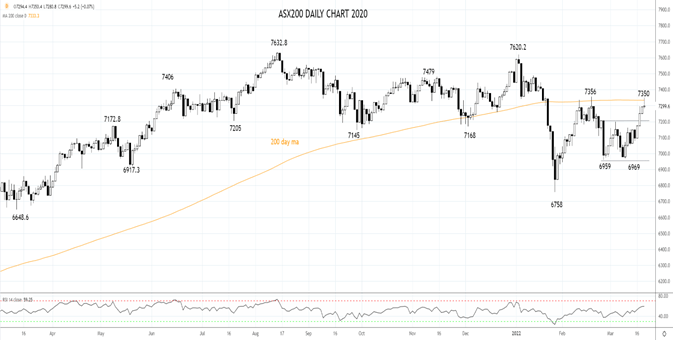

After punching through numerous headwinds last week, today’s reversal lower indicates stocks will find sellers at higher levels as the ugly macroeconomic backdrop of persistently high inflation, a full-scale war in Europe, sanctions, price shocks in commodities, and tighter monetary policy persists.

Despite a fall today in Nasdaq Futures, money continues to return to the local IT sector money. There was no stopping Afterpay owner Block (SQ2) as it added 9.41% to $184.78. Xero added 2.69% to $101.76, Appen (APX) added 1.29% to $7.06, while elsewhere Z1P Co (ZIP) added 0.30% to $1.60.

A 3.30% rally in crude oil futures, back above $106.00/bbl during the Asia time zone has helped boost local energy stocks. Santos (STO) added 0.80% to $7.60, Woodside Petroleum (WPL) added 0.86% to $31.64, Beach Energy (BPT) climbed 0.32% to $1.58.

News that Rio Tinto (Rio) has moved to halt alumina shipments to Russia having no discernible effect on the share price as it lifted 0.20% to $110.55. BHP Group (BHP) added 0.54% to $46.50 while Fortescue Mining (FMG) lifted 0.81% to $18.72.

Some gentle profit-taking weighed on the share price of the big four banks. National Australia Bank (NAB) fell -1.09% to $30.87, Commonwealth Bank (CBA) dropped by 0.15% to $106.13, ANZ closed flat at $27.60 and Westpac (WPC) is 0.46% lower at $23.55. Bucking the trend, Macquarie Group (MQG) added 0.40% to $195.58, although well below the $198.57 high it traded to earlier in the session.

Aussie gold miners remain on the outer as the gold price continues to trade sub $1950. Northern Star Resources (NST) fell by -2.35% to $10.40, Evolution Mining (EVN) dropped -2.34% to $4.41 and Newcrest Mining (NCM) has fallen by -2.70% to $25.27.

A sad day for Magellan (MFG) as co-founder Hamish Douglass left the board, after a tumultuous period. Its shares closed $4.32% lower at $15.06.

The AUDUSD is trading lower on the day at .7406 after running into a wall of selling ahead of resistance .7425/45 earlier today. The resistance comes from the trendline drawn from the February 2021 .8006 high and the early March .7441 high.

Source Tradingview. The figures stated are as of March 21st, 2022. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade