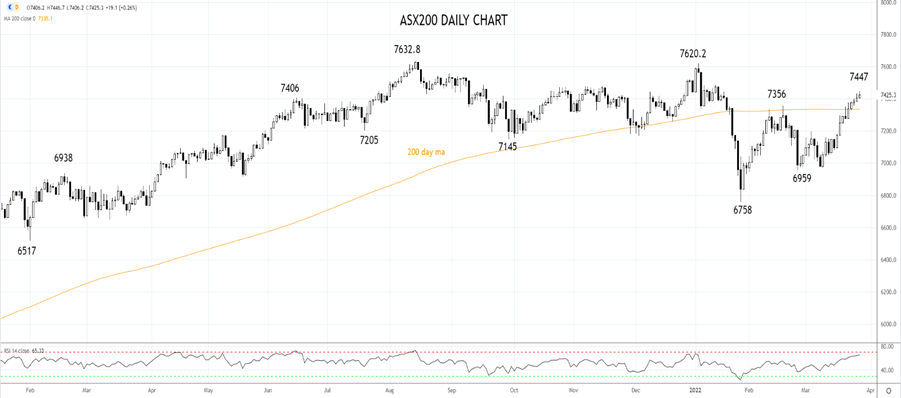

The insatiable appetite of offshore investors looking to increase their exposure to Australia’s mining mega giants has played a big part in the local index lifting for eight of the past nine sessions.

BHP Group (BHP) added 2.68% to $51.10, fresh highs for the year. Rio Tinto (Rio) added 1.92% to $119.11, and Fortescue Metals Group (FMG) added 1.04% to $19.47. Elsewhere coal miner New Hope Coal (NHC) added 1.75% to $3.49 and Mineral Resources (MIN) added 1.29% at $49.32.

Gains for all the major banks today ahead of tomorrow night’s Federal Budget release, which will see the government pull a “rabbit out of its hat” via assistance to households with “cost-of-living” pressures while announcing a reduced budget deficit, all ahead of the upcoming Federal Election.

Westpac (WBC) lifted by 1.26% to $24.05, National Australia Bank (NAB) lifted by 1.04% to $31.99, ANZ added 0.72% to $27.81, Commonwealth Bank (CBA) added 0.26% to $106.20, while Macquarie (MCQ) added 1.23% to $200.30.

Crude oil is trading 3% lower today at $110.41 ahead of this week’s OPEC+ meeting. Since OPEC+ last met, the U.S and the UK have banned oil imports from Russia, and the price of crude oil reached a high of $130.50. Despite this, the group isn’t expected to do the West any favours and will maintain its current production plans and greenlight the return of 400k bpd in June.

Beach Energy (BPT) added 0.61% to $1.64, Santos (STO) added 0.06% to $7.93 while Woodside Petroleum (WPL) fell by 1.28% to $33.16.

The price of gold continues to follow the lead provided by crude oil and has fallen to $1945 during today’s session in Asia. Newcrest Mining (NCM) is trading flat at $26.84, Northern Star Resources (NST) also closed flattish at $10.78, Evolution Mining (EVN) is the big loser in the space today as it fell 2.64% to $4.42.

IT stocks have felt the heat of the bond market breathing down its neck today as yields continued their unrelenting march higher. The U.S. 2yr benchmark bond yield has climbed by another 9bp to 2.37% during the Asian session. The 2yr benchmark Australian bond yield is 7bp higher at 1.78%.

Xero (XRO) fell by 4.86% to $99.35. Seek (SEK) fell by 3.55% to $29.07, Afterpay owner Block (SQ2) lost 3.70% to $171.48, while Appen (APX) lost 3.30% to $6.75.

The AUDUSD is trading firmer at .7525 and looks set to test the .7555 high of October 2021, before .7700c, supported by booming commodities and Australia’s Terms of Trade at record highs.

Source Tradingview. The figures stated are as of March 28th, 2022. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade