00 following media reports overnight of a potential nuclear deal to be signed in Vienna with Iran over the weekend.

Should an agreement with Iran be concluded, the return of Iranian oil would partially offset the loss of Russian supply. Iran produces around ~2million barrels per day, about 33% of Russia’s exports. Beach Energy (BPT) closed -0.89% lower at $1.665. Santos (STO) closed 1.02% lower at $7.76, while Woodside Petroleum finished the day marginally higher at $31.42 (0.26%).

Despite the price of iron ore rallying by an impressive 5.5% overnight to $153 p/t the big miners have run into some profit-taking ahead of the weekend. BHP Group (BHP) closed -0.24% lower at $49.94, Rio Tinto (Rio) closed -1.01% lower at $126.56 while Fortescue Metals Group (FMG) closed lower at $19.20 (-0.88%).

Elsewhere the big banks have had a mixed day ahead of another nervous weekend in Ukraine and U.S. jobs data this evening.

The Commonwealth Bank (CBA) was again the best of the big four as it finished 0.1% higher at $94.60. Westpac (WBC) lost 1.16%, National Australia Bank (NAB) lost -0.76%, ANZ lost 1.2% and Macquarie Group (MQG) fell 0.41% to close at $180.25.

Source Tradingview. The figures stated are as of March 4th, 2022. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade