The ASX200 has plunged, to be trading 108 points lower at 7075 at 3.15 pm Sydney time.

After a promising start to the week, the ASX200 collapsed after a morale-sapping session on Wall Street as the benchmark index, the S&P500 dived 4% on Wednesday, its biggest one-day fall since June 2020.

The cause of the overnight weakness on Wall Street was a sting in the tail of the Q1 2022 earnings season. The shares of U.S. retail giant Target plunged 25 per cent, its largest drop since the 1987 market crash, after missing on earnings and echoing a similar warning from Walmart that rising cost pressures are eroding profit margins.

Retail and consumer stocks on the ASX200 have faced the music, with many household names being run over in an investor stampede to avoid a similar fate as Target.

Woolworths (WOW) lost 6.92% to $34.70, Wesfarmers (WES) lost 6.85% to $46.38, JB Hi-Fi (JBH) fell 6.2% to $45.10, Metcash (MTS) fell 5.77% to $4.33, Coles (COL) slumped by 4.50% to $17.62. Aristocrat bucked the trend to be trading 6.3% higher at $33.61 after announcing a $500m share buyback.

Travel stocks were also caught in the merciless crossfire. Flight Centre (FLT) fell 5.5% to $20.04, Corporate Travel (CTD) fell 3.3% to $21.65, Webjet (WEB) fell 1.9% to $5.68, despite reporting April to be its most profitable month since covid-19. Qantas (QAN) fell 1.8% to $5.42.

Being thrown once again onto the trash pile IT sectors felt the wrath of investors. Novonix (NVX) fell 6.1% to $3.69, Life 360 (360) fell 6% to $3.42, Altium (ALU) fell 4.1% to $27.23, Megaport (MP1) fell 3.69% to $7.05, Xero (XRO) fell 3.5% to $85.35, EML Payments (EML) fell 2.9% to $1.42. New 52-week lows for Zip (ZIP) which fell 3.6% to $0.87c and Sezzle (SZL) which fell 2.5% to $0.59c.

Often an anchor in uncertain times, there was no escape for the big banks, despite labour force data for April confirming that the jobless rate fell to its lowest level since the 70’s. Westpac (WBC) fell 4.17% to $23.42. ANZ fell 1.97% to $25.33, and National Australia Bank (NAB) fell 1.44% to $310.84. Commonwealth Bank (CBA) fell 1.1% to $103.62, and Macquarie (MQG) fell 1.96% to $177.94.

The Materials sector also gave back a good chunk of this week's gains as investors sought safety in cash. Lynas Rare Earths (LYC) fell 3.7% to $9.45, Mineral Resources (MIN) fell 2.5% to $59.24, Rio Tinto (Rio) fell 2% to $106.72. Fortescue Metals (FMG) fell 1.75% to $19.43. BHP Group (BHP) fell 1.7% to $46.24, and Oz Minerals (OZL) fell 1.35% to $22.58.

Rounding out a miserable day for the dirt diggers, Lithium names have fallen again today. Lake Resources (LKE) fell 4.67% to $1.42. Liontown Resources (LTR) fell 4.6% to $1.25, Galan Lithium (GLN) fell 4.4% to $1.41. Vulcan Energy (VUL) fell 2.7% to $7.27, and Core Lithium (CX0) fell 2.3% to $1.28.

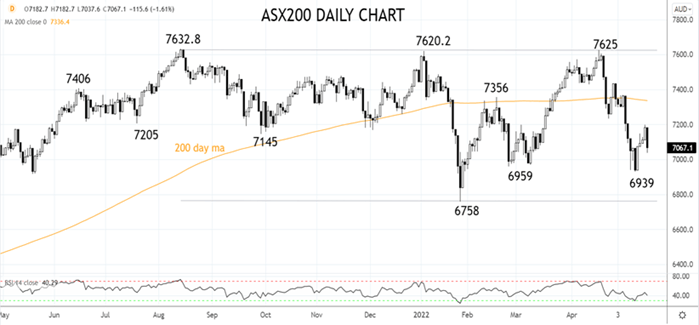

Turning to the charts. Over the past fortnight, the ASX200 has followed the road map almost to the T. After hitting our 7000/6950ish downside target last week, we called for a recovery towards 7200, a level it tagged yesterday.

Technically, a final leg lower towards range lows 6950/6750 is needed. However, whether that plays out will depend on this weekend's Federal Election outcome.

Source Tradingview. The figures stated are as of May 19th, 2022. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation