In a throwback to pre the current ESG era, it’s been coal mining stocks that have been the star of today’s show, sparked by sanctions on Russia that have resulted in extreme panic in the coal futures market overnight. ICE Newcastle coal futures rallied +46% in a single session.

Russia produces around 15% of both met coal (steel making) and thermal coal (power generation). Elsewhere, Indonesian coal exports are down 20% this year while Australian exports are also lower, making the market very tight and more susceptible to shocks.

In response, Whitehaven Coal (WHC) is up 10.61% today to close at $3.96, Yancoal (YAL) closed 10.98% higher at $4.75, while New Hope Coal (NHC) added 4.27% to close at $2.93.

Crude oil futures surged another 3.64% during today’s session in Asia to be trading near $114.50 p/bbl, up a jaw-dropping 25% for the week. The latest leg of the rally came after buyers of crude oil rejected Russian supply overnight and as OPEC+ maintained its existing policy of increasing output by 400k bpd, despite calls for a supply increase.

Beach Energy (BPT) has added 4.67% to close at $1.68. Origin Energy (ORG) added 3.55% to close at $5.84, while Woodside Petroleum (WPL) gained 2.96% to close $31.34.

Another strong day also for the materials sectors as the price of iron ore futures rallied 9% in Asia. Fortescue Metals Group (FMG) added 4.20% to close at $19.37, Rio Tinto (Rio) added 3.72% to close at $127.85, and BHP Group (BHP) finished the session 3.60% higher at $50.06.

In the day's two key economic events, the notoriously volatile data series that is Australian building approvals collapsed in January, down by 27.9%. The decline was much larger than economists had expected (consensus estimate of -3%).

The January trade surplus increased to $12.9bn from $8.8bn in the prior month. Exports rose strongly, up by 7.6% and imports were down by 1.6% which tells a neat story of Australia’s Terms of Trade currently making fresh record highs.

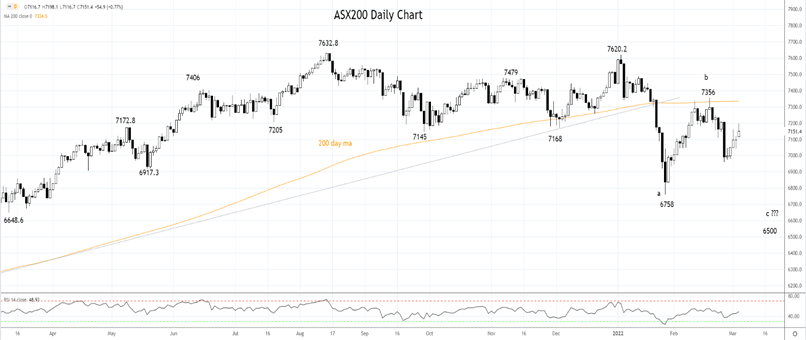

Source Tradingview. The figures stated are as of March 3rd, 2022. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade